Just like that, one of the largest payment networks in the world has allowed payments to be settled in cryptocurrency.

Visa, with a current market cap of over $475 billion and processioning over 150 million traditional payment transactions every day, has officially started utilizing stable coins as a settlement tool on the Ethereum blockchain. Yet another massive signal of digital currencie’s growing role in the mainstream financial industry.

Today, @Visa announced a major industry first: the use of USD Coin (USDC) to settle a transaction with Visa over the @Ethereum public #blockchain: https://t.co/QiCuOGns77 pic.twitter.com/GVVGrzuBgo

— VisaNews (@VisaNews) March 29, 2021

USDC, the stable coin created by Circle and Coinbase, is currently being used exclusively in this Visa pilot program launched with Crypto.com and digital asset bank Anchorage, with additional partners planned for later this year. This is big news for everyone involved! The level of daily transaction volume facilitated by the Visa network has long been regarded as a high-water mark. The level to which decentralized networks like Ethereum aspire to scale. Now, Visa is taking advantage of the very decentralized technology which has previously been deemed somehow insufficient or impractical.

We’re excited to share news of a historic moment:https://t.co/vCNztABJoG & @Visa successfully conducted the first settlement of transactions using USDC!

— Crypto.com (@cryptocom) March 29, 2021

A huge milestone for the industry as crypto and fiat networks begin to converge.https://t.co/v70qC8n4Yy

This marks the launch of a pilot which would allow Crypto.com to settle a portion of its obligations for their Crypto.com Visa card program in USDC.

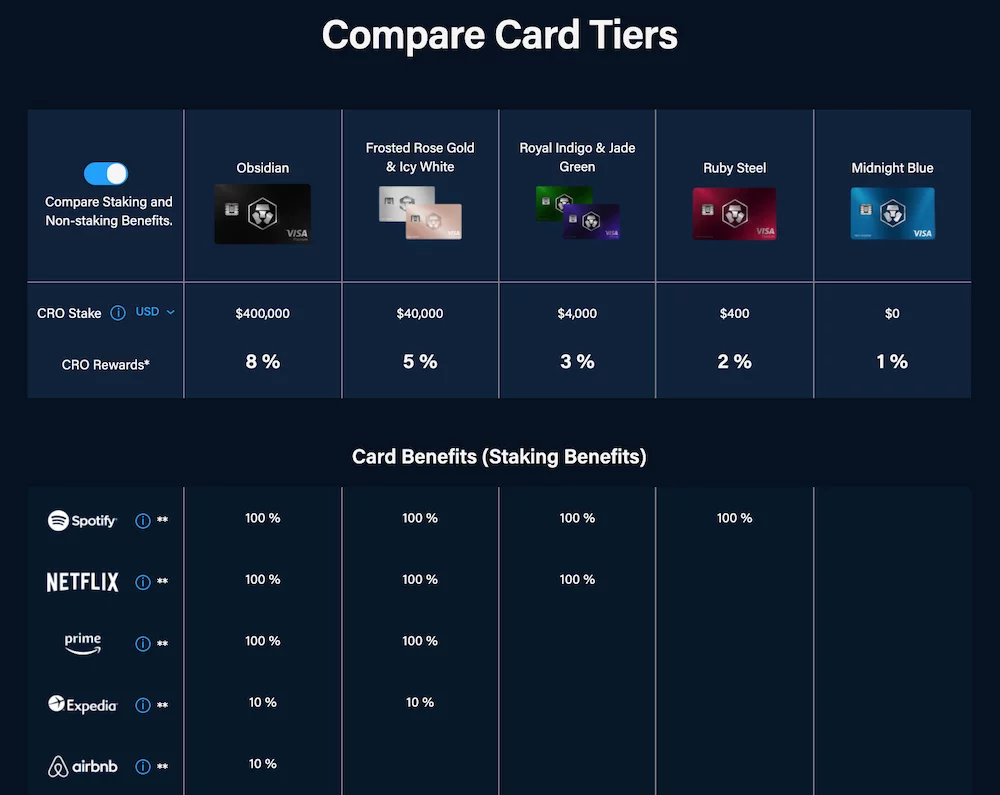

Crypto.com Visa Card Tiers and Benefits

Up to this point using a Crypto.com Visa card for payments meant that the digital currency held in a user's cryptocurrency wallets first needed to be converted into traditional money before a purchase could be fully completed. Often adding complexity and expense for businesses. By using the Ethereum blockchain however, there is no need to convert crypto into traditional currency in order for the transaction to be fully settled. Visa has partnered with digital asset bank Anchorage to act as a custodian and completed their first transaction with Crypto.com by sending USDC to Visa’s Ethereum address at Anchorage.

Making things easier for crypto users and companies needing interaction with old world finance feels like a step in the right direction. Though there are those who aren’t totally convinced of the current wider applicability of this pilot program. Ethereum’s current scaling potential being the most widely cited hurdle to overcome, which might be addressed much sooner than many expect. Ready or not, ETH and USDC are now clearly being institutionalized as Visa has now officially utilized them both in order to wade further into the crypto space. It’s also certainly worth noting just what a crucial head start Visa stands to gain in accommodating Central Bank Digital Currencies (CBDCs) as they come available. While crypto stable coins like USDC are backed by central banks, CBDCs would be directly issued and managed by central banks. Basically a digital version of fiat. From this perspective it seems likely this is only the first step of a much larger pivot to come.

BREAKING: Visa has become the first major payment network to incorporate a digital dollar (USDC) into their network and settle transactions in the new system, rather than the old banking system.

— Pomp 🌪 (@APompliano) March 29, 2021

Eventually every payment network will do this.

The cumulative cryptocurrency market cap now exceeds $2 trillion. Bitcoin and Ethereum are both currently trading at near all time highs. The mainstream adoption of BTC, ETH, and now stable coins is likely the largest single contributing factor behind the current bull market. Every day more and more traditional financial businesses including but not limited to banks, funds, VC’s, payment networks, and fortune 500 companies are adopting the next generation of financial technologies.

Everything has accelerated so quickly over the past months that it might be easy to mistake just how early we are in this amazing journey which seasoned crypto enthusiasts are assuredly the most prepared for!

Breaking:

PayPal will let US users pay with Bitcoin, Ethereum, and Litecoin with their newly launched “Checkout with Crypto” feature!

Today, we are announcing the launch of Checkout with Crypto, a new way for PayPal customers to check out with #Cryptocurrency to pay for select online purchases. https://t.co/RbOe8aLtlz pic.twitter.com/zGWHgbwVlU

— PayPal (@PayPal) March 30, 2021