Eight words in a 2700-page, $1 trillion USD bipartisan bill that the U.S. House of Representatives just voted to pass may serve as the death knell for the budding NFT industry. To say that 2021 has been an extraordinary year for the growth of this space would be an understatement. With numerous sales ringing above 1000 ETH—setting aside the tens of millions of dollars of cash transacted for NFTs at traditional auction houses—the federal government and various regulators have set their sights on tracing the flow of money used to buy and sell NFTs. Not surprisingly, governmental efforts have so far focused on attacking one of the most sacred features of blockchain technology—anonymous and permissionless transactions that care only about triggers and interactions.

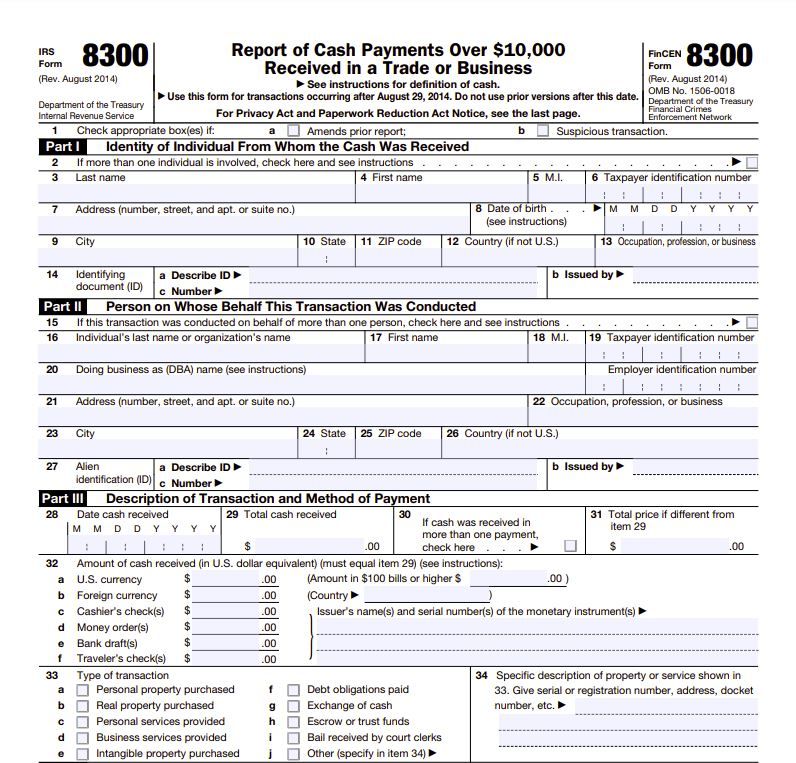

In short, one of the amendments in the much-debated bill would add “digital assets” to the category of transactions that must already be reported by “any person engaged in a trade or business that receives cash in excess of $10,000 in a single transaction or in related transactions” within 15 days of such transaction. As part of the IRS’s anti-money laundering initiatives, businesses and individuals that fall under the above definition must file a Form 8300, which requires the filer to disclose the name, address and social security number of the counterparty in the transaction (or series of transactions amounting to greater than $10,000).

The full legal test, as distilled in a report by the Proof of Stake Alliance, is as follows:

1. You receive

2. In the course of your regular gain-seeking activities

3. Digital assets

4. Having a value exceeding the legal threshold; and

5. No exception applies.

If it is found by a court that the person who received the assets intentionally did not report the transaction, they could face up to five years in prison and a minimum $25,000 fine. The original provision is several decades old and was originally focused on cash transactions, which is why adding “digital” to the bucket of applicable assets results in what the Web 3.0—and, particularly, the NFT—community believes to be an absurd legal result with disproportionate consequences.

The bill is currently on President Biden’s desk, waiting for his approval, but a number of advocacy groups and lobbyists have made significant efforts to bring attention to the provision so that it’s struck before becoming law. The Treasury Department, which oversees the stability and security of the U.S. monetary system, would have jurisdiction over enforcing the provision. That means that even if the bill with the amendment is passed as-is, the Treasury can use internal guidance to limit the way in which it applies the rule to businesses and individuals.

Not only do collectors have to worry about projects imploding due to the actions of their creators (see our Jungle Freaks piece in this issue of the Gazette), but regulatory oversight is closing in on NFTs, as it has over the last few years on cryptocurrencies. Many fear that this amendment may lead us down the path of centralization quicker than expected, injuring the business and artistic creativity the space has come to be known for.