This week has been a bloodbath. Bitcoin collapsed to below $27K (smashing through its important $30K support) to the lowest it’s been since December 2020. Ethereum tumbled to under $2,000 and wrote off over 20% of its value in just 24 hours. Over $200 million was written off the cryptocurrency markets on 11th May, triggered by Terra losing its peg with USD.

So is this how it ends? Nobody makes it and we all go back to doing whatever it was we did before Satoshi launched the genesis block?

The crypto apocalypse - apparently

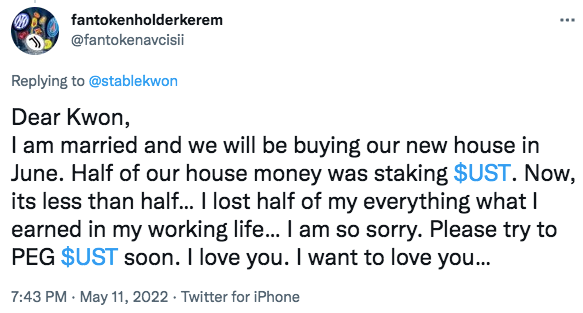

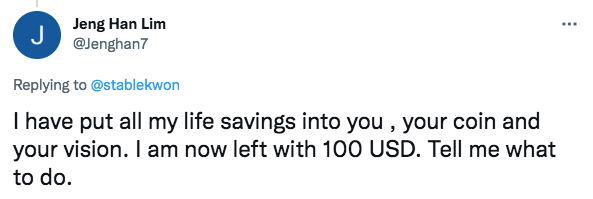

Opening Twitter is like strolling through a morgue, with most users reporting big to catastrophic losses. Investors in Terra and LUNA were hit the hardest. Stablecoin UST - supposedly a safe haven - lost its peg with USD, plunging the markets into free fall. LUNA, the token supposed to prop Terra up and maintain the peg, dropped 99.87% in just 24 hours and has since gone to virtually zero. People lost millions. Despite a devoted following, the Terra project wasn’t without its critics, some of whom likened it to a glorified Ponzi scheme.

Some LUNA holders lost everything

The Terra forum now features a pinned post with helpline numbers. Some investors claim to have lost everything and fear being made homeless. No coins were safe from the ripple effect, people lost fortunes and life savings vanished overnight. To make matters even worse, Coinbase shares slumped and the media started talking about bankruptcy. Even beloved meme coin Doge, once destined for the moon mounted on a Musk rocket, was obliterated and teetered on the brink of a 70% downturn.

News outlets gave the bloodbath many names; a crypto “winter,” “meltdown,” “wipeout” and even “ice age.” One newspaper speculated that the destruction of Terra/LUNA might be a Lehman Brothers moment for crypto. Another suggested that Bitcoin could go to zero. Clickbait abounds and sensationalist headlines dominate the narrative.

Some economic context

Although the de-pegging event was a catalyst, crypto was already labouring against growth/inflation fears, the war in Ukraine and rising food prices. It isn’t alone. Many countries are now facing a daunting cost of living crisis. Crypto markets tend to track global indices. As they fall, so does crypto. While this is undoubtedly a troubling time, it isn’t a freak incident that proves something is innately wrong with cryptocurrency.

There’s similar anxiety around NFTs. A cursory glance across Twitter suggests that artists are selling less. The glory days of last summer - when NFT sales soared - appear to be over. This is backed up by data. Sales are down around 92% from their height in 2021, something which detractors are quick to point out. This is obviously tied to the wider economic downturn, but there are other more complex issues at play too.

Similarly bleak headlines prophesied the end of NFTs.

The initial NFT boom was fuelled by hype around new technology. It was akin to a gold rush as investors, inspired by the soaring prices of BAYC, Clone X and Beeple, flocked to make money. NFTs were quite literally get rich quick schemes. Increased demand meant increased supply. Hundreds of new collections appeared daily, hoping to leverage the hype. It was inevitable that supply would eventually outstrip demand. It’s equally inevitable that the situation will reverse.

Let’s take a breath…

Nobody would call this period a bull market, but let’s look for some context behind the headlines. If you think the current crash is the end of the world, then you probably weren’t around for the much-worse one in 2018. Bitcoin fell by 65%. The 10 biggest cryptocurrencies of the time lost a combined 80%. Bitcoin continued to plumb new depths, dragging the rest of the market with it. By any barometer, 2018 was worse than last week and it was only one such crash in a long history of ups and downs (Bitcoin is currently at $30,541.80 - up just a bit from its December 2018 low of $3,183).

Bitcoin has done alright since the last crash

Back then, pretty much every financial commentator was calling crypto a speculative bubble; Warren Buffet, George Soros and Jamie Dimon to name but three. The “cryptocurrency bubble” idea even has its own Wikipedia page. 4 years on and there are thousands of new currencies and mainstream adoption is closer than ever. Ethereum was worth $115 in December 2018. NFTs and Web3 existed only on the fringes of knowledge.

Ethereum was worth $200.53 just two years ago - and the merger is coming up.

If you believed the hype, 2018 was the end. Since then, Bitcoin (dragging the rest of the market with it) has surpassed all time highs again and again. Looking even further back, the Dotcom bubble and subsequent burst decimated 90% of online companies. It now seems laughable to think that commentators saw this as the end of eCommerce. Companies (including Amazon and Google, who haven’t done too badly) simply rebuilt in the aftermath.

The same applies to NFTs. Writing headlines like “The Death of NFTs” certainly generates clicks but it’s simply not true. Some of the biggest sales in NFT history occurred very recently, including Moonbirds, Azuki and, of course, a BAYC drop so big that it broke the network. Investors were willing to spend $2k+ on gas fees for plots of virtual real estate. These are hardly the death gurgles of a crumbling space. The long awaited Ethereum merger is on the way, too.

Where exactly we are on the crypto road is harder to pinpoint. Events of the past week will go down in history, but organisations, individuals and innovators are already picking over the bones. Investors are talking about buying the dip. More and more people are seeing opportunities amidst disaster and looking to rebuild. It’s tempting to paraphrase Winston Churchill and say that this certainly isn’t the end, but it might be “the end of the beginning.” Perhaps even more fitting are a few lines from Rudyard Kipling;

“If you can dream—and not make dreams your master; If you can think—and not make thoughts your aim; If you can meet with Triumph and Disaster And treat those two impostors just the same; Yours is the Earth and everything that’s in it, And—which is more—you’ll be a Man, my son!”

Stay safe out there.

Read more:

10M$ Defi LUNA Bet

2025 Solar Superstorm Could Crash Crypto

ApeCoin Staking or Bribery in Disguise