Is the Dawn of Mass Crypto Adoption Near?

The cryptosphere is one step closer to going mainstream, thanks to a March 9 US executive order. While most of the executive order (EO) is a collection of redundancies, hot air and legalese, it marks an important milestone for broader cryptocurrency adoption in the US.

What the Executive Order Lays Out

The EO states the case for the United States government to invest in the research and development of digital assets and blockchain technology. Specifically, it states how the advancement of these technologies has led to “dramatic growth in markets for digital assets, with profound implications for the protection of consumers, investors, and businesses.” And with a market cap of around $3 trillion, the value of digital assets has simply become too big to be ignored.

The EO also brings up the possibility of developing a central bank digital currency (CBDC): a fully digital US dollar issued by the Federal Reserve. A CBDC could support more efficient and low-cost transactions, and transform the wider banking industry. Of course, like a lot of official documents, the EO takes over 5,000 words to say “more research must be done.”

As for what should be researched and who will be involved in the government R&D for digital currencies, the EO outlines this in somewhat greater detail. A lot of government departments are name-dropped here: the Department of State, the Attorney General, the Department of Energy, the Department of Labor, the Department of Homeland Security, the EPA… the list goes on.

The sheer number of departments that are to be involved in this research just goes to show how much a broader adoption of cryptocurrency could change things, and it’s not just a matter of finance. It’s also a matter of technology, of law, of security, of energy… The US government seems to finally be taking crypto seriously.

The EO also outlines timelines for the R&D of a CBDC and digital asset regulation among various departments. Deadlines are set from 120 days to a year, but we know how inefficient the government can be, especially in the case of technology. So I wouldn’t expect much movement on this in the coming year.

This EO is major not so much because the US government is going to start doing anything about cryptocurrency and NFTs; rather, it has now acknowledged their growing significance. And if the US does move forward with developing its own CBDC, that could lead to other countries following suit.

A Focus on the Risks

However, the EO puts more emphasis on the most common criticisms of cryptocurrency — namely, its environmental impact and its use for illegal activities — referring to them as areas for more research and assessment.

In fact, when discussing the implications of crypto, the term “risk” is among the most frequently used keywords in the Executive Order, at 47 times. “Illicit,” referring to illegal activities, occurs 24 times. “Benefits,” on the other hand, appears only six times. So while the potential upsides will be explored, the EO focuses more on risk. Perhaps in part because of the negative publicity surrounding cryptocurrency (namely, scams) the last few months.

This word cloud done by Chair of the Kin Foundation William Mougayar offers a helpful visual representation of the most common keywords used in the EO.

The Crypto Community Reacts

While the crypto community is truly global, the United States is home to a large swathe of the community and some of its most influential figures. Not to mention the fact that the United States is the largest economy in the world and a major global power. So the fact that the government is taking an official stance on looking into crypto is pretty damn significant.

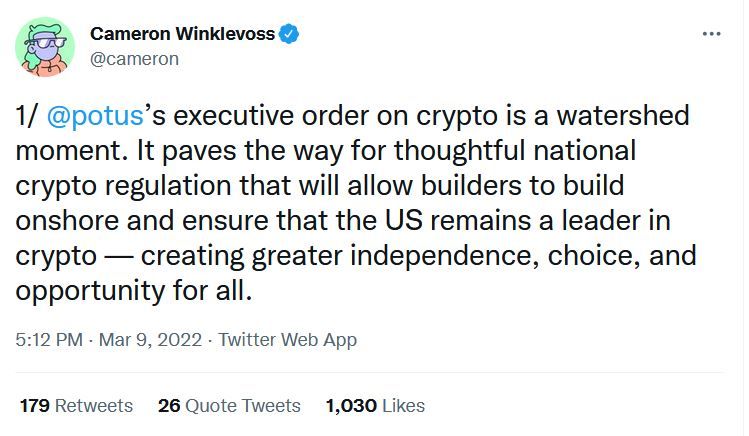

Jerry Brito, the Executive Director of crypto think tank Coin Center, stated Wednesday on Twitter that he saw the EO as the federal government acknowledging cryptocurrency as a “legitimate, serious, and important part of the economy and society,” rather than as dangerous. This stance will reassure and encourage people to get involved in the cryptosphere.

Others in the crypto space also expressed optimism at the EO, including Cameron Winklevoss, Uniswap Labs, and cdixon.eth. The crypto market also responded positively to the news, with Ethereum value up 6.62% on March 9.

But this is the internet, and we’re talking about a community based almost entirely online here. There’s bound to be dissent. Investor and entrepreneur Robert Kiyosaki was among one of the more out-there negative reactions, claiming that the EO was signaling the beginning of government crypto. Others, such as Bitcoin investor Mark Moss, questioned the government’s commitment to privacy.

Overall, however, Crypto Twitter has reacted positively to the Executive Order as an acceptance of crypto’s legitimacy as both technology and financial instrument.

Of course, while much was said in the EO, little will be done anytime soon. The community will have to wait and see what comes out of the research. What it will mean for crypto in the future remains to be seen.

With so many crises going on at the moment, the government probably won’t move fast on this. But with the US government publicly acknowledging crypto’s legitimate potential, other countries may follow its lead. Whether you appreciate government support or abhor it, mass adoption of crypto may soon be on the horizon, after all.