Let's take a deep dive into what this means:

Ethereum Improvement Proposal - 1559

EIP-1559 is an update to the Ethereum Mainnet, coming after the April 2021 Berlin hard fork. The update also makes preparations for the planned Ethereum 2.0 release by making adjustments to its consensus model. This is a proposed change to the way users pay gas fees on the Ethereum network. EIP-1559 was created by Ethereum’s founder, Vitalik Buterin, and a team of other developers. Over time, the average fee paid by Ethereum users has become too costly for small transactions. EIP-1559 proposes a new transaction pricing mechanism that will instead create a base fee for each block. The blockchain will burn the fee, reducing the overall supply of ETH. This effect will create deflationary pressure on the cryptocurrency. The base fee changes for each block depending on network demand. If a block becomes more than 50% full with transactions, the base fee will increase and vice versa. This mechanism attempts to keep a half-full equilibrium level for the majority of blocks. This change in the code paves the way for Ethereum 2.0, an upgrade and total overhaul of the system, which has been in the works for more than 2 years.

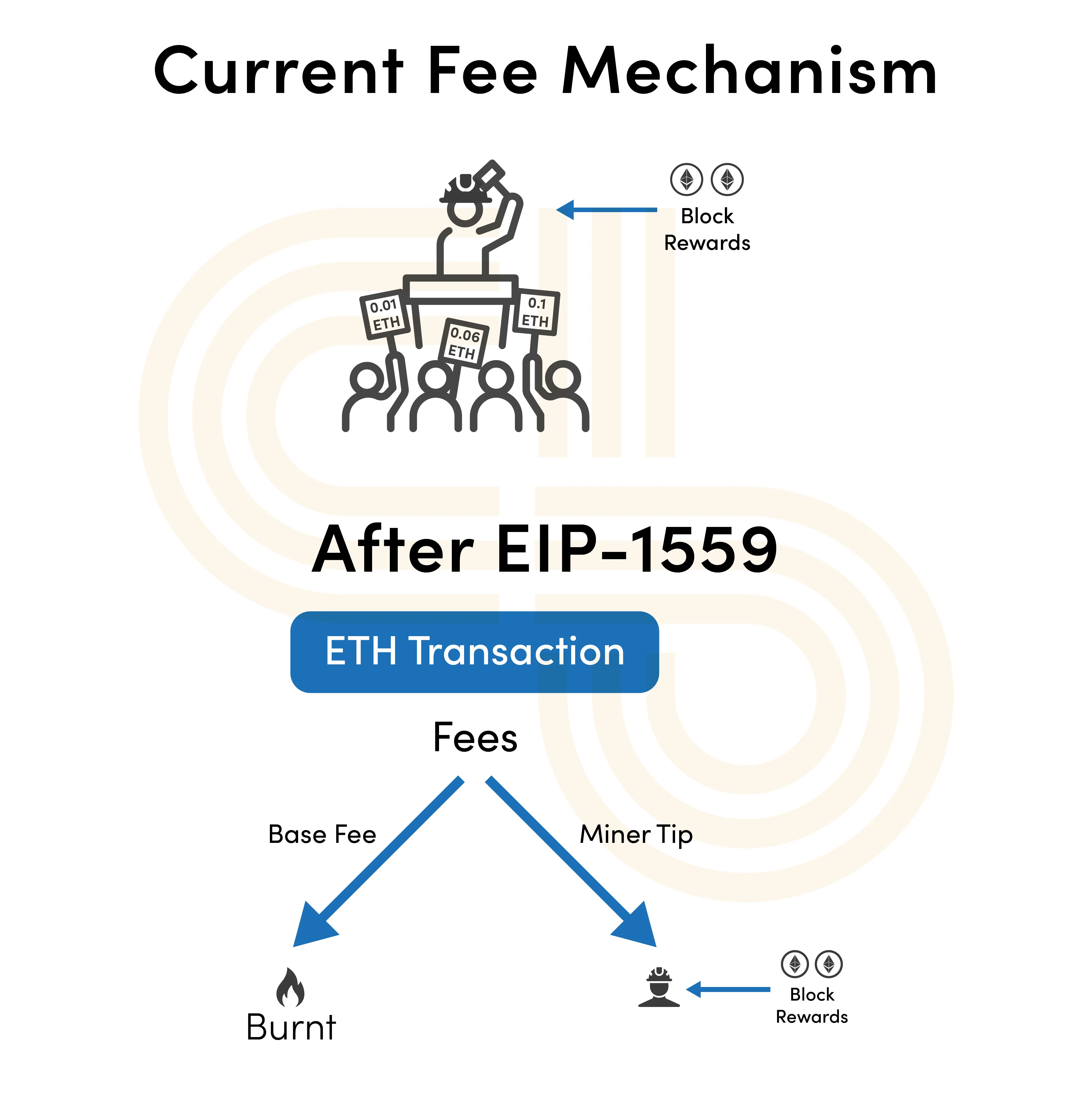

Gas fee model before EIP-1559:

Before EIP-1559 there was an auction system for determining the gas price. If the gas price is high enough, miners will bid to include the transaction in the block. So it is more likely that a miner includes a transaction in a block if the user is willing to pay more. As a result, if the network is busy over the 15-20 transactions per second which are currently Ethereum’s limit users must incentivize miners to accept their transaction, which leads them to add higher gas fees to their transaction. One of the problems faced by the auction system is that there is no simple strategy for choosing the optimal bid price. On account of this, the gas price becomes unpredictable.

How gas fees will be decided after EIP-1559:

EIP-1559 aims to eliminate this uncertainty and regulate the gas fees by calculating the base fee for a block beforehand based on the level of congestion. And instead of an auction, EIP-1559 will feature a base gas fee that changes depending on the flow of transactions on the network. The base fee will be burned, which means it doesn’t go to the miners. The other significant improvement in EIP-1559 is the introduction of variable block sizes with a higher gas limit of 25 million units, double the previous limit of 12.5 million.

Why Burn ETH?

Why burn Millions or potentially Billions of Dollars? It’s Money, isn’t it?. Why not give it to charity, reserve it for the treasury, feed the starving..is it illogical?. Hold on folks, before you find millions of use cases, Let’s explore the Big WHY. This is critically brainstormed, discussed, voted, and rigorously tested prior to the implementation.

To answer the WHY, we need to look at a couple of WHOs, WHO will get all those ETHs, WHO will decide? WHO is in charge? Decentralisation is not just a marketing tag for Ethereum Community, It is one of the main pillars which holds the fundamental core value.

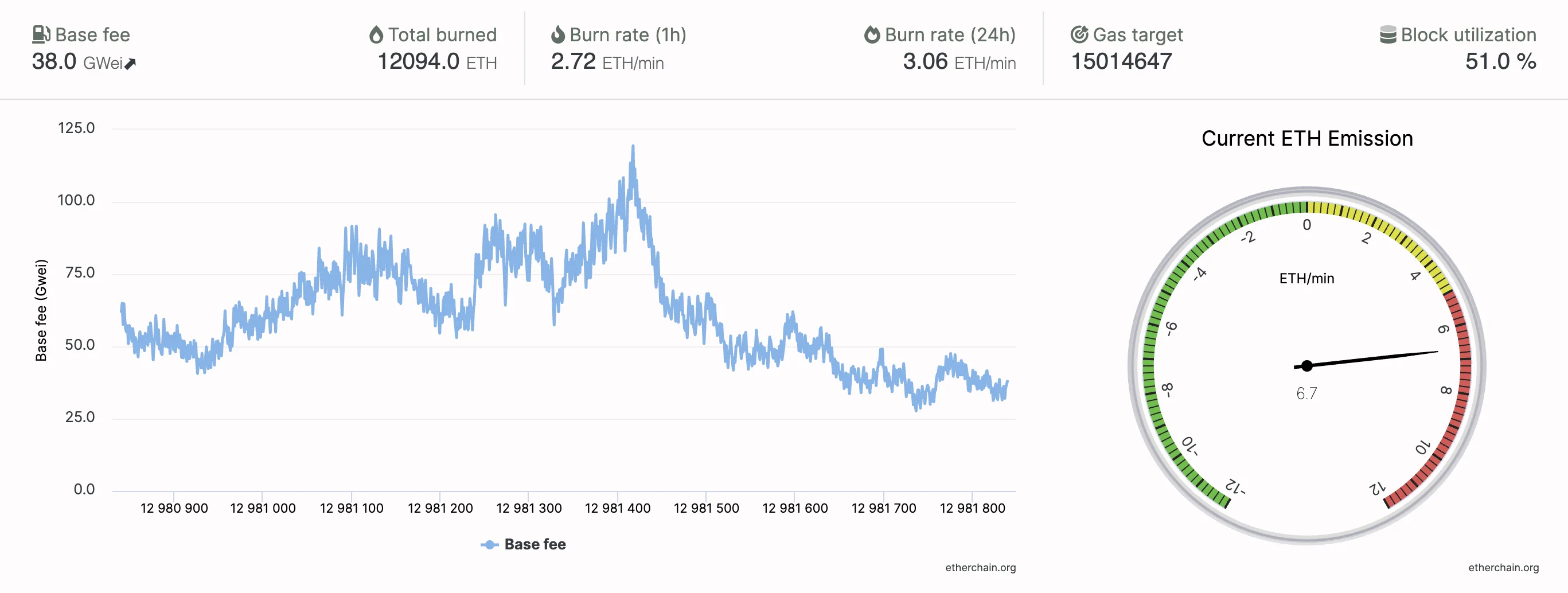

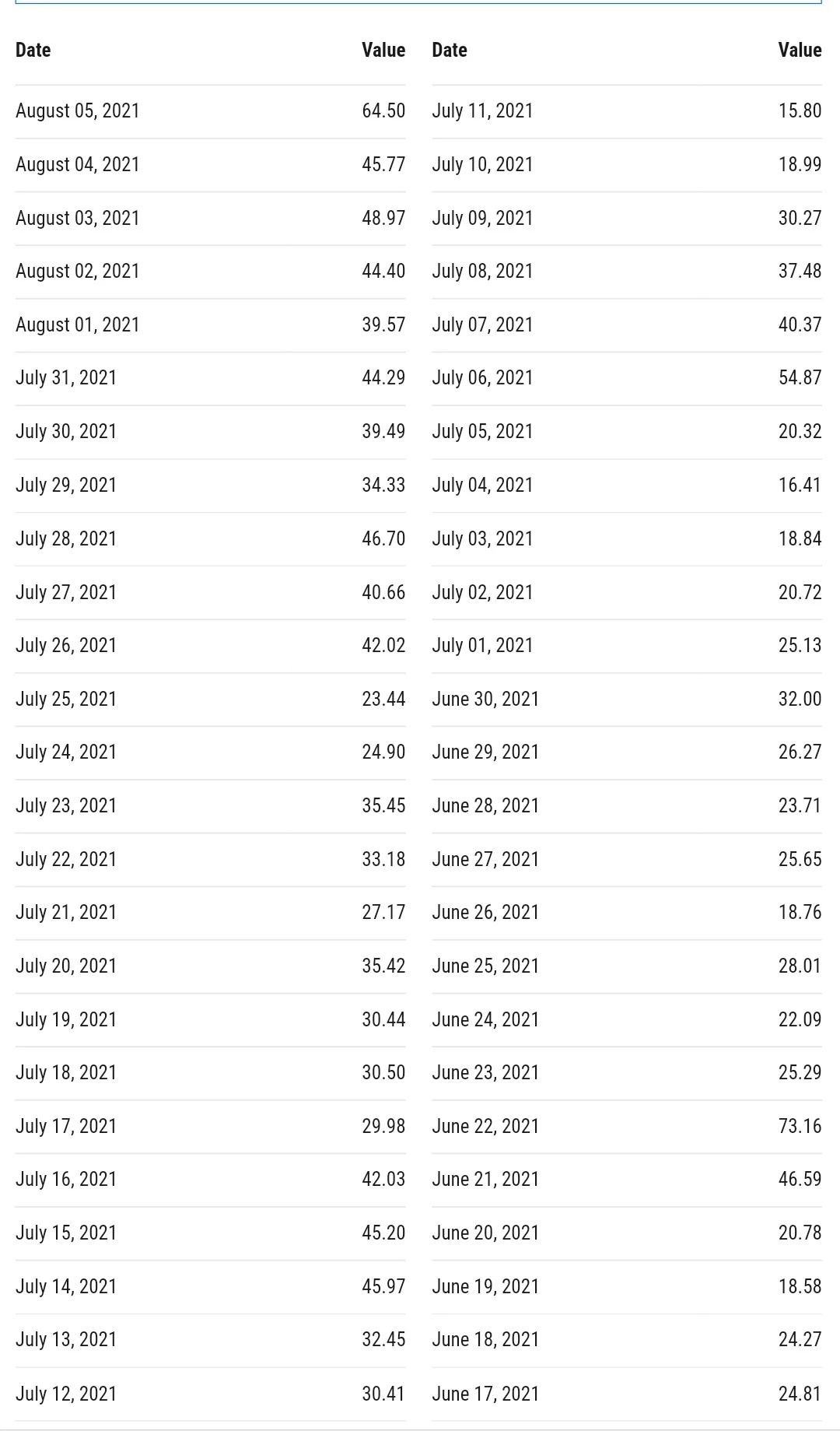

Gas fee fluctuation for a few days before EIP-1559

Does Eip-1559 make Ethereum deflationary?

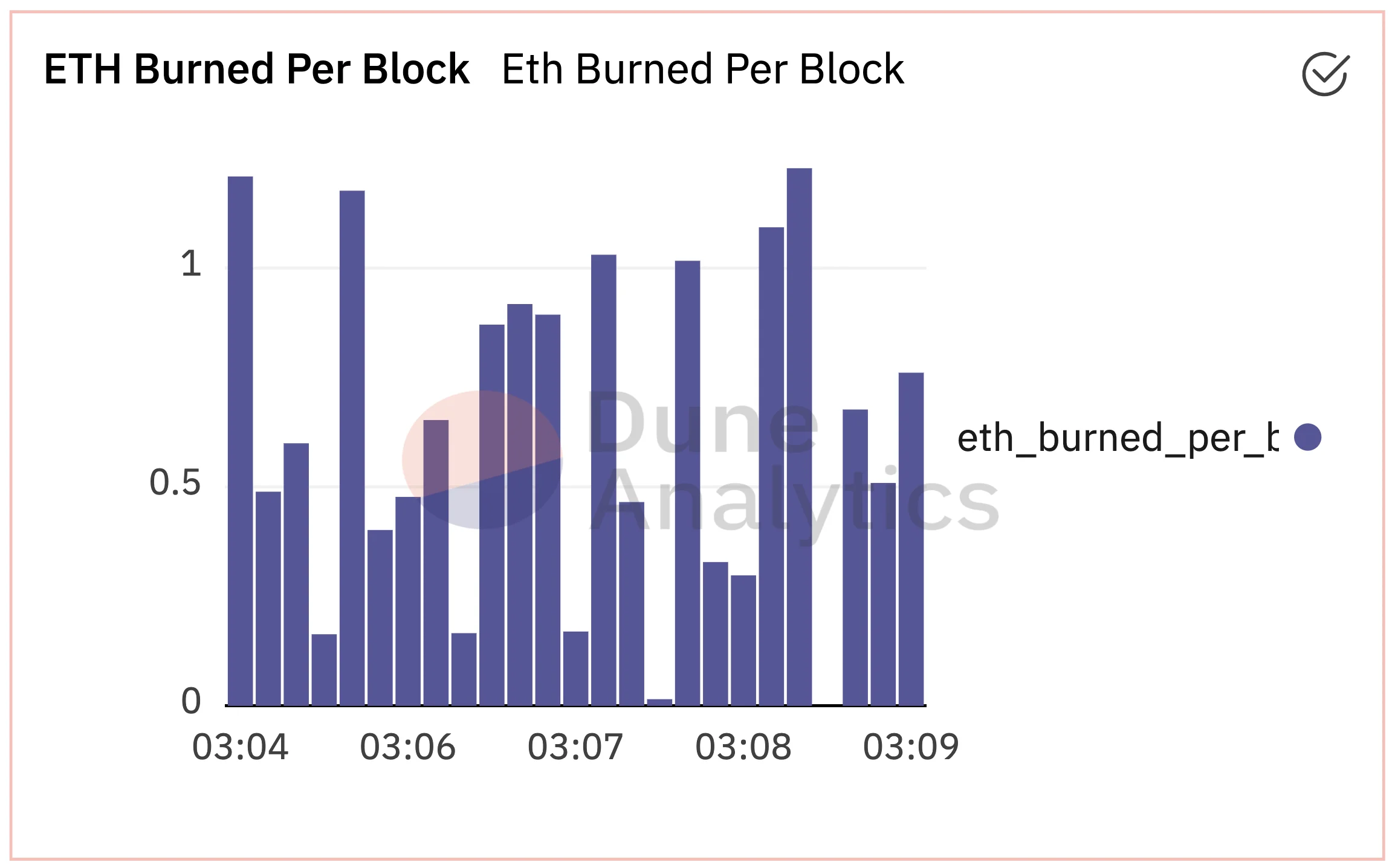

Ethereum is burning at a rate of around 3.17 coins a minute since the new upgrade rolled out across the network, data showed. The ether that would otherwise go to the miner will now be “burned,” which permanently destroys a portion of the digital currency that otherwise would be recycled back into circulation. How soon could ETH become deflationary from EIP-1559 fee burning? The short answer is no one knows currently. The precise answer is that ETH becomes deflationary whenever the amount of ETH fees burned daily exceeds the amount of ETH distributed to miners/validators via block rewards since at that point more ETH will be getting destroyed than is being created.

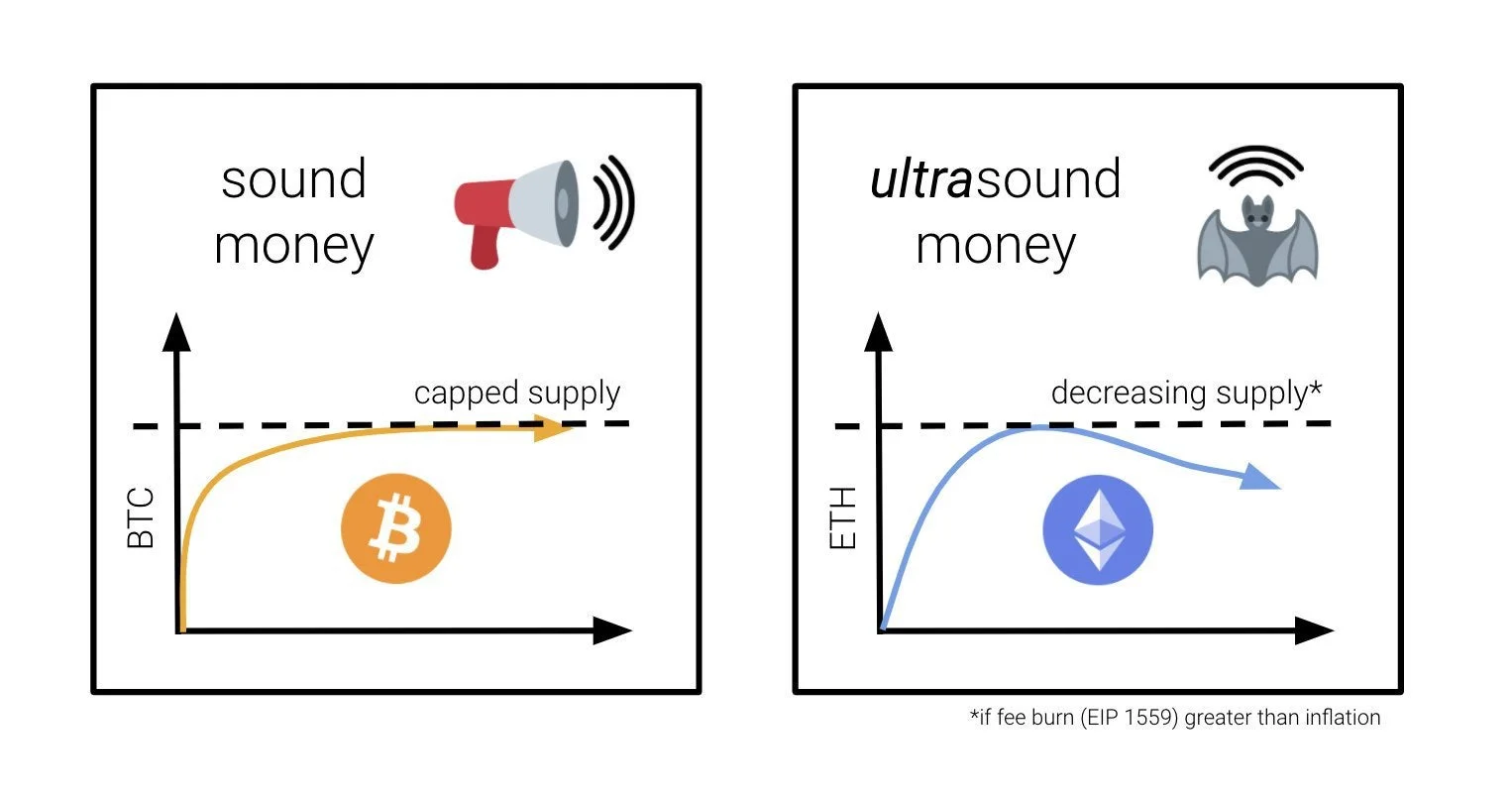

The Mechanism operates more efficiently than the POS estimated issuance, or it will be Deflationary to a much greater degree post-merge ETH 2.0. That’s why it is being called the “Ultra Sound Money”.

Ultra Sound Money 🦇 🔊

What started as a meme kicked off a wave of support from the community and You might have wondered what the bat 🦇 and speaker 🔊 emoji is all about?

This began as a joke but represents a monumental shift in Ethereum’s monetary policy. If Bitcoin is sound money, ETHER will be ultrasound.

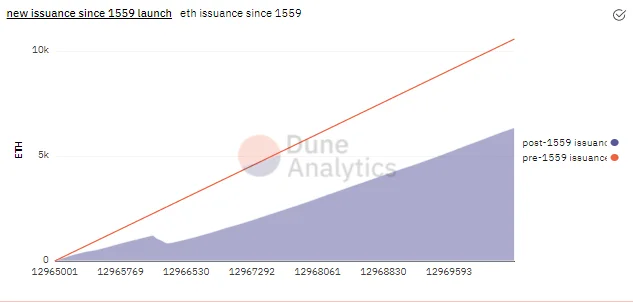

The supply of ETH has increased since the network launched in 2015. With EIP-1559 and the merge, this trend should reverse: ETH supply will decrease.

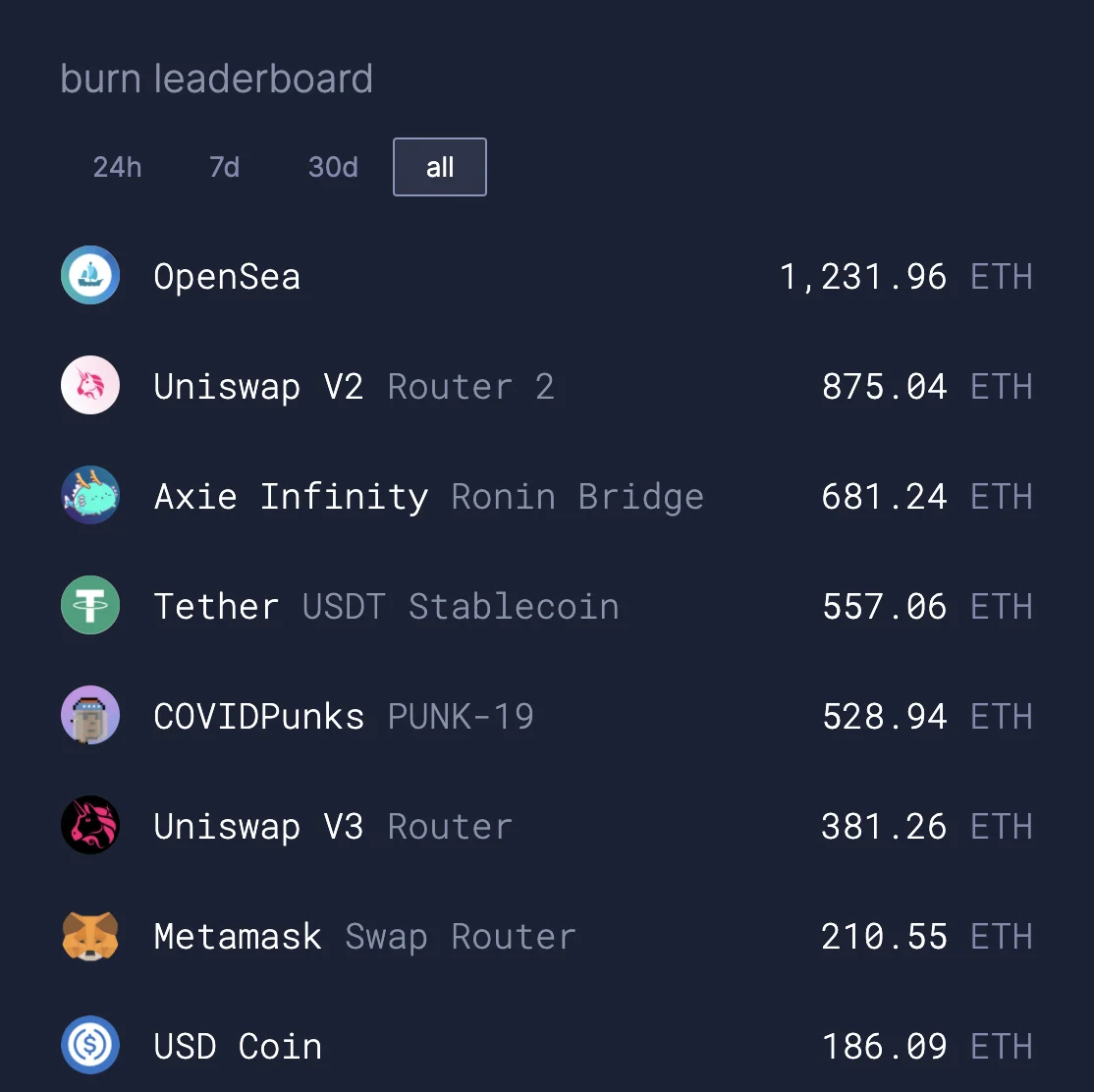

Meanwhile, 10,540.54 ETH🔥 (around $32.17 million) were burned at the time of writing, as a result of the London upgrade. Currently, popular non-fungible token (NFT) marketplace OpenSea is the largest “ETH burner” as over 1231.96 ETH ($3.7 million) tokens were destroyed thanks to transactions it facilitated since the upgrade, Ultrasound Money's data shows.

The key indicator to note here is the volume in which Opensea is trading, which is bigger than any DeFi protocol, even Uniswap. In other words, NFTs are single-handedly contributing more than DeFi.

What does this upgrade mean for the miners?

Ethereum's latest hard fork, London, went live today with several changes meant to prepare the cryptocurrency for long-term success. One change, in particular, could drastically reduce the profitability of Ethereum Mining in the process. The upgrade makes several changes to ETH transactions that favour cryptocurrency users over miners. The introduction of an algorithmically determined base fee that is burned means it's permanently removed from circulation once the transaction is completed.

Some rough calculations to show how the London fork was affecting mining rewards. Before the fork, looking at 100 blocks (12,964,992 through 12,964,893), the average block reward was 2.581 ETH. After the fork, looking at another set of 100 blocks (12,965,779 through 12,965,680), the average reward dropped to 2.234 ETH. That's 'only' a 0.347 ETH difference, but it's still about 15% fewer profits for miners in the long run. It's also about $280,000 per hour in potential shared profits that will no longer be available.

London Hard Fork Success Made Vitalik Buterin More Confident About the Ethereum 2.0 Transition.

Just a day after the highly-anticipated upgrade to the Ethereum blockchain, Buterin commented that the event had paved the way for the migration to proof of stake (ETH 2.0). He also outlined EIP-1559 as the “most important part of London.”Furthermore, he believes that the hard fork is “proof that the Ethereum ecosystem can make significant changes.” As such, he feels more confident about the upcoming merge with ETH 2.0.

How full blocks are in a range of EIP 1559 blocks from today, versus in a simulation from two months ago that assumes fairly uniform but random tx activity and realistic block production.

— vitalik.eth (@VitalikButerin) August 6, 2021

It actually looks pretty similar! pic.twitter.com/2e4wZlOq7H

What we think….

London Hard Fork will be regarded as one of the significant updates we’ve seen regarding how users interact with Ethereum. Many previous updates (Berlin) have changed systems that we don’t usually see when using Ethereum. Now, the likelihood of a decrease in transaction prices and time is much more likely, but still not guaranteed yet. Soon that will change with the Merge from POW to POS consensus which is named “Shanghai Hard Fork”, No no it has nothing to do with China or the FUD, Hard Forks are named after the Devcon hosted cities 🖖.

"The Merge" will become the top priority for the Developers. The Shanghai Hard Fork is currently expected to take place in Q1 2022. We will be there 🦁.