This is rightfully being perceived as a significant achievement for the entire cryptocurrency space. Coinbase will be the first cryptocurrency exchange to go public in the United States.

We’re happy to announce that earlier today, the SEC declared our S-1 registration statement effective and that we expect our direct listing to occur on April 14, 2021, with our Class A common stock trading on the @NASDAQ under the ticker symbol COIN.https://t.co/cwRZWmj9Pv

— Coinbase (@coinbase) April 1, 2021

The expansion of cryptocurrencies continues to collide with many core interests of traditional centralized financial services, but the upcoming Coinbase direct listing actual aligns interest of both of these parties once totally at odds. The user friendly centralized crypto trading platform reported revenue of $1.8 billion for Q1 2021, compared to $1.3 billion in revenue they produced in calendar 2020!

That’s right, not an IPO, but rather the direct listing of Coinbase is the latest extremely validating news for the entire crypto industry from a regulatory standpoint, not to mention further indicating mainstream adoption and continued acceptance of crypto in traditional finance. The collective digital asset industry stands to be bolstered by Wall Street and institutional investment access made possible by this listing. An incredibly affirming achievement for the future of decentralized finance as a whole. However, it is worth paying close attention to the recently released Coinbase Q1 financial earnings which the COIN valuation banks heavily upon. This most recent quarter has been perhaps the most bullish in crypto market history, one that can likely only maintain for so long. Accordingly, after careful consideration, not everyone is convinced the expected $100 billion valuation is totally realistic...

A report from @NewConstructs CEO David Trainer argues that #Coinbase should be valued at 81% lower than its expected $100 billion valuation.https://t.co/DwvHifGITN

— Decrypt (@decryptmedia) April 9, 2021

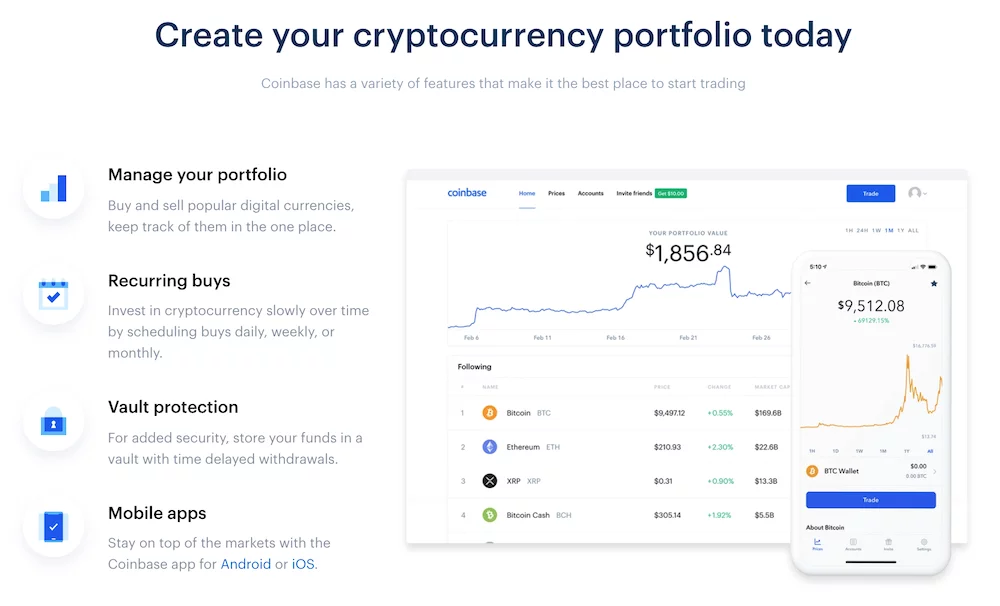

This is one investor’s take and there’s certainly an equal and opposite one to consider just as seriously. Regardless, it is undeniable that Coinbase now plays an evermore crucial role. Suddenly they bridge the gap between centralized and decentralized financial agendas. Plenty of crypto users keep funds on Coinbase, even if they know and practice cold storage of their own cryptocurrencies. Plenty more will likely utilize Coinbase services even further in a crypto-friendly future society in which day-to-day real-time decentralized financial settlement is happening everywhere.

As things like crypto micro-payments become commonplace good record keeping will become evermore essential for personal and business financial prudence. A platform like Coinbase has the potential to become evermore convenient and appealing for businesses and users. New users and investors might be pleasantly surprised to find Coinbase is already poised to succeed as much more than just a FIAT on-ramp and crypto trading platform…

To be clear, Coinbase announced their Q1 profits to be upwards of approximately $800 million, with revenue of approximately $1.8 billion. These heightened figures certainly most certainly do reflect the recent record setting crypto market interest from institutional investors as well as individuals contributing to the collective crypto market cap boom, which we might infer to be at least partly attributable to the unprecedented recent monetary policy seen worldwide in the wake of COVID. Clearly this most recent quarter’s performance being used as the primary basis for the COIN direct listing valuation is creating expectations which might be difficult to satisfy going forward...

"Crypto has the potential to be as revolutionary and widely adopted as the internet."

With such powerful statements made in the Coinbase S-1 filing, with the crypto space still being so young, I have to give pause.. Who is to say if the lofty valuation is really so unmerited?