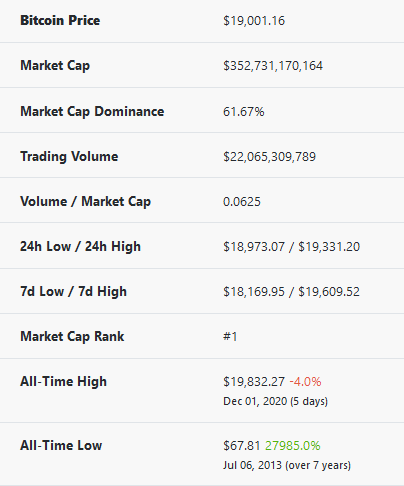

Tuesday December 1st 2020 Bitcoin recorded the new ATH price of 19.8k $ and is currently trading only around 5% lower than that.

The previous ATH being recorded at Dec 17 2017 at 19.6k $, so as you can tell this has been a long awaited event.

Hysteria, fomo and gold rush type mania seem to had been the driving force behind that rally then, but this current one feels different. Bitcoin has methodically crashed every level up to its ATH and is currently facing some resistance there.

‘’Yes RLE Gazette, but why is it different this time?’’

Well… Glad you asked

The current bull run is believed to be driven by the excess buying by new mainstream financial giants such as PayPal and Bitcoin management trust fund Grayscale who are currently buying more bitcoin than it is being mined. It was anticipated that when markets open PayPal and Grayscale would buy more bitcoins which would drive the price further.

Institutional FOMO has been the driving force behind bitcoin’s dominant bull rally and it seems more mainstream asset management firms are looking to hodl the hardest currency in the world before its scarcity goes beyond their reach.

Guggenheim, one of the largest global investment firms with over $275 billion worth of assets is planning to invest 10% of its net asset value worth $5.3 billion Macro Opportunities Fund to invest in Grayscale Bitcoin Trust.

The Bitcoin bulls dominated each level brushing aside any hurdle small or big in its way, if it manages to break and hold above $20k we could witness a different league of price momentum never seen before.

As the weekend concludes, are we going to see another price run as markets open again, with boomers going to work buying BTC? That remains to be seen.

A couple of interesting observations here.

When the price of BTC started surging we saw a spike in price of some dead chains and 2017 shitcoins, that could mean a lot of new gladiators are joining the arena of cryptos after buying some BTC and a lot of normies from 2017 that haven't touched crypto since then are back at it and of course, they will buy some more XRP. Another interesting observation as we can see on the 14-day chart here

The dip from 19k to the upper 16k range which seemed at the time to be a larger correction brewing. However, that lasted only 2 days and we can clearly see the trend reversal and the bulls taking the wheel again to reach the new ATH.

What a beast!

Truly historic times as we see all the mechanisms Satoshi Nakamoto and the BTC developers put in place in full effect.

Who is Satoshi Nakamoto?

Of course here in the Gazette we know who Satoshi is but that’s for a later article…

How do these bull runs affect our NFT community?

Just the fact that the $ price of crypto is rising is making people hodl harder and be more mindful with their crypto spending, so as it was expected, market volumes and activity have dropped significantly. Another factor that was fuelling NFT markets was defi gains and farming rewards that made some people a lot of money. So with deflated defi and BTC/ETH bull run it is normal to experience a small dip. Nevertheless we remain optimistic about the NFT markets due to Christmas being around the corner.