- Blur and OpenSea are at war over customers

- NFTs that trade on one exchange are blacklisted on the other

- Blur's lucrative airdrop has seen it take the most trade volume recently

- It seems like a ceasefire has been declared 🤞

There’s an all out war raging in NFTs right now. It’s an unavoidable conflict where neutrality is not an option: the combatants are forcing traders to choose a side. In the seesaw battle between Blur and OpenSea, the weapons are royalties and loyalty rewards; the collateral damage is artist livelihoods.

If you’ve spent any time in the NFT space, you know that upstart NFT exchanges have slashed artist royalty fees in an effort to annex market share from OpenSea (OS). Lower fees mean NFT traders keep more profits. But how in the immutable world of web3 can one just take away an artist’s cut of profits? Well, it came as a sad revelation last year that royalties were not enforced by smart contracts; in fact, royalties were simply collected and dispersed by OS in a web2ish way. In response to losing customers, OS tried to fight fire with fire by slashing fees and creating a Draconian royalty enforcement tool–but it was met with a massive backlash. Now Blur seems to winning the latest round of this exchange battle.

Trade count has been higher on @blur_io for 5 consecutive days, Blur even saw 50% more trades than @opensea yesterday

— hildobby (@hildobby_) February 20, 2023

Source: https://t.co/yPbPkHn08h pic.twitter.com/LmLuEjHSpw

Blur markets itself as “the NFT marketplace for pro traders.” Being trader-centric, they know that profits are the primary way to entice users away from OS. Since Blur’s launch and airdrop, the platform has taken pole position in NFT trade volume. The reason it has reached number one? Loyalty rewards.

I earned 77,000 $BLUR (currently worth $85,000) in @blur_io's 1st airdrop by bidding with just 1-2 ETH

— Luke Cannon | Lukecannon.eth (@lukecannon727) February 16, 2023

Here's how, plus how I'm playing season 2 (might surprise some people): pic.twitter.com/J4qWGu0mpE

In a clever gamified loyalty campaign, Blur handed out points to traders that placed offers near NFT floor prices. The closer one’s offer came to a floor price–aka the more risk a trader took–the more points they scored. At the end of this campaign, Blur airdropped tokens to users based on their scores. Some traders were able to cleverly farm this airdrop with minimal collateral and make nearly six figure sums of the new Blur token!

BREAKING: Blur just made a game-changing move to bypass OpenSea's blocklist control

— Panda Jackson (@pandajackson42) January 30, 2023

As stated in airdrop announcement, Blur is trying new things for an unprecedented launch.

Here's how they did it & the impact their move will have on the NFT market, esp. for creators&traders👇 pic.twitter.com/19aLLMRfKg

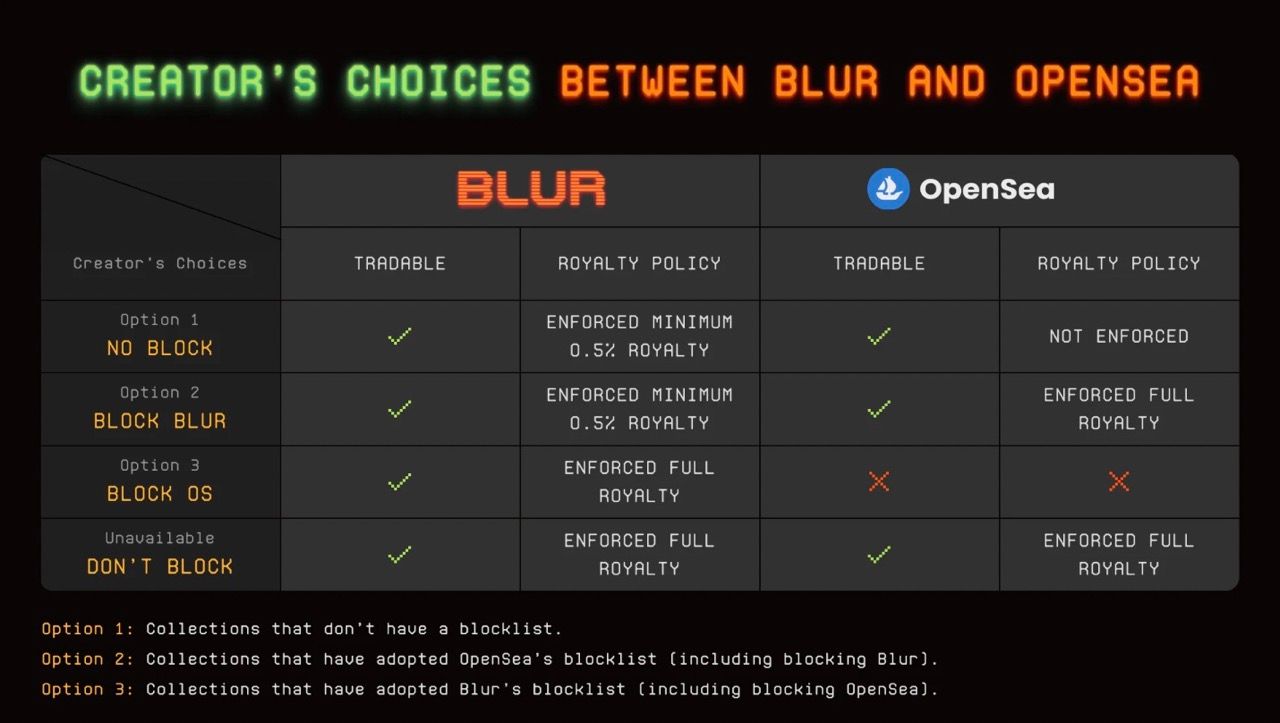

On top of rewarding degen traders with valuable airdrops, Blur has gone on the offensive in the royalty realm. Right now, there is a blacklist, or blocking, war between the two rival exchanges. Despite the decentralized free market ethos of web3, if an artist wants their rightful cut of trades, they have to choose a side! The choice: does a collection go with Blur’s or OpenSea’s tools? As far as Blur is concerned, the best way for artists to get their full royalties, is to block OpenSea and whitelist Blur. The reason has to do with Blur’s ability to avoid OS's blacklist. Essentially, OpenSea tried to create a blacklist for their collections that would block trading on Blur–it failed. Thus, if an artist chooses to use OS’s royalty enforcement, traders will dodge fees by going to Blur. On the other hand, if a collection trades on Blur with their royalty enforcement, traders will be locked out of OS and forced to accept full royalties on Blur. Seems like checkmate for OS, right?

In response to the massive success of Blur, and the vulnerabilities of their sieve-like enforcement tools, OpenSea announced a change of policy. First of all, they launched a rewards program to rival Blur's airdrops. Secondly, they accepted Blur’s invitation to halt the tit-for-tat blacklist battle. Hopefully this signals and end to the royalty wars that have gone on since the middle of 2022.

This episode should be a wake up call for the entirety of web3. Large private players have sullied what should be a decentralized, free market. Royalties should be governed by smart contracts that immutably guarantee pay outs on all trades for all time. Instead, there has been a corporate turf war that has put artists in the middle of a fight they didn’t create.

A month ago, around 75% of NFT buyers opted-in to paying royalties on x2y2, when given the choice.

— NFTstatistics.eth (@punk9059) October 28, 2022

Now that number is around 18%

The idea of "tip jar" royalties where buyers can opt-in or opt-out will likely prove to just be a 0-royalty policy over time

Free riding is too easy pic.twitter.com/BAG9VfI18q

History is filled with avoidable market-destroying moments like this. The fight evokes a Mercantilist tariff battle from the 18th Century–or a gang war where ordinary people are forced to choose colors. The race to the fee bottom echoes the predatory pricing, aka monopolistic undercutting, of 19th Century railroad tycoons. Somewhere lost in all of this economic warfare is the fact that projects rely on fees to keep up operations and bring new products to market.

1/ @LimitBreak is excited to announce OPT-IN, BACKWARDS-COMPATIBLE PROGRAMMABLE ROYALTIES POWERED BY STAKING. Read the complete blog post here:https://t.co/nxtArtLV1K

— Gabriel Leydon (FREE,OWN) (@gabrielleydon) January 10, 2023

Web3 is supposed to be better than this. This whole sad saga is the result of a failure to follow best practices–royalties should have always been enforced on-chain! Perhaps tools like Limit Break's opt-in smart contract will prevent future collections from having to choose enforcement over decentralization. In the meantime, there’s a cease fire between Blur and OpenSea–let’s hope for a lasting peace.