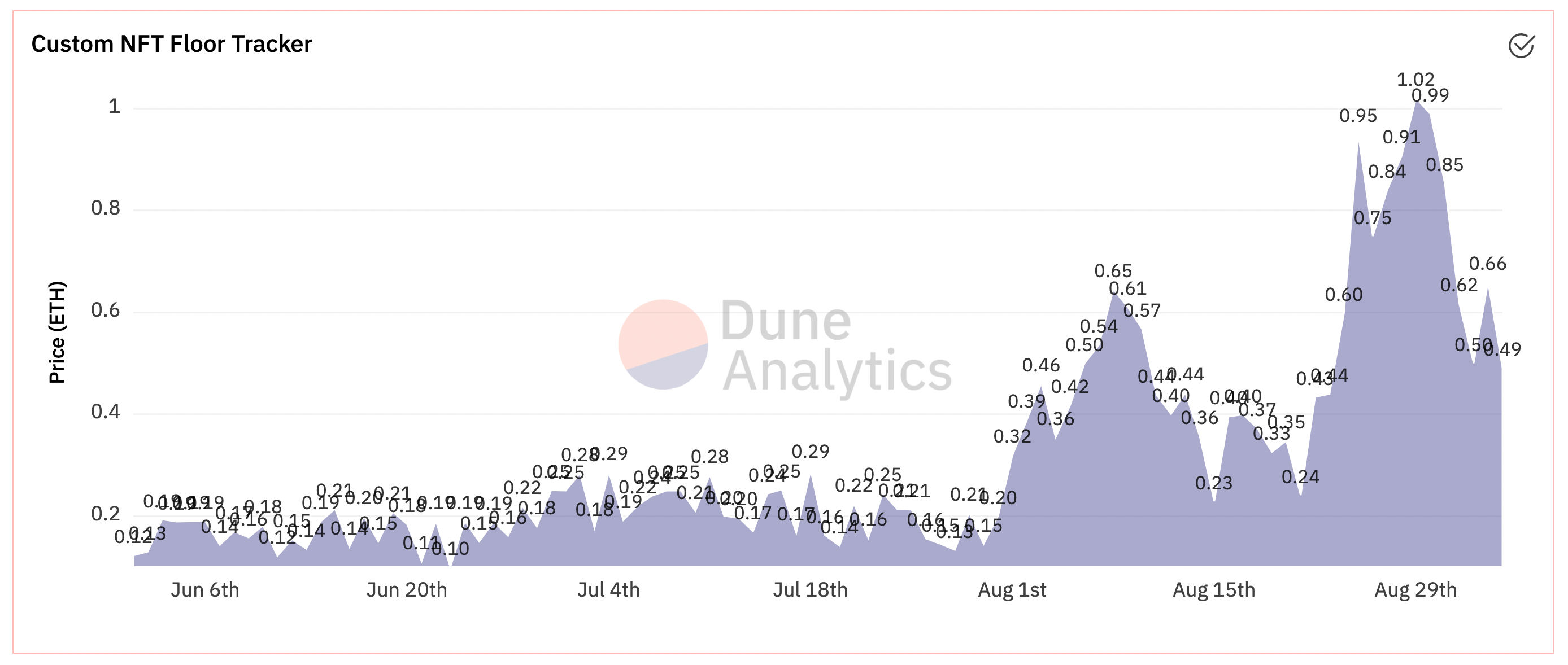

At this point, the Market is on a recovery path.

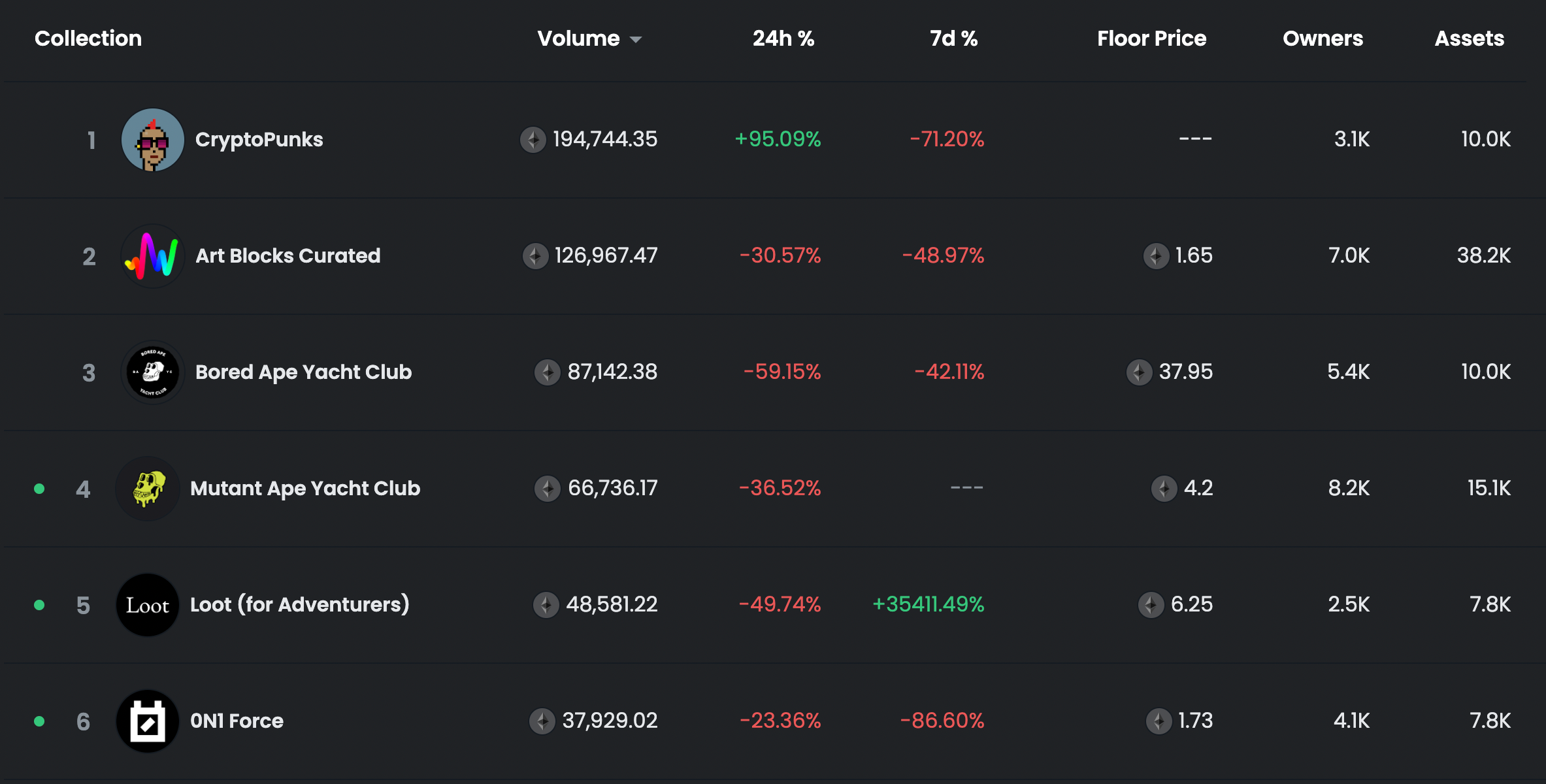

CryptoPunks

After several weeks of being in the limelight, punk floor dipped from 145 ETH to 92 ETH. But it did not stay long there with a gradual rebound to 105 ETH, breaking the psychological resistance of 100 ETH. Larva Labs signed with Universal Talent Agency, The Hollywood Reporter - The agency will represent the crypto-art projects from Larva Labs for film, TV, video games, and publishing projects, becoming some of the first crypto-native IP to seek mainstream content deals. Punks and Meebits stamping their authority mainstream.

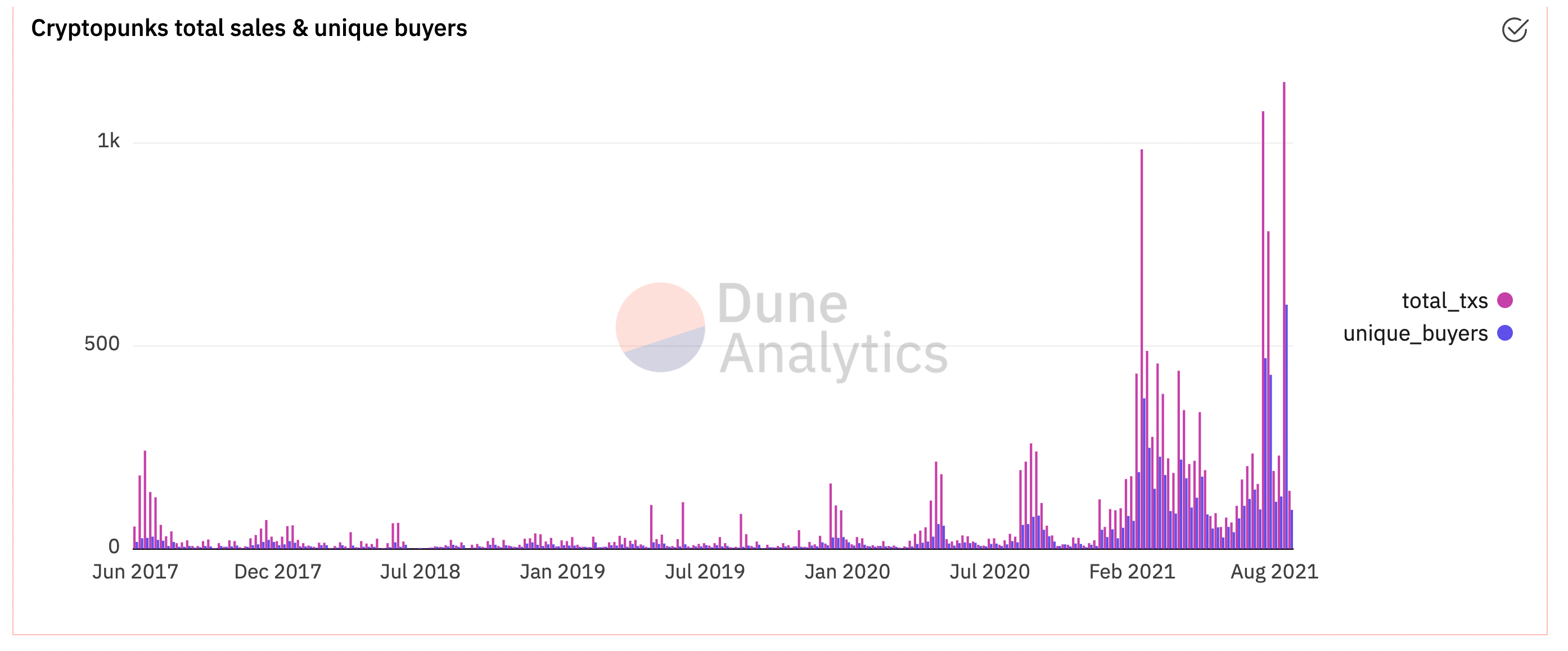

Another important recovery metric to check market health is unique buyers or active wallets. It has reached 3,943 at the time of writing. That clearly indicates demand.

Art Blocks

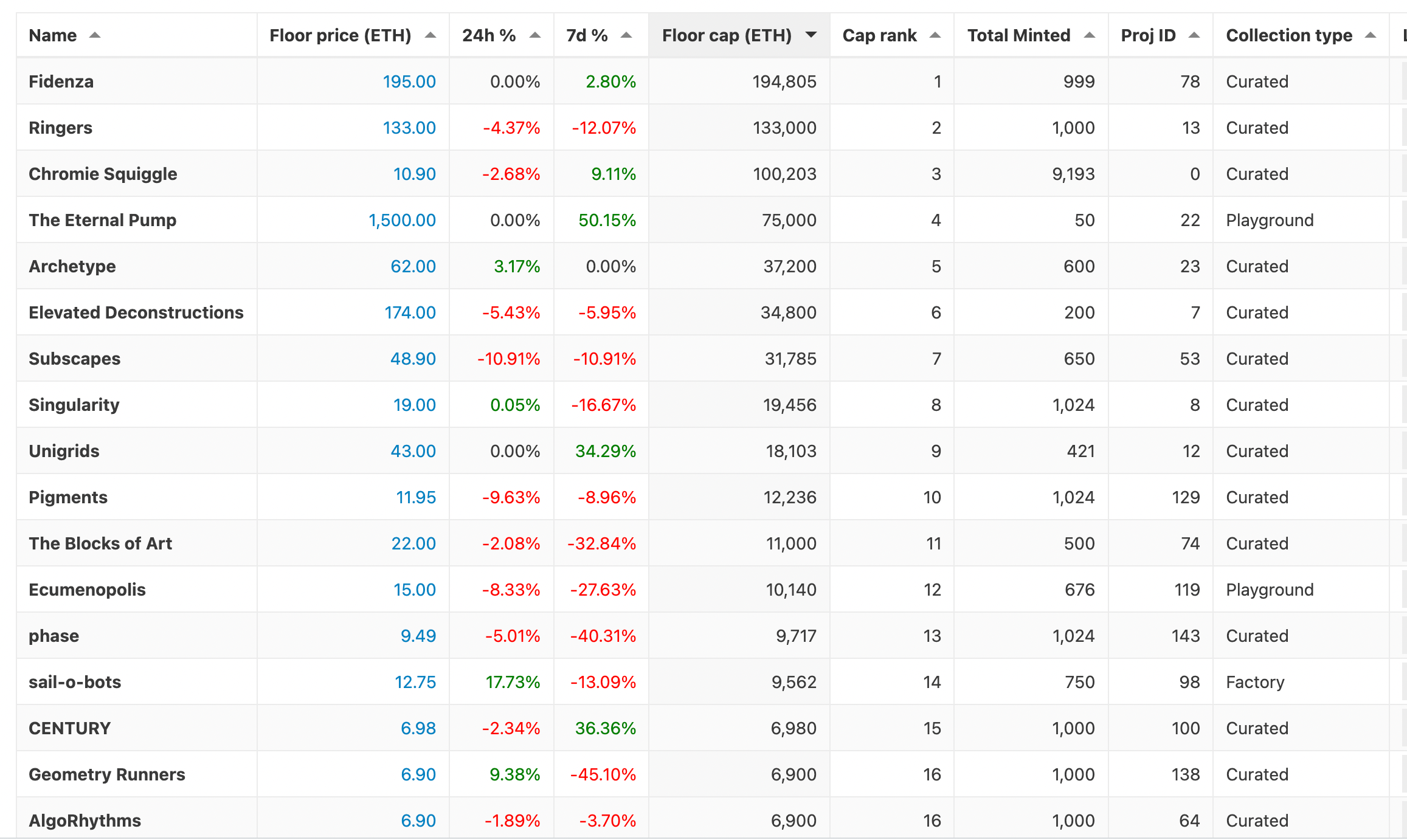

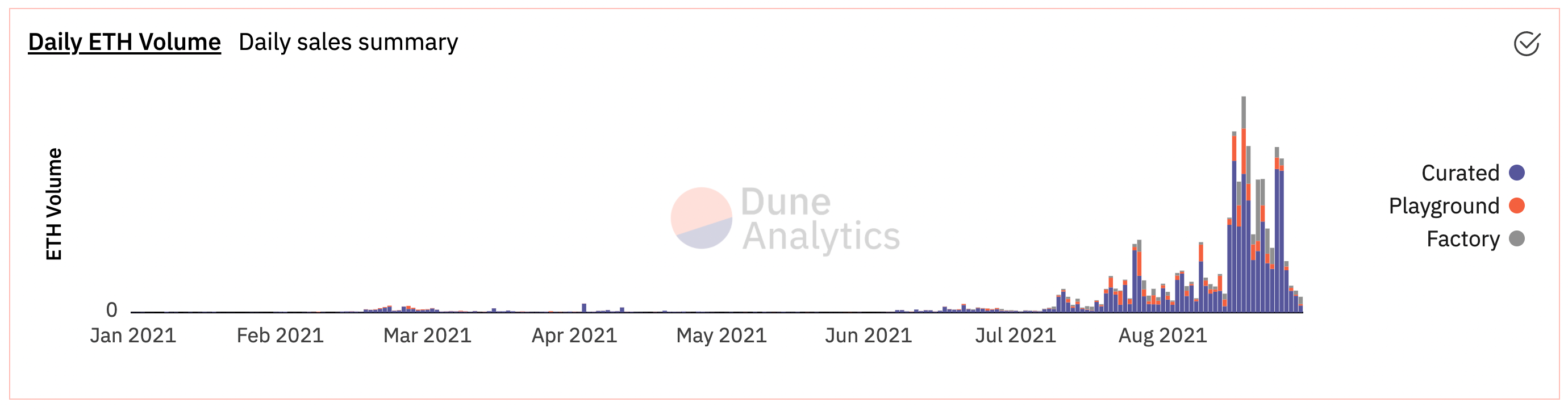

Though it did not make much noise this week, Art Blocks nearly represents an entire index of generative arts. This week we saw the total Art Blocks market down 5.6% to $3.5B floor capitalisation. Curated and Factory showing some correction from overextension in the recent weeks. The Eternal Pump is up by 50% in the last 7 days while Unigrids made 34%

Volume has dropped comparatively, but it is difficult to maintain that level of volume and it looks settled and neutral. Since we haven’t noticed underpriced sell-offs, the overall trajectory looks positive for a higher rebound.

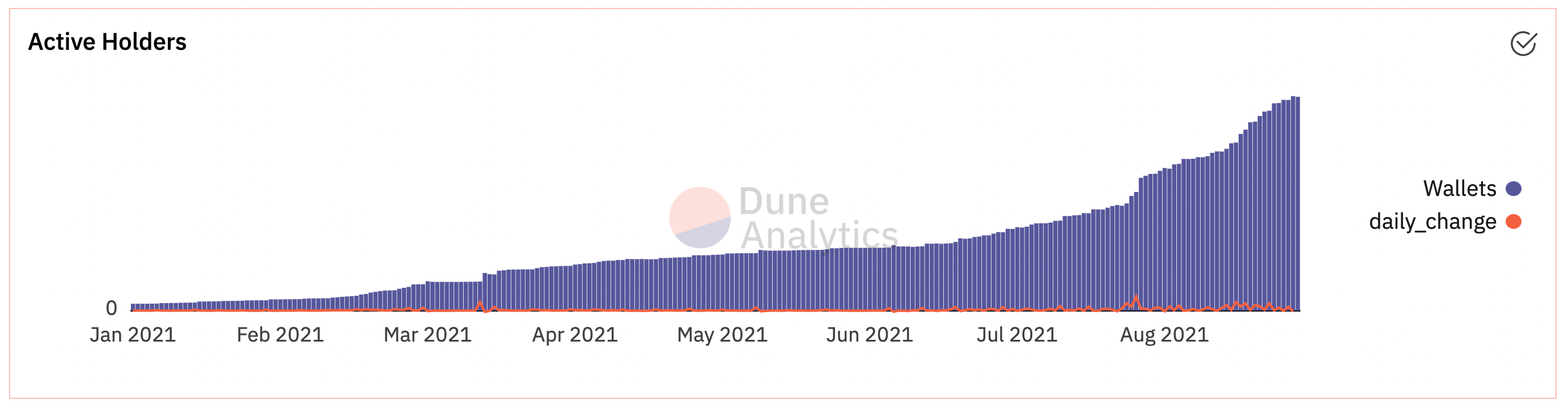

Active holders indicate adoption growth in a steady increment. The overall social sentiment is a net positive.

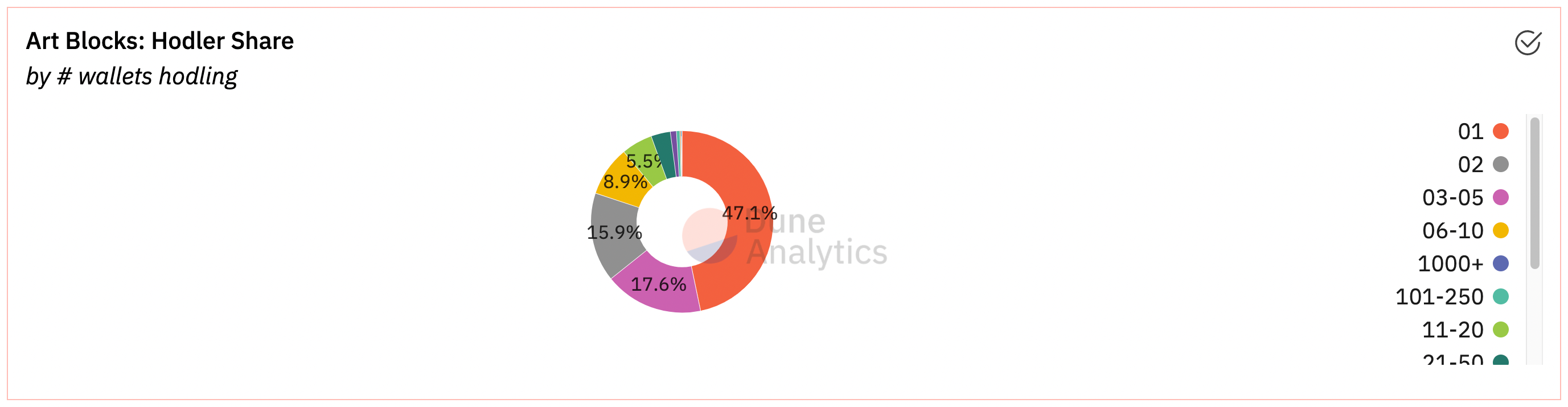

Another key performance indicator is the ratio of assets to wallets. Figuratively, If we discount 6 whale wallets that hold ~1000 assets, the remainder of assets are evenly distributed and 90% of the wallets hold less than 10 assets.

Bored Ape Yacht Club

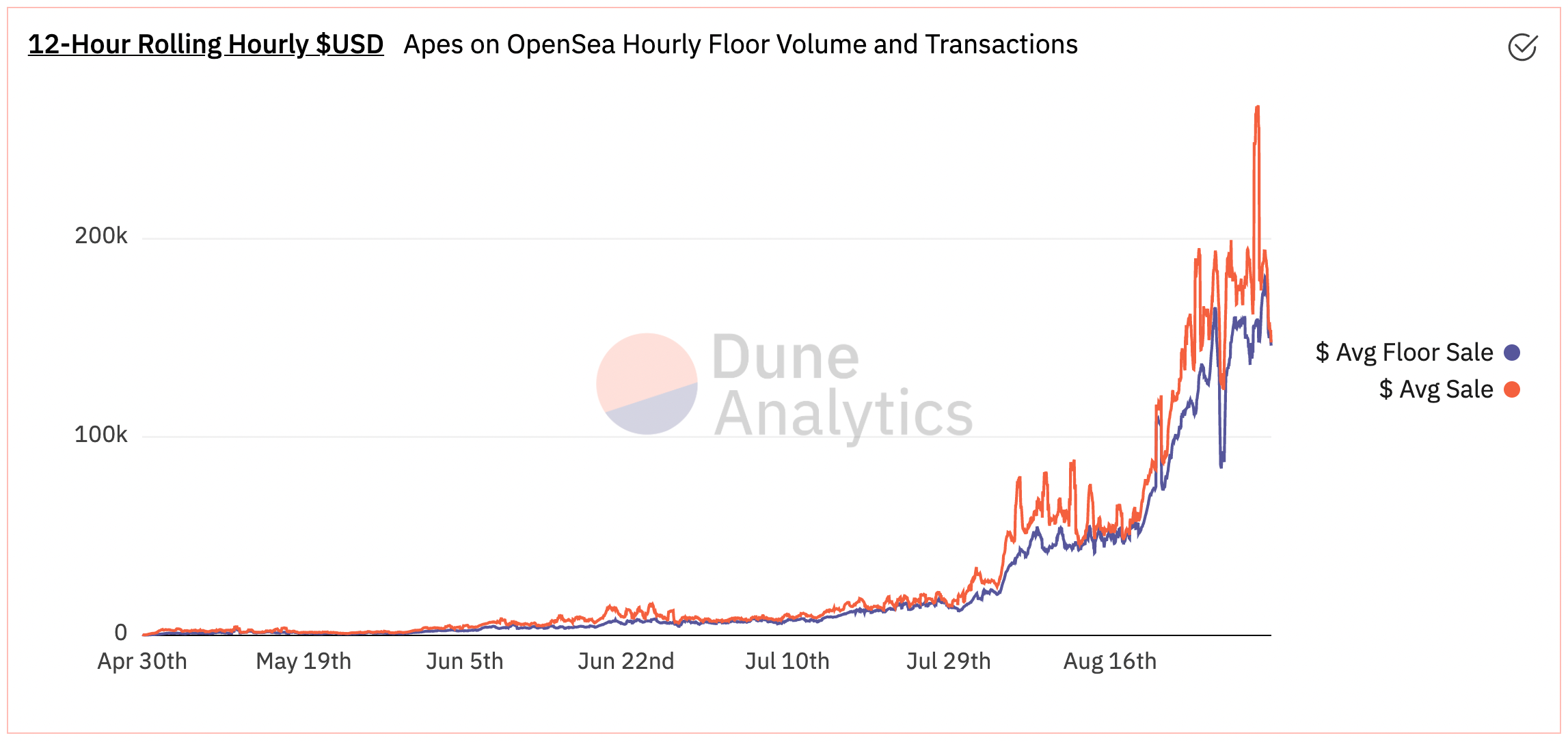

Prior to the launch of Mutant apes and Serum, Bored apes were at 44 ETH floor. After redistribution and market frenzy, the floor has settled at 37 ETH.

There are two ways to acquire a Mutant. The first is by MUTATION - exposing a Bored Ape to a vial of Mutant Serum. There are three tiers of Mutant Serum - M1, M2, and Mega Mutant. MUTATION will begin after the public sale concludes. pic.twitter.com/xB12hDzHuG

— Bored Ape Yacht Club (@BoredApeYC) August 29, 2021

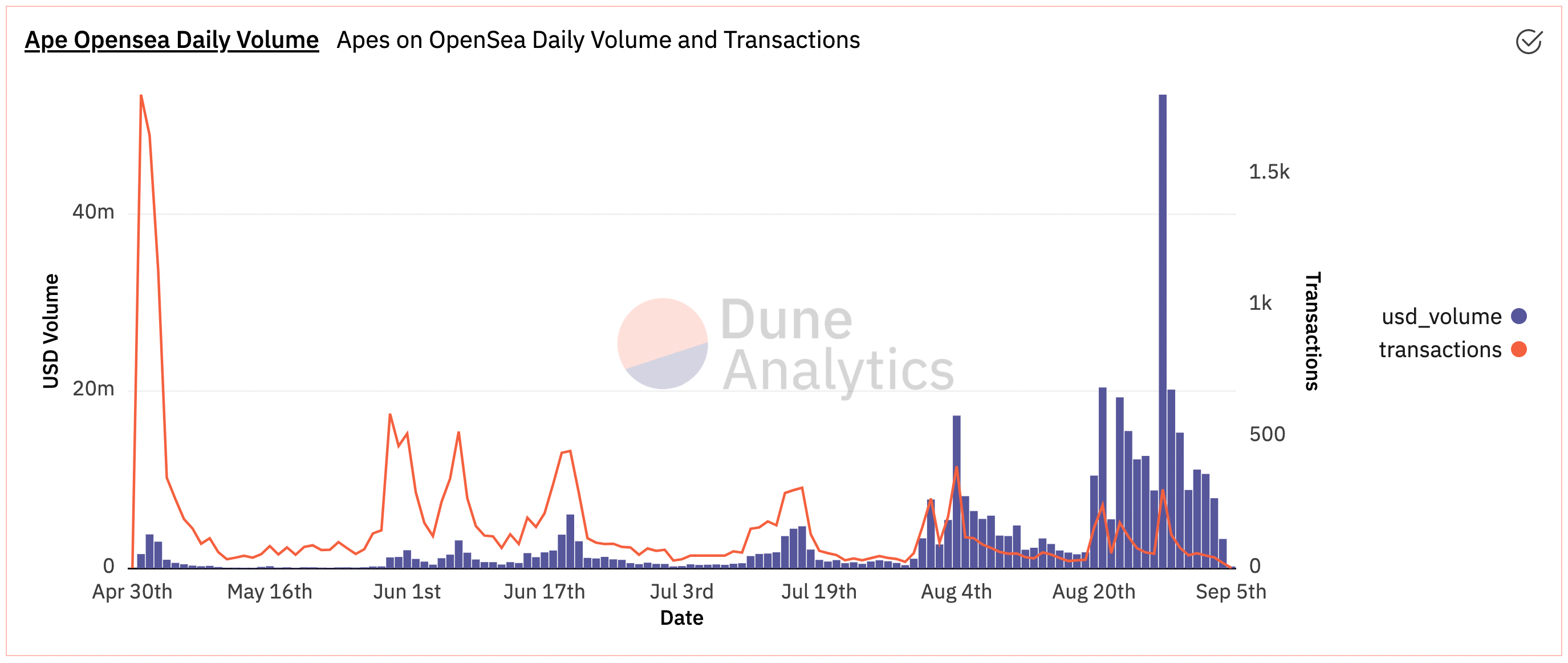

42% volume dropped since last week marking its buying climax for now. We will see how it will progress in the coming weeks.

An astonishing metric to note from the above analytics is the relation between volume and transactions that have taken place. Both have been on the decline since MAYC. Major contributions from the top tier apes helped push the floor price up.

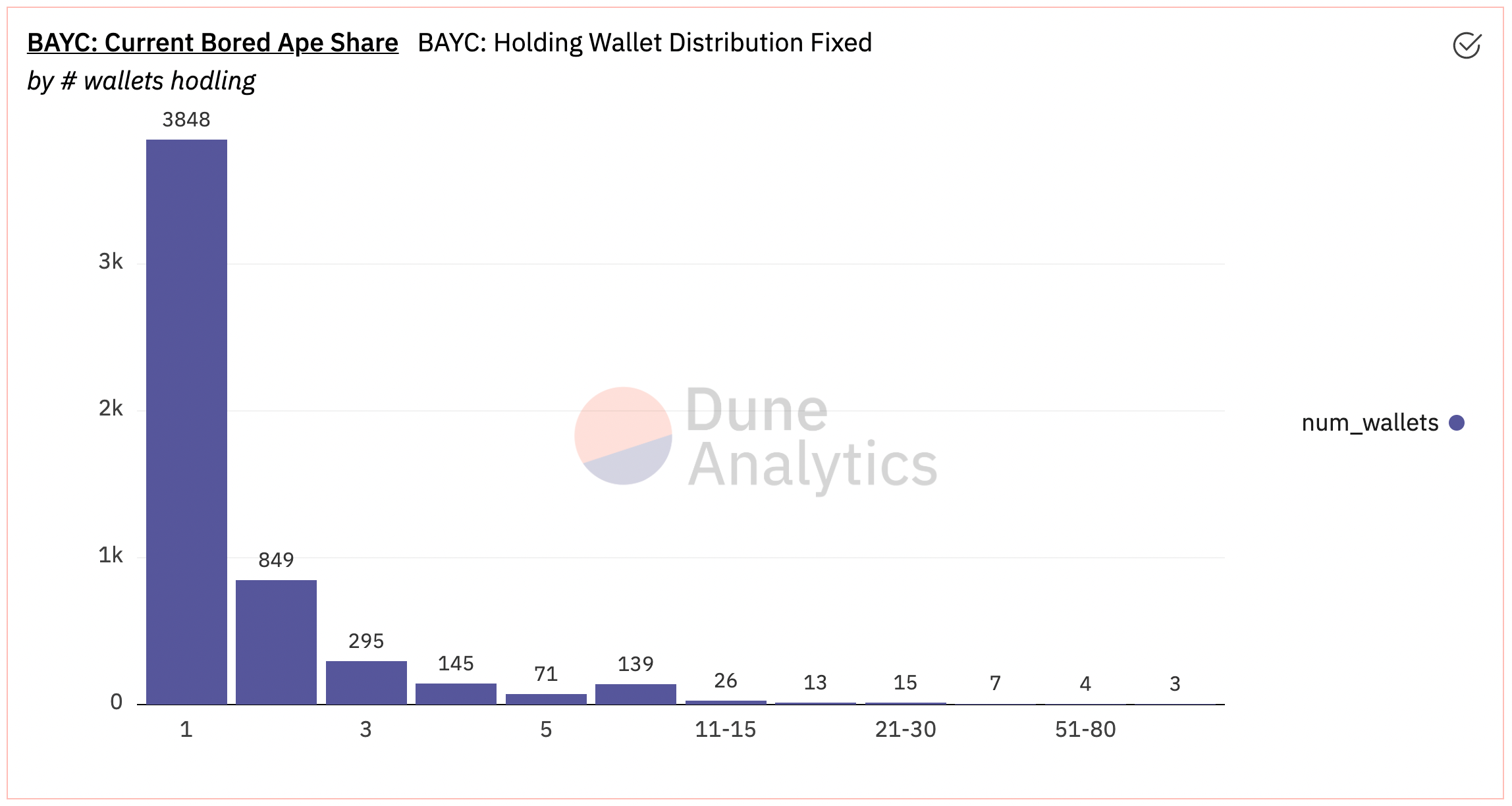

Unique wallets holding shows the reception from the market. Excluding some whales with holdings of 80 apes, others have been evenly distributed as 3848 wallets holding 1 ape.

Zora launched APES.HOUSE, a permissionless auction house system for BAYC.

New enthusiasts flocking into NFTs contribute to the social sentiment. One true range indicator was institutional money flowing to NFTs. Which solidified the fact that NFTs are going mainstream.