The era of ApeDAO seems to be coming to an end. Members voted last week to liquidate the DAO with a two-thirds majority. The ApeDAO saga has raised questions of what it means to manage a DAO, the fluctuating relationship between token value and asset value, and the intricacies of DAO membership.

ApeDAO, formed last year by NFT collector KyloRen, is a DAO of NFT collectors. Their mission was to be the single largest holder of Bored Apes in the space, and with 81 Bored Apes and Mutants in their possession, they had been well on their way to earning that title, becoming the 3rd largest holder of BAYCs and the fourth largest holder of Mutants. But it seems that dream of becoming number one will never be realized.

ApeDAO’s assets, in addition to the 81 BAYCs and MAYCs, include one Punk, one Fidenza, five Chromie Squiggles, two Kongz, and three Cool Cats, among many more NFT projects. As of this writing, the floor estimate of ApeDAO’s treasury is over 11,500 ETH (about $32,590,295 USD) — that’s no small sum. With the liquidation set to move forward, these assets will be sold off and the proceeds distributed among token holders.

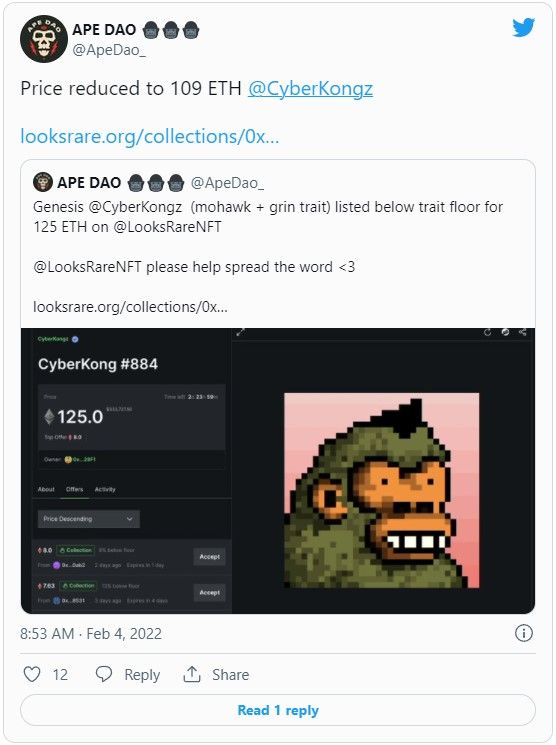

So far, the liquidation process is underway, with several assets in two wallets already on sale. Their first major asset to be listed for sale, Cyberkong #884, is currently priced at 109 ETH, with pending offers below the floor price.

This news is so big it’s even made a splash outside the Web3 space, with Business Insider reporting on the liquidation, especially noting the DAO’s BAYC collection.

How did it come to this?

ApeDAO is token-gated, governed by $APED. Holders of $APED hold voting rights and fractionalized ownership of the DAO’s treasury, apes and all. And the value of $APED — or lack thereof — is where the trouble began.

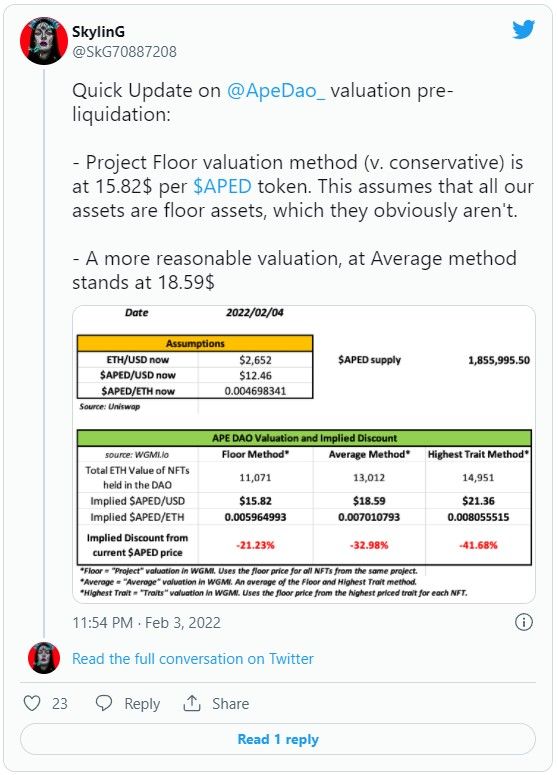

When the DAO did a community fundraiser in August 2021, the token was valued at about $10, as Montana Wong noted in his viral Twitter thread. Since then, the floor estimate of BAYCs alone has increased five times their valuation in August. But by January, the value of $APE actually decreased to $8, which is about half the valuation its price would presumably be, considering the value of ApeDAO’s assets. Predictably, this led to some drama in the DAO.

In the intervening months before the liquidation proposal, ApeDAO wasn’t up to much, and coordination issues led to slow development. The decrease in value occurred despite the fact that no new tokens had been created since the August fundraiser. This led to some discontent among $APED holders.

The first attempt to bump the value of $APED, a proposal to hire a professional team to run and manage the DAO, was voted down by the community. Then, on January 29, a community member proposed to liquidate the DAO’s assets and have the ETH proceeds distributed among the token holders pro-rata. In the days during the proposal the price of $APED skyrocketed to a high of $13, as investors anticipated liquidation and bought in to cash out.

What does this mean?

First of all, this means that high-value NFTs — in the case of BAYCs, 81 of them — will be back on the market, making some BAYC holders concerned that the floor price of their Apes will be depressed. Not good news when crypto, and markets in general, have already had a shaky start to the year. Members of ApeDAO have promised to handle the liquidation gradually, and as it has only just begun, it remains to be seen whether that promise will hold true.

The ApeDAO situation is reminiscent of trad-fi corporate raids, as Wong noted, in which investors buy up ownership of a company and use voting power to force liquidation of the assets for a profit. Corporate raids were big in the ‘80s (what wasn’t?), and some investors earned notorious reputations as corporate raiders. Corporate raids are generally frowned upon, as the raiders’ sole intent of buying up and selling off company assets can disrupt a company’s ability to do business.

However, ApeDAO hasn’t had a mission beyond buying NFTs with the intent of selling them later, acting more as an investment club than a company creating products and services And so far, the liquidation is being handled responsibly, avoiding flooding the market with high-value assets.

And as for the future of ApeDAO? It will likely remain in operation as long as there are assets to sell off, and once everything is sold the proceeds will be distributed as planned — presuming that the signature holders of the multisig wallet follow through with their promises.

Having been in existence for only a few short months, ApeDAO was a star that burned fast and bright, and may fade to obscurity just as quickly. How it winds down its assets will likely set an example for similar DAOs in the future, so other NFT collector DAOs should be watching closely.