The buyer of the NFT is a decentralized autonomous organization (DAO) called PleasrDAO. A DAO which was specifically formed to buy this NFT!

🦄🦄🦄 pic.twitter.com/uEdz2qiqgL

— Uniswap Labs 🦄 (@Uniswap) March 22, 2021

This video and NFT were created by pplpleasr.

It was recently used by Uniswap to promote it’s upcoming version 3 platform and sold for 310 ETH ~$520,000.00. The buyer of the NFT is a decentralized autonomous organization (DAO) called PleasrDAO. A DAO which was specifically formed to buy this NFT!

There sure is a lot of excitement for Uniswap version 3, and understandably so. Since 2018 with the launch of version 1, Uniswap has been pushing the boundaries of decentralized exchanges (DEXs) and automated market makers (AMMs). Many improvements and new features were introduced in Uniswap version 2 just under a year ago, and since the v2 launch the DEX has managed over $135 billion in trading volume! Uniswap has become a pillar of the decentralized finance world.

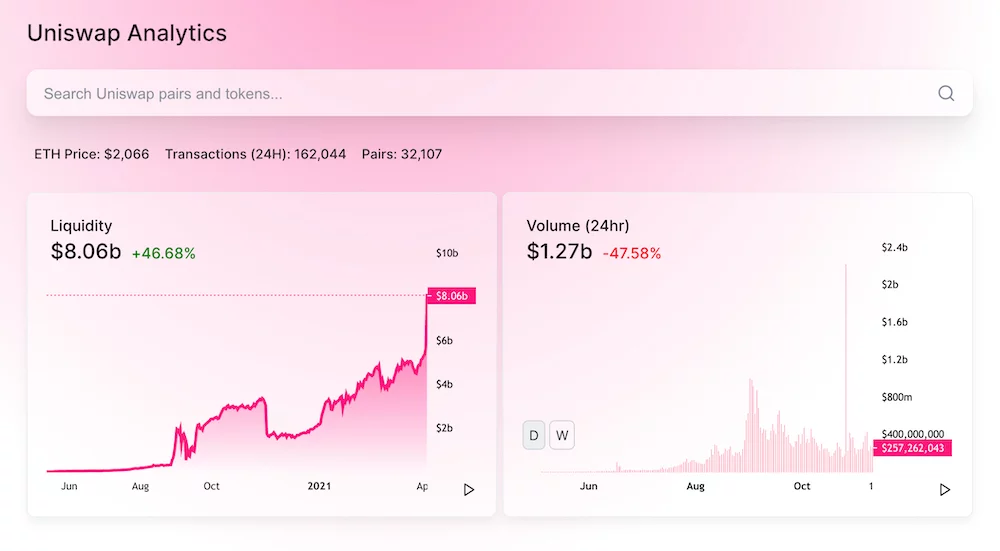

Uniswap Analytics 4-3-21

According to data collected by theblockcrypto, Uniswap activity comprises 20% to 25% of all transactions on the Ethereum blockchain each day. Uniswap also commands approximately 60% of the DEX market and caters to 15 times more users than any other Ethereum decentralized exchange.

The highly anticipated version 3 has been given an Ethereum layer-1 launch date of May 5th 2021, with a deployment on Optimism set to follow shortly after. The overview of Uniswap V3 indicates the upgraded platform is geared towards improving the decentralized exchange’s capital efficiency.

Uniswap v3 introduces:

- Concentrated liquidity, giving individual LPs granular control over what price ranges their capital is allocated to. Individual positions are aggregated together into a single pool, forming one combined curve for users to trade against

- Multiple fee tiers , allowing LPs to be appropriately compensated for taking on varying degrees of risk

These features make Uniswap v3 the most flexible and efficient AMM ever designed:

- LPs can provide liquidity with up to 4,000x capital efficiency relative to Uniswap v2, earning higher returns on their capital

- Capital efficiency paves the way for low-slippage trade execution that can surpass both centralized exchanges and stablecoin-focused AMMs

- LPs can significantly increase their exposure to preferred assets and reduce their downside risk

- LPs can sell one asset for another by adding liquidity to a price range entirely above or below the market price, approximating a fee-earning limit order that executes along a smooth curve

🦄 Uniswap v3 just dropped.

— Haseeb Qureshi (@hosseeb) March 24, 2021

It contains some huge ideas—I remember hearing about them from Hayden back in early 2020. Now they’re finally public!

These are my first reactions for the effects v3 will have on Uniswap's future. Rough takes right now, but here's a thread. 👇

At first glance it seems Liquidity providers (LPs) will be the most impacted by utilizing the updated platform. Largely due to their ability to make markets within custom, and more specifically, narrower price ranges via what is being called ‘concentrated liquidity’. LPs provide assets to liquidity pools which Uniswap users trade against. Previously, liquidity providers needed capital ready to deploy among an infinite price range, often leaving a bulk of their available capital idle and not earning fees. Uniswap v3 allows LPs to customize the allocation of their liquidity towards more narrow ranges where most trade volume are occurring, resulting in a higher rate of return on the LP’s capital.

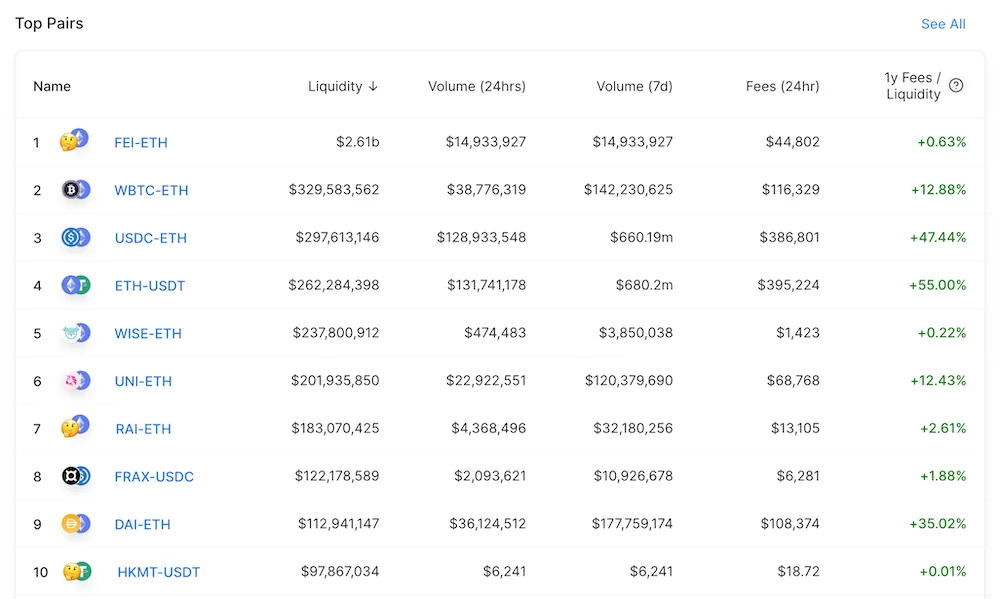

Top 10 Uniswap V2 Liquidity Pairs 4-3-21

The Uniswap DEX technology has certainly helped revolutionize the world of decentralized trading. However, not all of the Uniswap version 3 changes necessarily make this an improved experience for everyone when compared to the current Uniswap version 2. Greater efficiency for LPs on one side of the coin might mean sacrificing automation on the other. Liquidity providers will likely have to regularly update their liquidity range settings in order to assure returns.

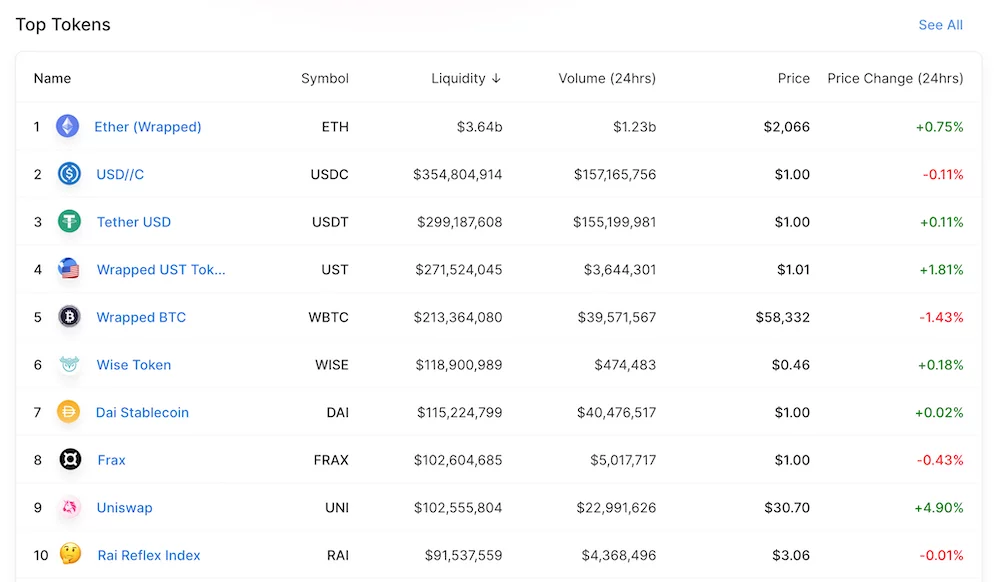

Top 10 Uniswap V2 Tokens 4-3-21

Plenty of projects have been working on optimizing AMMs over the past years. This is clearly not an easy undertaking, as many of the more complex improvements might bring many pros, but also cons worth considering. Of course, because Uniswap is open-source others can take their publicly available code and build their own version of the DEX, as we’ve seen with SushiSwap. This time Uniswap appears to have taken steps to protect its version 3 innovations from direct cloning of the project by licensing Uniswap’s version 3 code as a business source license. After two years this code will be repurposed as an open-source GPL for the crypto community to use or build upon.

Just like the launch of v2, Uniswap v3 is an entirely separate protocol which will be deployed to run alongside the earlier versions of Uniswap. Though some might not feel too rushed to migrate to v3 as v2 has done such a great job facilitating their decentralized trading needs, it seems likely that a majority of the Uniswap user-base will indeed want to experience the latest and greatest AMM DEX technology available on the Ethereum blockchain. Optimism can’t launch soon enough!