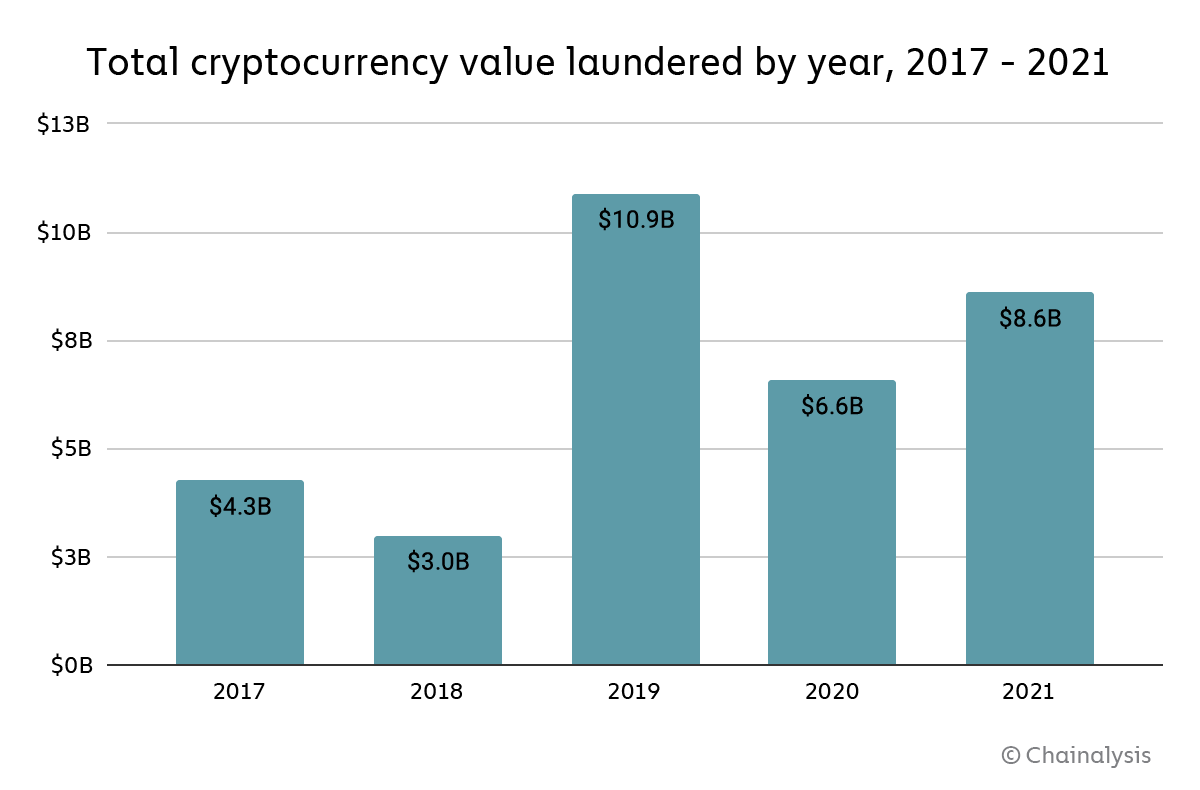

While in movies, you may see scammers transporting illicit money in duffel bags; in real life, cryptocurrencies are fast emerging as an alternative to money laundering. The fact that crypto transactions are anonymous and border-free has made it challenging to regulate the issue. According to Chainalysis, a blockchain data company, $8.6 billion was laundered around the world in 2021 alone, targeted mainly by hackers and scammers. It's a wild west!

Image source

Vulnerable Bridges

Cross-chain bridges, designed to facilitate interoperability between two blockchains, have been at the centre of money laundering. Scammers often resort to ‘chain-hopping’ — exchanging assets from one chain to another to make them harder to trace. Also, these bridges are decentralized and do not require KYC details, making it easier for cybercriminals to go untraced.

Blockchain analytics firm Elliptic has reported that at least $540 million in crime-related crypto funds have been laundered using the popular cross-chain RenBridge. It also found out that "more than $2.4 million from the hack of Nomad Bridge has already been laundered through RenBridge."

Image source

Mixers

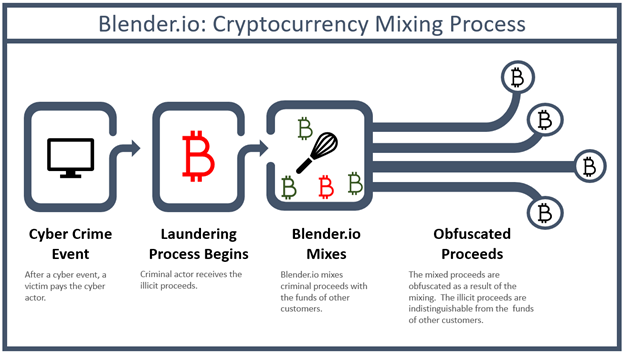

Illicit funds are often cleaned up using mixers or tumblers. Each crypto transaction is traceable on the blockchain. However, mixers can break down multiple coins from several chains and blend them. Stolen crypto goes into the mixer, where it is ‘washed’ or ‘cleaned’ and mixed with legitimate coins. The original amount is transferred to the owner through multiple wallets, thereby obscuring the trail.

Earlier this month, the US Treasurybanned Tornado Cash, a decentralized mixer that was allegedly used by the North Korea-based Lazarus Group to launder a large sum of funds. Blender.io, another popular mixer, was also sanctioned in May. TheTreasury stated that the mixer was used in the Axie Infinity heist and facilitated the process of over $20.5 million in illicit funds.

Online Gaming and Gambling

Online gaming and gambling platforms accept payment in cryptocurrencies, making them an easy destination to clean or launder coins. Money launderers often use their stolen crypto to buy in-game currency and cash out after a few transactions. Once the platform pays out the crypto, it gains legal status.

Can Crypto Laundering Be Stopped?

Cryptocurrency networks often present loopholes, allowing a network of funds to be moved in bits and whole from one wallet to another or country to country without causing any significant attention. Several exchanges have anti-money laundering features and implement KYC (know your customer) rules to keep their platforms safe, but there are many unregulated platforms that don't enforce identity checks or flag accounts that engage in unusual activities.

However, all crypto transactions are stored on a public ledger and are traceable on the blockchain, which has resulted in several high-profile busts and arrests.

It's still a long haul from sanity, but with more demand for stringent checks, crypto platforms are investing in security measures and reporting activities or persons whose actions are in tandem with financial crime.

Sources:

- https://blog.chainalysis.com/reports/2022-crypto-crime-report-preview-cryptocurrency-money-laundering/

- https://hub.elliptic.co/analysis/cross-chain-crime-more-than-half-a-billion-dollars-has-been-laundered-through-a-cross-chain-bridge/

- https://www.redlion.news/article/nomad-bridge-exploited-for-usd200-million-how-the-first-decentralised

- https://home.treasury.gov/news/press-releases/jy0768

- https://www.redlion.news/article/tornado-cash-ban-highlights-debate-between-privacy-and-money-laundering