As regional banks fail, inflation keep flying, de-dollarization salvos start a new Cold War, debt-ceiling debates threaten a government default, and the U.S. Dollar Index continues to fall from September ‘22 highs, Congress and several government agencies are focused on… crypto?

Yes, that’s right, innovative U.S. tech companies like Circle and Coinbase, companies that have always ‘played the game’ of following regulations for both state and federal lawmakers, are being squeezed for no good reason. Coinbase stole headlines last week when it sued the SEC for stalling and failing to answer simple questions.

Today, we filed a narrow action in the U.S. Circuit Court to compel the SEC to respond “yes or no” to a rulemaking petition we filed with them last July asking them to provide regulatory guidance for the crypto industry. 1/4 https://t.co/rlsS1DIFfl

— paulgrewal.eth (@iampaulgrewal) April 25, 2023

What didn’t make headlines, but might be even more important than the Coinbase suit, was a stablecoin hearing from last week. The House of Representatives’ Subcommittee on Digital Assets held a hearing entitled Understanding Stablecoins’ Role in Payments and the Need for Legislation. The event shed light on a new effort to regulate stablecoins. Essentially, a small group from the House heard different witnesses talk about stablecoins. For crypto enthusiasts, the meeting led to fear that all stablecoins will be declared securities. The origin of this effort is tied to the SEC’s February Paxos suit–the stablecoin issuer was sued for selling an unlicensed security… but how can something that has stable value be a security?

This is where things get weird. As covered in previous stories, a security is defined in the U.S. by the expectation of security buyers that the security seller’s efforts will grow the security’s value. Obviously, anyone buying a dollar-pegged stablecoin expects zero profit. However, the SEC made a strange logical jump and claimed that stablecoin issuers are creating a security because they buy U.S. government bonds with the income they receive. In other words, because the stablecoin issuer makes a small profit on Treasury Bills, the stablecoins they issue are securities. If this doesn’t make sense at all… don’t worry, the SEC’s logic here really doesn’t make sense!

What’s even more odd about calling stablecoins securities because the issuer owns U.S. treasuries, is that buying treasuries is exactly what U.S. banks do with their cash reserves. If you have a boatload of money, the safest, most boring investment is government bonds. It’s seen as the responsible thing to do. Why punish companies for NOT taking risks with their cash reserves?

Another way to look at it is that Circle is a major customer of the U.S. government. Circle is putting money into Uncle Sam’s hands! If you buy a USDC, you are indirectly giving money to America. Moreover, Circle was the first company to get licenses in New York to distribute crypto. It has always been transparent and followed the law. Thus, this whole effort to misclassify stablecoins will hurt an honest technology company.

U.S. Congressional Committee Highlights the Importance of Payment Stablecoin Legislation. Read more in this recap. https://t.co/6ETCcDGNwx

— Circle (@circle) April 19, 2023

Why is this happening? Responses in the hearing made that clear. Many Representatives made completely, verifiably-false statements that blamed the failure of regional banks on crypto: in reality, SVB and FRB failed due to “duration risk,” which is the combination of owning too many long-term bonds while suffering a rash of bank-run style fund withdrawals.

However, in this post-FTX climate, where many Representatives are still embarrassed by cavorting with SBF, it makes sense that the U.S. would distance itself from crypto. In fact, why not dump some BTC? This is what happened to some of the seized Bitcoin from the Silk Road case. According to a Circuit court memo almost 10,000 BTC was moved in late March.

Despite the regulatory FUD, Bitcoin has performed well in recent weeks. Bank failures and the threat of a government default over the debt-ceiling debate makes a strong case for owning Bitcoin–it is, after all, a hedge against falling fiat values.

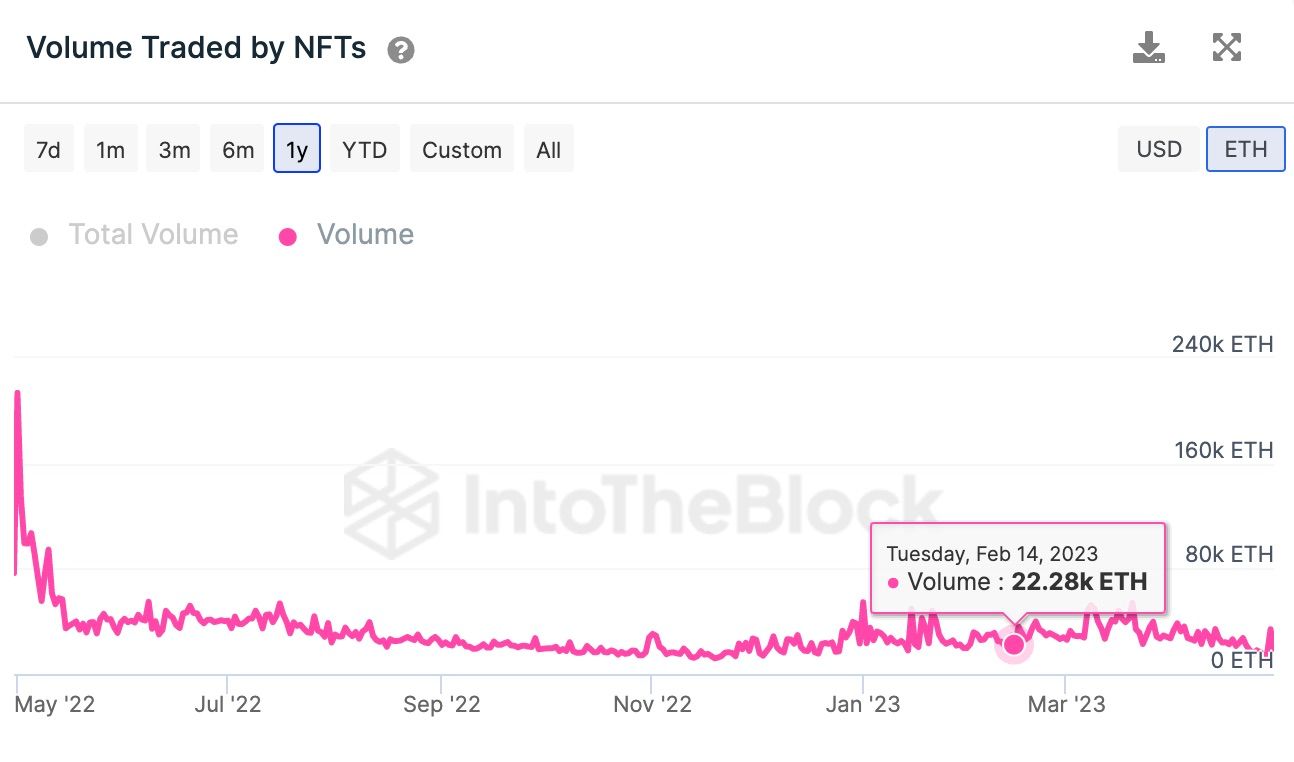

While Fungibles have done well in this climate, NFTs are continuing to struggle. According to trading data from IntoTheBlock, NFT volume declined significantly in April. This probably has something to do with several factors: the PFP market is struggling, Blur’s airdrop hype is fizzling and the frenzied Ordinal trend is cooling.

Proud of you for buying At a 90% discount

— Olde_Craig.AS© (@olde_craig) April 15, 2023

It is worth considering whether or not this could be a signal for the NFT sector’s bottom. It is unusual for the fungible market to be completely decoupled from the non-fungies. While only time will tell what happens with markets, there are significant discounts out there for many top-tier projects! Moonbirds, for example, is one of many bluechips that has fallen far in the last 30 days. While this is not financial advise, many collectors are enjoying the discounts!