To use crypto parlance, Azuki has mooned. Its sales volume reached $300 million in the first month, one of the rarest Azukis recently sold for $1.4 million, there’s been a Forbes magazine feature and even celebrity endorsements. Top tier Azukis trade for close to half a million dollars and the floor price currently sits at 25.50 ETH. Azuki’s performance in 2022 has been light years ahead of even BAYC and Cryptopunks. The result? It’s already the 8th most traded NFT collection ever to exist. Not bad for a project that only launched in January.

Is Azuki the new Bored Ape Yacht Club?

Azuki is a collection of 10,000 anime avatars minted (in the public part of the auction) for 1 ETH each. It sold out in three minutes, leading people to draw Bored Ape Yacht Club comparisons. BAYC was launched in early 2021, Azuki in early 2022. Both collections sold out immediately and both double as a kind of digital “pass.” Apes grant users access to the Yacht Club, owning an Azuki gives you entry into The Garden. Both soared in value shortly after their release and traded for colossal sums on secondary. Both use airdrops to great effect.

The big difference, of course, is the art style. BAYC spawned countless animal pfp knock-offs (expect to see a lot of Azuki style anime in the near future) but Chiru Labs dared to take things in a new direction. The anime style is stark, eye-catching and stands out in the flooded market that is 10K pfp projects. If Azuki really is the next blue chip NFT, it will own that mantle precisely because it avoided derivation in favour of originality.

Comparisons are inevitable for any big collection but Azuki’s underlying ecosystem is unique. The focus on community is palpable (whitelist entrants were screened according to community activity) and Azuki grants will one day fund creatives within the Azuki family. Moreover, as BAYC has gradually become associated with massive wealth and celebrity, Azuki deliberately cultivates a rebellious, “skaters of the internet” vibe that appeals to crypto outsiders.

Why is Azuki so popular?

A lengthy feature in Forbes magazine is a testament to how Azuki has exploded through the NFT bubble into the mainstream. The article speculates on the reasons for this, suggesting that a combination of superior artwork, an unusually high quality website, demand for anime and the rebellious “skateboarder” culture have all contributed to its success. Chiru Lab’s website offers one of the most advanced search functions of any NFT collection, making it easy to browse Azuki according to traits like clothing, hair and headgear.

Azukis are minted on their own contracts (ERC721A). This allows collectors to mint multiple tokens at once for substantially lower gas fees. Price and demand also soared on news of an airdrop, from which each Azuki holder received two “somethings.” The promise of more community rewards in the future undoubtedly makes this project - which is still technically in its infancy - extremely attractive to investors and collectors alike.

The team also promises to blur boundaries between the physical and digital worlds. In practice, this means a lot of merchandise. Physical collectables and streetwear are both in the pipeline. The website suggests that these will be delivered to holders as exclusive drops, further bolstering the community vibe. A link to the Azuki shop is currently labelled “coming soon,” a gentle reminder that perhaps this sudden success has taken even Chiru Labs by surprise.

What are Azuki’s plans for the future?

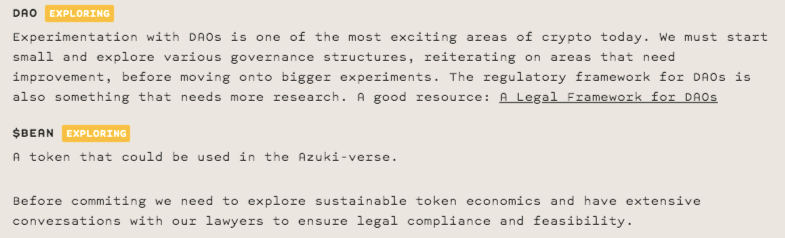

Azuki’s mission statement is as simple as it is ambitious: “create the largest decentralised brand for the Metaverse that is built and owned by the community.” Meta-games are in development along with interactive experiences and in-real-life events. The prospect of an Azuki DAO and $BEAN coin also explains why collectors are so bullish. The team even has an eye on Hollywood, with suggestions that TV shows could pay to licence the Azuki brand. This would generate a new income stream for Chiru Labs alongside royalties.

The project has already netted $31 million from the first mint, followed by another $15 million from secondary sales. Interest around Azuki is so high that even the 20,000 airdropped “somethings” hit a floor price of 3.14 ETH shortly after release. The founding team is relatively small, consisting of just four men living in LA. Although the team keeps its identities hidden, they reportedly have experience with Google, Facebook and Y Combinator. A fifth member, Arnold Tsang, was a leading character developer for Overwatch.

It’s this mix of experience, early success and future potential that has helped Azuki blow up so dramatically. Throw in a unique art style and a website that’s head and shoulders above most other NFT collections, and it’s not difficult to see why Azuki’s rise has been so meteoric. The big question, of course, is whether it will be able to live up to its potential and deliver on all that promise. If it does, then Azuki has a home in the pantheon of the most successful NFT collections ever. If it doesn’t and the hype fades, then it will be remembered as just another case of the “what ifs?”

Read more:

Top-10 NFT Art Sales of 2021

Top-10 NFT Flippers of 2021