We had previously featured Mekaverse in Gazette #56 where we highlighted various issues regarding the project’s whitelisting raffle draw, botting and, most importantly, the sustainability of hype over the actual value of the project.

This week, we want to focus on a detailed analysis of the project post ‘art reveal’ and how a mega-hyped project of this magnitude can implode.

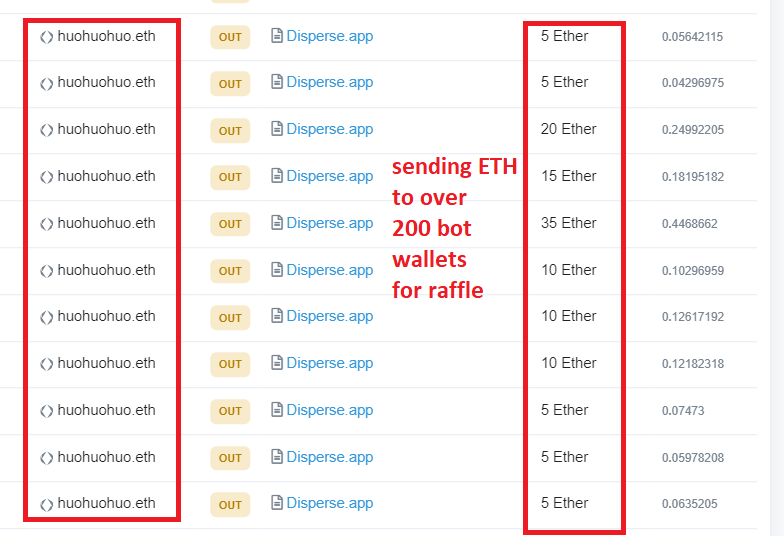

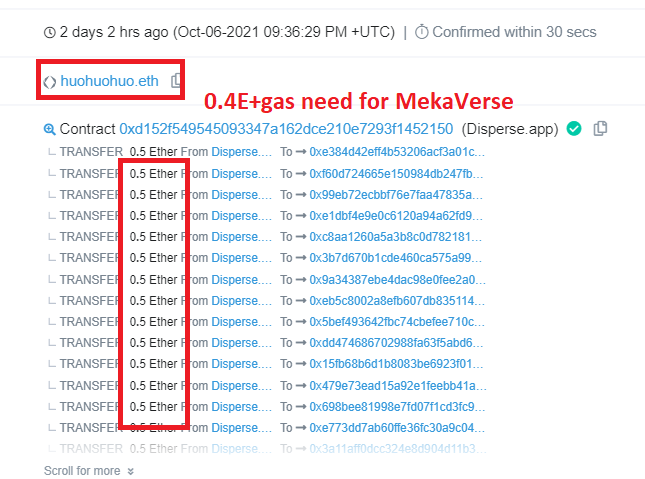

To start, the launch and whitelisting process were heavily botted by the usual suspects, like huohuohuo.eth, along with some proxies, like godblesschina.eth, cheermomogo.eth and crazydragonman.eth. These users created hundreds of wallets and funded them with ETH using disperse.pp, a service that allows you to distribute ether or tokens to multiple addresses. There was no way the Mekaverse team was manually going to check those wallets and cross-reference them against valid accounts.

Huohuohuo.eth succeeded in doing so like many others who attempted similar loopholes to get their way around the requirements. In all, there were 172,876 wallets registered for the raffle. The team hasn’t yet revealed the mechanics of the raffle allocation.

Huohuohuo.eth and his proxies alone grabbed 22 Mekas at an expense of 4.5 ETH When the floor of Meka was over 5.5 ETH, they would have had a minimum net profit of well over 110 ETH. Although bots are common in drops these days, this large return was noted by many members of the NFT community.

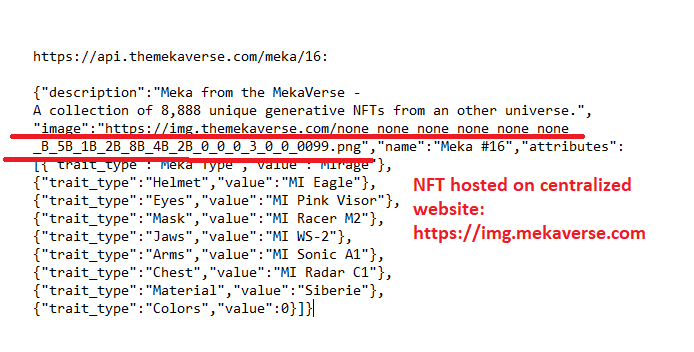

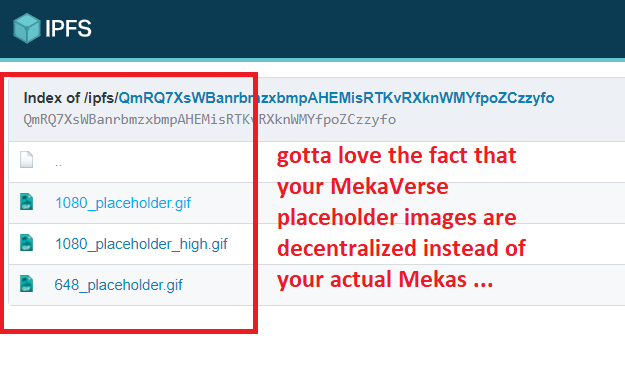

Mekaverse’s coding and development was done by Miinded Studio, a team that is known for their work on Pudgy Penguins and CryptoFoxes. However, prior to the art reveal, the trait files for the individual NFTs were hosted on the Mekaverse website, which meant that trait snipers were able to mine the data in order to target rare Mekas that were available on the secondary market on OpenSea as placeholder images without publicly visible traits.

In order to store trait data, the developers used IPFS, the InterPlanetary File System, which is a protocol and peer-to-peer network for storing and sharing data in a distributed file system. Despite that, the code allowed the project creators to assign token IDs to wallets, which gave them the ability to pick their choices of Mekas on the secondary market.

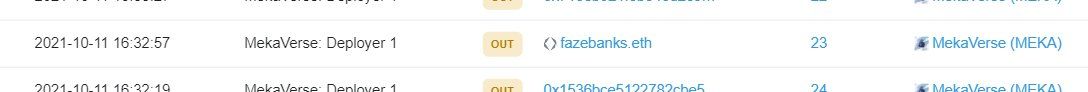

There were around 300 NFTs that were raffled but unclaimed, which had earlier been announced to be used as giveaways to active community members. Instead, some of the spare Mekas have been given away to influencers like Faze Banks, an alleged influencer and scammer with a dirty track record of running various fake charity giveaways and rugs.

The team was also accused of not paying a contract artist. The creators addressed these concerns on Twitter but eventually deleted those tweets. We do not know about their deal and agreement concerning payment terms, but ghosting artists for completed work isn’t what we expect from a project like Mekaverse.

The Meka team initially dismissed most of the accusations against it, calling it FUD and baseless, but even basic research on Discord and the blockchain proves that the creators made several missteps and lacked transparency and integrity. When a project asks 0.2 ETH as the minting price, buyers and the community deserve some level of quality. Given the poor overall execution of the project and the developer’s lack of adequate response, the floor has crashed and is currently stagnating at 1.5 ETH.