By any barometer, Moonbird’s rise has been meteoric. Within two days of dropping, the collection of 10,000 pixelated owls had generated over $281 million in sales volume, immediately making it one of the most successful NFTs of all time. At one point it was generating more volume than BAYC, Azuki and CloneX combined. It smashed OpenSea sales records and dragged trading volume on the platform to the highest it’s been since January. At time of writing, the floor price sits at 31.79 ETH.

Success hasn’t come without controversy, though. There are already allegations that bots were used to manipulate the mint raffle and that the team used insider knowledge to scoop the rarest birds. Jimmy Fallon owns a Moonbird, but he may or may not have received it for free. Now, certain trading patterns and transactions have begun to raise eyebrows.

New wallets and new money

Some of Moonbird’s trading action is suspicious, to say the least. Many of the big sales in the region of 30-40 ETH appear to have originated from newly created wallets funded with one-off lump sums, often via CEX. These wallets purchase a Moonbird but don’t hold any other (or only one or two lower value) NFTs. This is, obviously, strange behaviour.

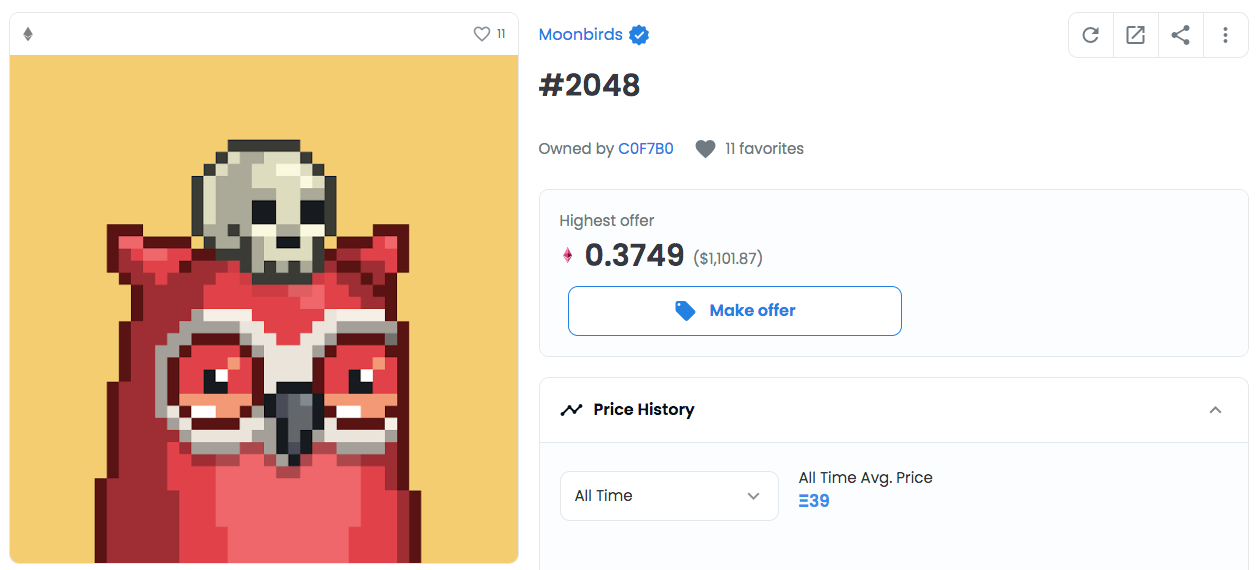

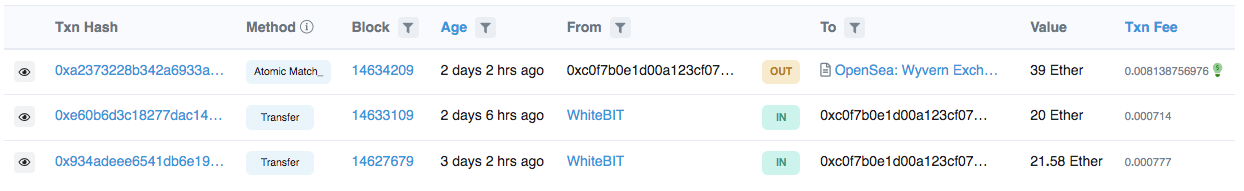

For example, Moonbird #9531 was last sold for 36 ETH (around $106,500). Impressive on paper, but Etherscan shows that the purchase was made from a newly created and newly funded wallet with just 4 transactions, as though it was created soley for this purchase. The user only holds one other NFT: a Misfits Ape priced at a lowly 0.20. While there isn’t anything necessarily wrong or suspicious about this in isolation, it's a pattern with Moonbirds. The even more valuable Moonbird #2048 (bought for 39 ETH) was purchased by another brand new wallet with just 3 transactions.

Wallet transactions for Moonbird #2048

The same pattern applies to Moonbird #6921 (sold for 37 ETH) and #7354 (32.4 ETH). Both belong to wallets with transactions starting no earlier than 10 days ago and in some cases much more recently. Moonbirds #714 (40 ETH) and #9700 (30.9 ETH) sit in a wallet (at time of writing) little over a day old and with only 9 transactions. Moonbird #8828 was sold for 31.9 ETH by an account with just 4 transactions and only 10 hours old. These addresses are, of course, all anonymous and seem to have been funded purely to purchase Moonbirds.

Speculation mounts

The upshot of all this is that a lot of “new money” from new wallets is being used to pay for high value Moonbirds. It certainly seems unusual that somebody would create a brand new, anonymous account, fund it from CEX and then buy just a Moonbird, which is left to sit there. Collectors do of course use alternative wallets, but Moonbirds in the 30-40 ETH sales bracket seem to be attracting this kind of behaviour.

The counter-narrative (and the one pushed by Moonbirds devotees on Twitter) is that the collection attracts new capital. These wallets and accounts are new precisely because the collection is bringing new people into the NFT space. Still, prices like 40 ETH seem implausibly high for a first-time collector/investor. Another explanation might be to do with the raffle itself. Twitter is awash with rumours that people created multiple, new accounts to increase their chances of succeeding in the mint raffle.

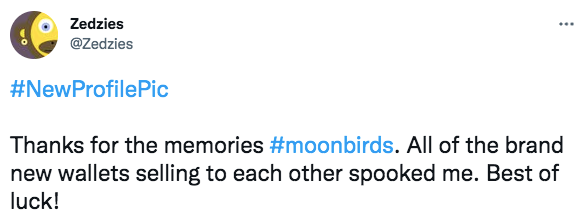

That hasn’t been enough to appease some users, though. Awareness of the new wallets/new money is widespread and has already led some investors to jump ship. Everybody has, must and will continue to draw their own conclusions, but some have inevitably suggested market manipulation and false pumping.

A controversial launch

Any collection that surges so quickly is bound to raise questions, especially since the Moonbirds Twitter account only launched in March and (seemingly) hasn't had enough time to build this level of hype. Even the raffle was hit with criticism. One user created over 400 different accounts to launch a Sybil attack, netting 50 Moonbirds in the process. A team member admitted that the raffle was beset by bots and it's unlikely that they were all removed.

There were also rumours of ‘rarity sniping’ (when NFTs are scooped for their particularly rare traits) by the project leaders - something that would amount to insider trading. Moonbirds has been aggressively hyped, using celebrities and influencers to push the price up. Jimmy Fallon changed his Twitter pfp to a Moonbird and came out in support of the project. Shortly afterwards the price doubled. When asked whether they’d sent him the NFT for free, a representative from the Moonbirds team claimed that they couldn’t remember.

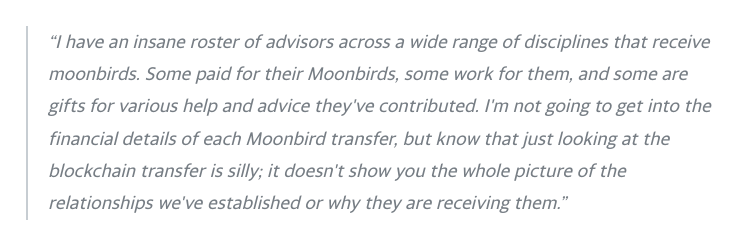

Avoid those silly blockchain transactions

They also advised against looking at blockchain transactions, which is “silly” and “doesn’t show you the whole picture.” Perhaps the same applies to those new wallets and all that new money - or at least that’s what Moonbirds would like us to think. As with all things crypto, NFT and life: only time will tell.

Read more:

The Rise of Azuki

Top-10 NFT Art Sales of 2021

Top-10 NFT Flippers of 2021