Let’s start with what happened. Melania Trump entered the NFT game officially January 11th, 2022, on the Solana blockchain. Per a press release on January 4th, she was set to auction off three “one-of-a-kind” signed items.

- The iconic white millinery masterpiece (their words, not mine) worn by Mrs. Trump

- Original watercolor on paper by Marc-Antoine Coulon

- An exclusive digital artwork NFT with motion

The auction ran through January 25th with an opening bid of 1,800 SOL, which was the equivalent of around 250,000 USD at the start of the auction. By the time the auction ended, 1,800 SOL was worth around 170,000 USD. Crypto is a fickle mistress. The buyer chose to remain anonymous as the sale ended for the starting price of 1,800 SOL, significantly lower than the 250,000 USD that was initially claimed.

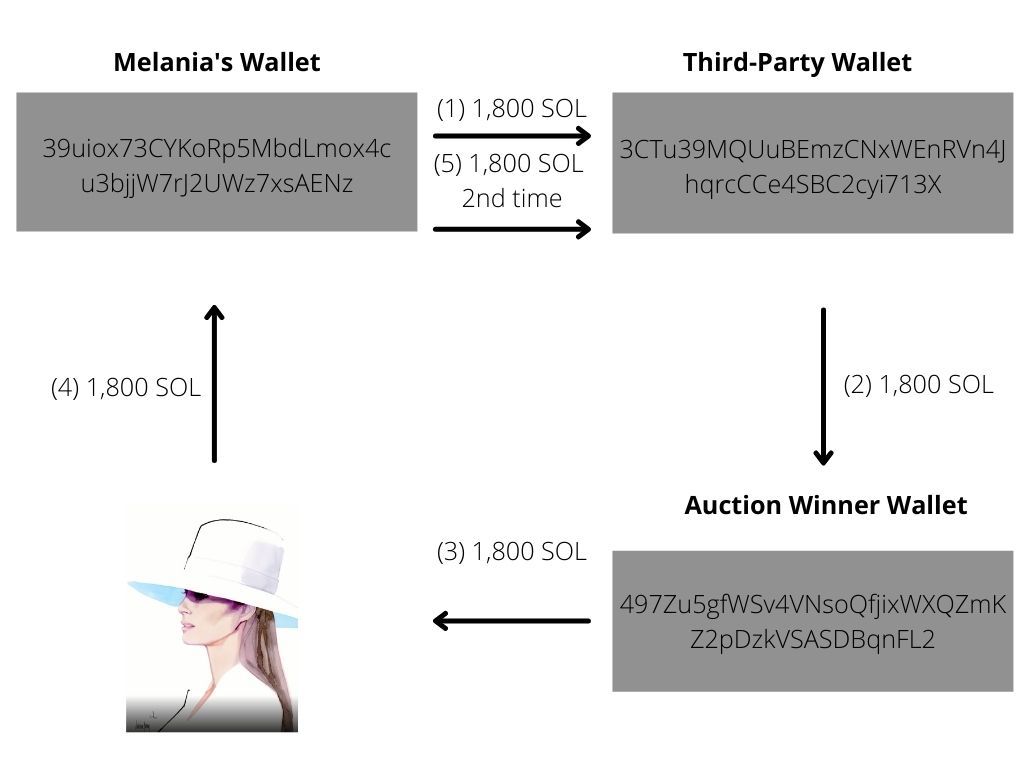

An on-chain ménage à trois!

Blockchain is also a fickle mistress. Tracking Solana blockchain records, verified by everyone on the internet, the mysterious buyer’s wallet was funded through a third-party wallet which was itself funded by Melania’s wallet (or at least the wallet that created Melania’s NFT). After the sale of the NFT, Melania’s wallet transferred 1,800 SOL back to the Third-Party wallet.

There is no official account of what happened from the Office of Melania Trump. There are two possible scenarios that the internet came up with. One is from Vice News reporter Jordan Pearson (originally broke the story) and self-described on-chain sleuth zachxbt. They suggest that a plausible scenario is since the crypto markets were crashing the way they were, the NFT project chose to court an off-chain buyer who was willing to spend the original 250,000 USD starting bid. That money was transferred off-chain where there are no public records, and then the on-chain transfers were made so the winner could own the NFT. In other words, some boomer wanted to buy the art, but didn’t know how and didn’t want to learn. Although I don’t know her personally, I am making the assumption that Melania Trump knows many wealthy boomers, so this is actually a very plausible scenario. There is another possibility, though, a sinister possibility that’s been washed so much, it’s dirty.

“But just look at the last price it was sold at!”

Earlier this month, Chainalysis published a report about the increase in wash trading. Wash trading is where someone buys and sells securities (in this instance, an NFT) for the sole purpose of hyping the value and sending misleading information to the market. Wash trading was all the rage prior to the stock market collapse. Wash traders would hype a stock, signaling that there is an intense interest in the stock to artificially inflate the value. They would then short the stock and make their money when the price adjusts. This was made illegal in 1936 with the passage of the Commodity Exchange Act.

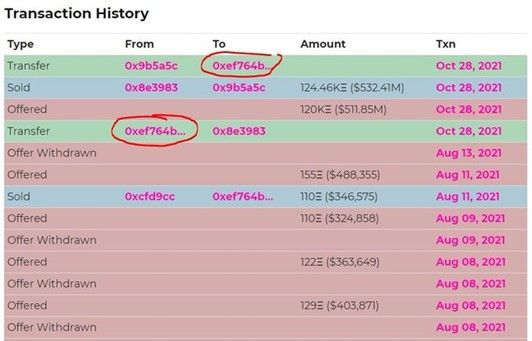

Let’s take a look at a wash trade in action. One of the most famous and recent cases of obvious wash trading happened with CryptoPunk 9998. The picture below is courtesy of Coffeezilla. You can see that Oxef originally bought the NFT on August 11th for 110. They then transferred the Punk on October 28th to Ox8e. Ox8e then sold it to oX9b for 124 that very same day. And then, later that day, Ox9b, the wallet that just bought the Punk, transferred it back to Oxef, the original wallet holder. All three transactions took place on the same day.

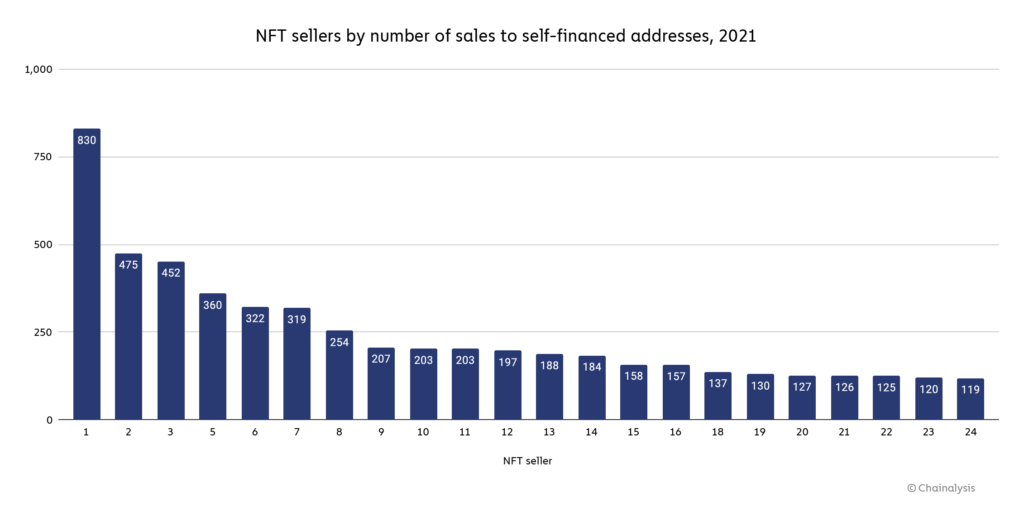

Per the Chainalysis report, they identified 262 users who have performed this triple wallet transfer dance at least 25 times throughout 2021. This is not always a financially smart move. The number one wash trader has performed a staggering 830 wash trades in this year alone, almost double than the number two wash trader.

When you’re averaging over two a day without taking a day off for the entire year, one would expect this to be a profitable enterprise. However, crypto is a fickle mistress (not sure if I mentioned that), and after spending 35,642 USD in gas fees, they accrued 27,258 USD in sales from wash trades for a loss of 8,383 USD. Man, it must suck to be the number one at something and still be so terrible at it. Widening the lens a little bit, out of the 262 active wash traders over the past year, 110 of them were profitable for a combined profit of 8,875,315 USD, so there is some money to be made misleading the markets. In fact, there’s a lot of money you can make at this if you didn’t have to worry about Ethereum gas fees. For example, if you were doing this on the Solana blockchain, you would have no problem seeing a profit.

Consumer Beware

Remember when I said that wash trading was made illegal in the US in 1936? Well, the normies of the 1930s didn’t write into the legislation digital art that’s tied to a distributed ledger, so technically, nobody is doing anything illegal here. Yeah, it’s morally bankrupt, and sure, it’s illegal in every other form of trading securities, but if you haven’t heard it yet, allow me to be the one to tell you that we are all still so early. This space is only regulated by the collective efforts of those who participate in it.

It’s the on-chain sleuths that are the detectives of these crimes, not anyone from the SEC or FBI. Per currency.com, the EU will be altering its language on anti-money laundering to include “…digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or something similar.” This is all well and good when we’re talking about money-laundering, but we’re talking about wash trading here, and it still seems like we’re a few years away from any serious regulation on market manipulation practices in the NFT world.

So is Melania at fault here? Maybe, but it’s much harder to prove than CryptoPunk 9998. For starters, Melania is a well-known, highly popular figure amongst certain affluent circles. The idea that she would sell her first NFT to someone who isn’t knowledgeable about NFTs or cryptocurrency really isn’t that far-fetched. If it happens five more times over the next month, then yes, we should pay attention, but there isn’t much we can do about it.

Maybe more important here are NFT sellers who aren’t Melania Trump. Ethereum gas fees are downright robbery at times, but they do act as a disincentive for wash traders trying to hype value in a market. The rise of multiple chains hosting NFTs, with gas sometimes less than a penny, will create a ripe market for manipulators to pray upon. As always, do your own research. As far as Melania’s first NFT venture, someone should tell her that’s not what we mean by white hat hack.