More than $2.6 billion worth of positions liquidated in 1 hour. $1.1Billion in BTC and $700Million in ETH positions were liquidated in a flash crash on September 7. Coincidently on the very same day when El Salvador officially announced Bitcoin as legal tender.

Liquidations are results of over Leveraged trading by inexperienced traders. 90% of leveraged traders lose their money as they are competing against bots and bigger whales or even against the exchange itself.

Leveraged trading is not a new instrument, it has been in existence for commodities for more than 70 years. Agricultural commodities opened up the market to hedge against unfavourable conditions or derisking volatility. Experienced wall street traders do not use more than 10X leverage, where irresponsible new traders go from 20X to even 50X levered positions without proper understanding of the spot market.

Last Tuesday, ETH dropped 5% from nearly 4000$ to 3800$ on a red wick in 30 mins, well not a new thing for ETH, But, what followed was a cascade of liquidations from over leveraged traders further collapsing lower tranches of long positions till it reached 3000$ which was 25% drop from 4000$ just for ETH alone.

Bitcoin did its own version when it dropped from 52000$ to 47000$. When the bullish sentiments were on the rise with El Salvador and a plethora of mainstream news channels covering the story. This reminds us of the notion, “buy the rumours and sell the news”.

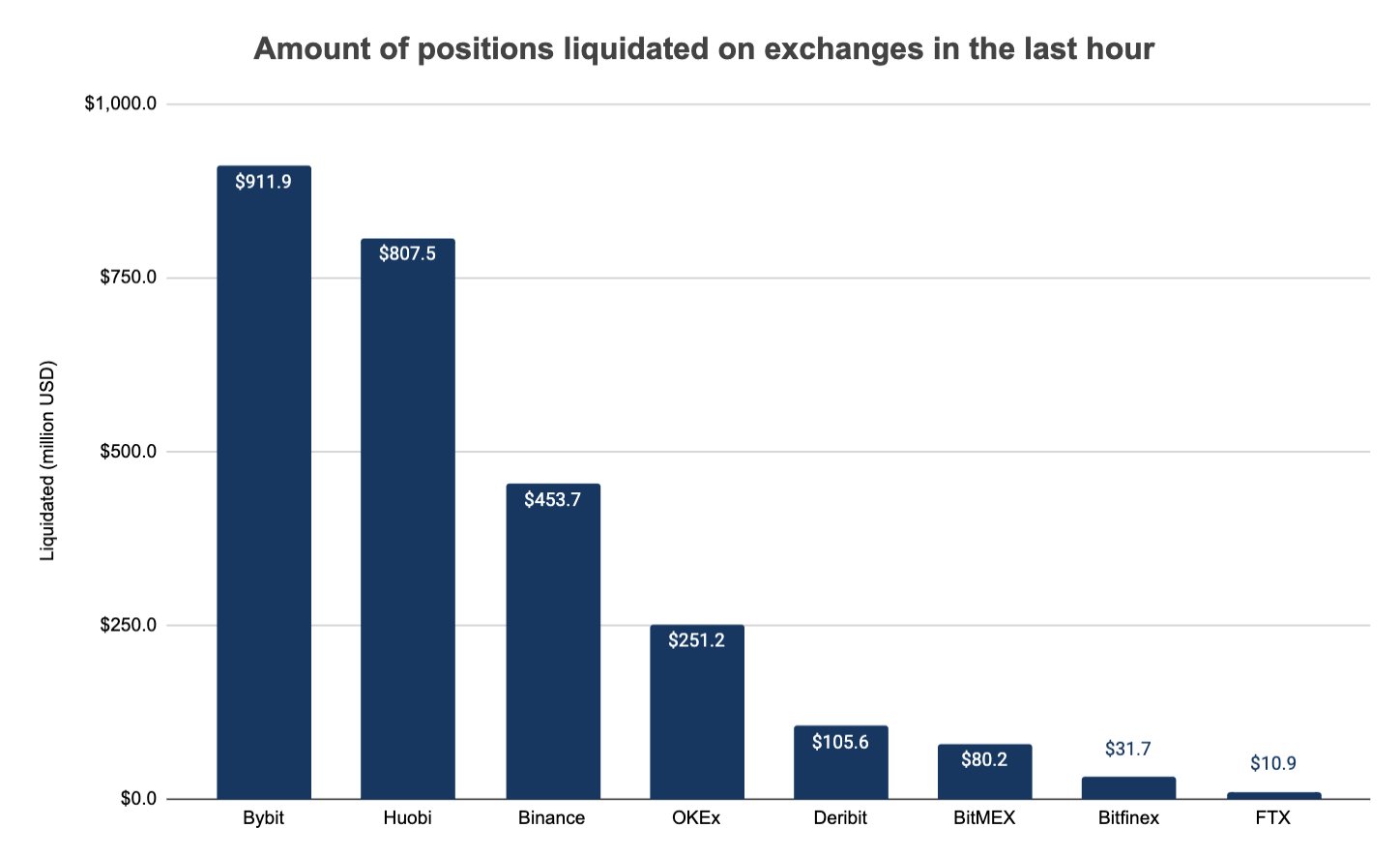

Bybit and Huobi constituted more than 50% of the total liquidations in that time frame. An analysis of the current market state was summarised by on-chain analyst Willy Woo, who tweeted outlining Sept. 7’s developments.

But he highlighted the fact that it is merely a shake off from weaker hands and exchanges and major whale wallets are buying up the crash from on chain metrics.

An interesting tweet that accurately highlighted this event even before it happened, strictly from technical analysis alone.

Feeling lucky you did not get liquidated in that corrective move earlier today?

— Crypto_Ed_NL (@Crypto_Ed_NL) September 7, 2021

Wait with getting new, dry pants...might not be over yet! pic.twitter.com/DIp9USNfK7

It played out with very high accuracy for liquidations and redistributions. Which led to the follow up tweet.

#BTC reached the green box

— Crypto_Ed_NL (@Crypto_Ed_NL) September 7, 2021

let's see how it bounces.....

should be it for this correction imo pic.twitter.com/zkUETg9RfB

Leveraged trading instruments are useful and highly effective tools to moon your portfolio If you know precisely what you are up against. conversely, It can get you Rekt with nothing but dust in your wallet if used irresponsibly. Crypto is a marathon and everyone will get their fair share of a deserved pump. Patience is the best preparation and always be an investor first before a trader Or you know what happens ⏬