LATEST: Bitcoin plunged 15%, the most in more than seven weeks, just days after reaching a record https://t.co/gEAmIFRMDD pic.twitter.com/zBJPq2Qv8X

— Bloomberg Crypto (@crypto) April 18, 2021

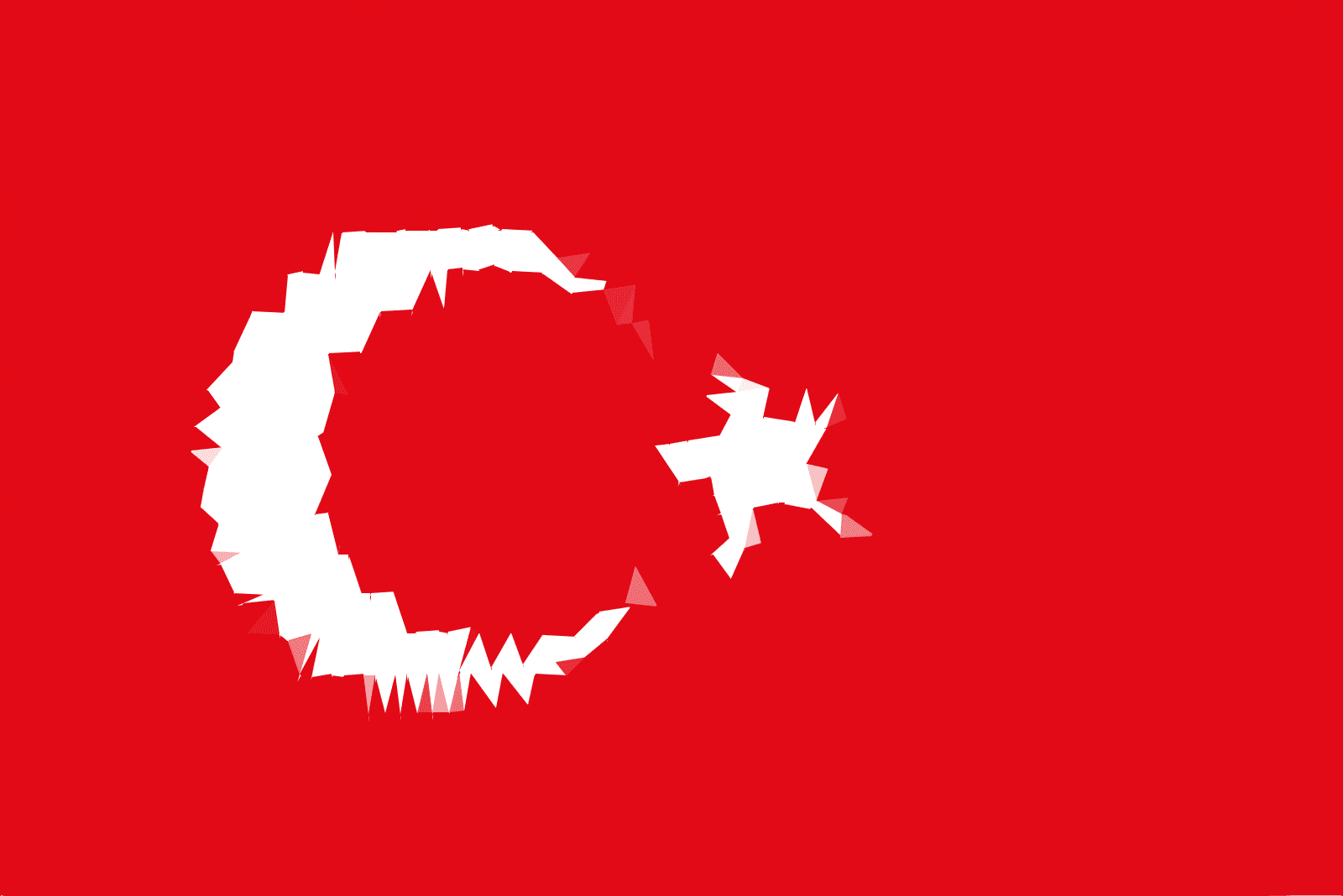

This latest ban reasons that the use of virtual money “may cause non-recoverable losses” and “undermine the confidence in methods and instruments used currently in payments” Additionally, that crypto assets are “neither subject to any regulation and supervision mechanisms nor a central regulatory authority”.

It is worth clarifying that Turkey’s most recent ban doesn’t prevent Turkish citizens from trading cryptocurrencies, for now. Put simply, the new legislation published by the central bank states that cryptocurrencies and other such digital assets based on distributed ledger technology cannot be used, directly or indirectly, to pay for any goods or services.

The price of bitcoin has dropped as billionaire investor Ray Dalio's fears of governments outlawing bitcoin to preserve their monopoly over currencies have come partly true in Turkey.

— CoinDesk (@CoinDesk) April 16, 2021

by @godbole17 https://t.co/HqdfXPhoHv

This news comes after months of economic uncertainty for Turkish citizens, who have begun to exchange their local currency, the Lira, for Bitcoin in greater and greater numbers. Suddenly, cryptocurrencies are simply reduced to being “excessively volatile and can be used for illegal activities”. As if the Lira could not be described in exactly the same way!

Crypto assets entail significant risks to the relevant parties due to the following reasons:

- They are neither subject to any regulation and supervision mechanisms nor a central regulatory authority,

- Their market values can be excessively volatile,

- They may be used in illegal actions due to their anonymous structures,

- Wallets can be stolen or used unlawfully without the authorization of their holders, and

- Transactions are irrevocable.

Is there anyone investing in Bitcoin who isn’t completely aware of and comfortable accepting these risks?

“It is considered that their use [crypto assets] in payments may cause non-recoverable losses for the parties to the transactions due to the above-listed factors, and they include elements that may undermine the confidence in methods and instruments used currently in payments” the Central Bank of the Republic of Turkey said in a press release titled the “Regulation on the Disuse of Crypto Assets in Payments.”

Turkey isn’t the only country looking to take tough measures on digital assets. Morocco has already put a similar ban in place, and now India is also poised to potentially enact laws banning cryptocurrencies, potentially making any trading or even holding of crypto assets a punishable offense. Earlier this year word came of the potential for an official digital currency issued by the Reserve Bank of India. The bill aims to outlaw all private cryptocurrencies in India, allowing for only certain exceptions to promote the underlying technology of cryptocurrency and its uses. This sets a bad precedent for other countries dealing with economic issues of their own. Though in the past similar regulatory moves made in Nigeria had little to no effect on crypto prices, it's a slippery slope...

“Every country treasures its monopoly on controlling the supply and demand. They don’t want other monies to be operating or competing, because things can get out of control”

-Ray Dalio

The new head of your central bank can pound sand. Dump all fiat, buy and use #crypto. The end of central banking is nigh.

— Aaron “#ravencoin is #bitcoin 3.0” Day @7421 (@AaronDayAtlas) April 16, 2021

Laser eyes all the way. #bankrun #shortthebanks#Endthefed#ravencoin is #bitcoin 3.0 pic.twitter.com/TJND6X3bjY