This attempts to be a no-BS review of the major NFT finance models, the major platforms that support them, and the pros and cons of each.

There are currently three basic models for loans using NFTs as collateral:

- Peer-to-Peer

- Peer-to-Pool (AAVE Model)

- Peer-to-Protocol (Maker Model)

Peer-to-Peer

Perhaps the easiest to implement, the Peer-to-Peer model is exemplified by NFTfi. The OG of the category, NFTfi has been around since May, 2020.

In Peer-to-Peer lending, the platform provides the underlying infrastructure for the loan, but is otherwise uninvolved. Borrowers list their collateral NFT along with the loan they want–for example, a 55 wETH loan on a Fidenza for 90 days at an APR of 20%. They may also simply list the collateral and await offers.

Lenders review the listings and can accept a proposal or make a counteroffer with terms of their own. When both parties agree, the contract executes, transferring the loan amount to the borrower and escrowing the NFT in the NFTfi contract. For this service, NFTfi charges 5% of the interest earned to the lender. There is no service fee on defaults, and in the case of the default the collateral transfers to the lender with no recourse.

NFTfi has done well, with about 96,000 wETH and 59.5 million DAI loaned so far. Its primary negative is that as a Peer-to-Peer platform, there is always a time lag between when a piece of collateral is listed and a loan is concluded.

Peer-to-Pool

This model is based on AAVE lending pools and is represented by BendDAO. In this model, depositors provide the loan capital to a pool, and that pool is lent out against collateral at an interest rate that moves along a bonding curve, becoming more expensive as the pool is depleted and cheaper as the pool moves into surplus.

BendDAO opened in March 2022 with an airdrop and open initial offering. Since then it has lent a cumulative 68,453 ETH and currently has 1,053 NFTs collateralized over 15,011 ETH.

As a Peer-to-Pool model, BendDAO allows entries and exits through a permissionless contract only limited by the supported collections and pool capital availability. Capital availability has been one of two crisis points for Bend since its start, with loan-to-value (LTV) threshold being the other.

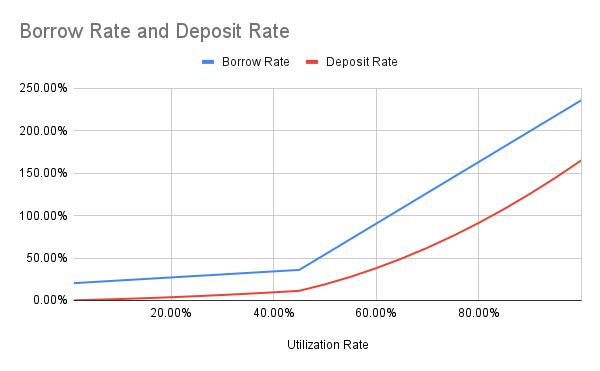

The bonding curve BendDAO is currently using is shown here. Once the pool utilization rate crosses 45%, both borrow and deposit rates increase at a much higher speed with additional usage. This is designed to discourage borrowers by raising costs while encouraging depositors with higher yield.

Four times since its start, once each in May and August, and twice more in September, BendDAO’s deposit pool has essentially hit 100% utilization. This resulted in ETH borrow rates of 200% and ETH deposit rates of >140%. While $BEND subsidies are used to bring down borrow rates and add to deposit yield, this resulted in short periods where borrowers were paying >100% APR on ETH loans. These conditions also result in depositors not being able to withdraw from the depleted deposit pool until loans are repaid or new deposits flow in.

The second crisis BendDAO passed through was a reduction of their LTV threshold for liquidations. Initially 90%, when the NFT market dropped this summer, it proved not enough to entice liquidators to come in and purchase the undercollateralized NFTs at auction, resulting in a period where collateral actually ended up being worth less than the loans they underwrote. A governance change reduced the LTV threshold to 80% and changed some other mechanisms, and the liquidation process appears to be running smoothly now. Markets eventually recovered, eliminating the loss on BendDAO’s balance sheet–good, because there is no backstop.

Fluctuations in interest rates and LTV have been the biggest negatives for BendDAO; however, it has captured a large share of the NFT-finance space with good timing, a good UX, and some innovative features such as Flashclaims: the ability to have an NFT locked in a loan contract and still be able to use it to claim airdrops. This alone made it hugely popular among BAYC/MAYC holders.

Peer-to-Protocol

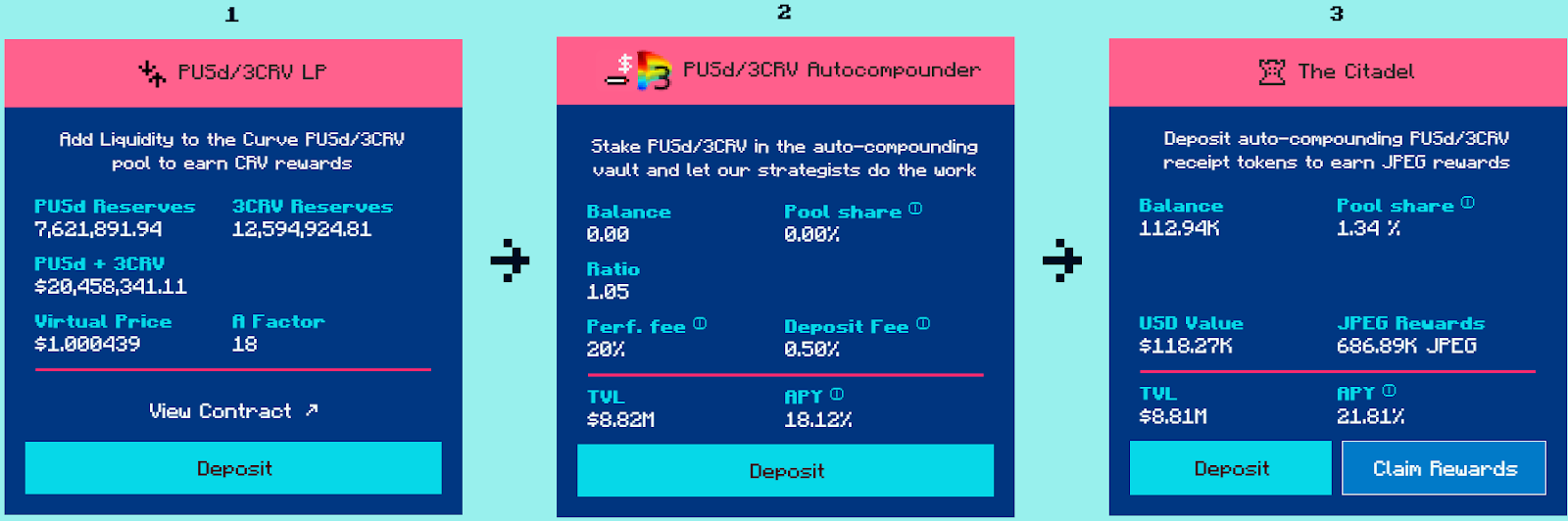

JPEGd, which opened in April, 2022, has chosen to go with a Maker-style model, using NFTs as the collateral to issue its own stablecoin, $PUSd. Because there is essentially no cost to issuing $PUSd, JPEGd is able to offer loans at 2% interest with a 0.5% loan initiation fee. To support the peg of $PUSd to the USD, JPEGd used large portions of its treasury to purchase CVX, which it now uses to incentivize a PUSd/3CRV pool on the Curve platform.

The result is that on Convex, LPers currently earn ~16% on a PUSd stablecoin deposit. They can also earn ~7% in a PUSd/FRAX pool instead if they prefer FRAX.

Users who want a set-it-and-forget-it situation can put their Curve LP into JPEGd’s own autocompounder, which harvests and reinvests the Convex CVX and CRV rewards into more PUSd and 3CRV. JPEGd charges 20% of earned interest for this service; but for users borrowing less than around $60,000, it currently makes sense because it costs less than the autocompounder gains. Above that figure, it may make more sense for a user to autocompound themselves. Another reason to use the autocompounder is that it's the only way into The Citadel, JPEGd’s staking contract, where you can earn an additional 7.3% in $JPEG.

Negatives at JPEGd are that it has a relatively low LTV threshold, liquidating borrowers at 36% LTV. The reasoning behind this is similar to Maker in that, as a Peer-to-Protocol system, any losses accrue to the protocol itself. Thus, as NFT finance matures we will likely see this slowly inch upwards–the current 36% threshold is already an increase of 3% over the initial level.

JPEGd also has a boost mechanism where holders of certain JPEG CARD NFTs can increase their LTV by 10%. Users with these NFTs can lock them, after which they can borrow up to 46% LTV before liquidation.

One innovation at JPEGd has been the inclusion of traits in determining the NFT value. JPEGd uses Chainlink for setting collection floor prices and now has added trait multipliers for the CryptoPunk collection, with BAYC traits reportedly coming soon. Traits can boost the amount available to borrow by 1.1-10x, meaning that in some cases even with JPEGd’s lower LTV threshold you can borrow much higher amounts than if your NFT was only valued at floor. For reference, a Zombie Punk gets a 10x boost, putting its value as collateral at 660 ETH, meaning that a 200 ETH borrow at 2% can be instantly arranged through the protocol while still keeping a safe margin to prevent liquidation.

One other comment from borrowers has been that PUSd loans require them to watch not only the floor prices of their collateral, but also the price of ETH in USD. As a result, JPEGd has recently announced that they will begin ETH loans, using the same Curve pool support mechanism. Yields should be similar or higher to the current PUSd stablecoin yields, but borrow costs will also be slightly higher.

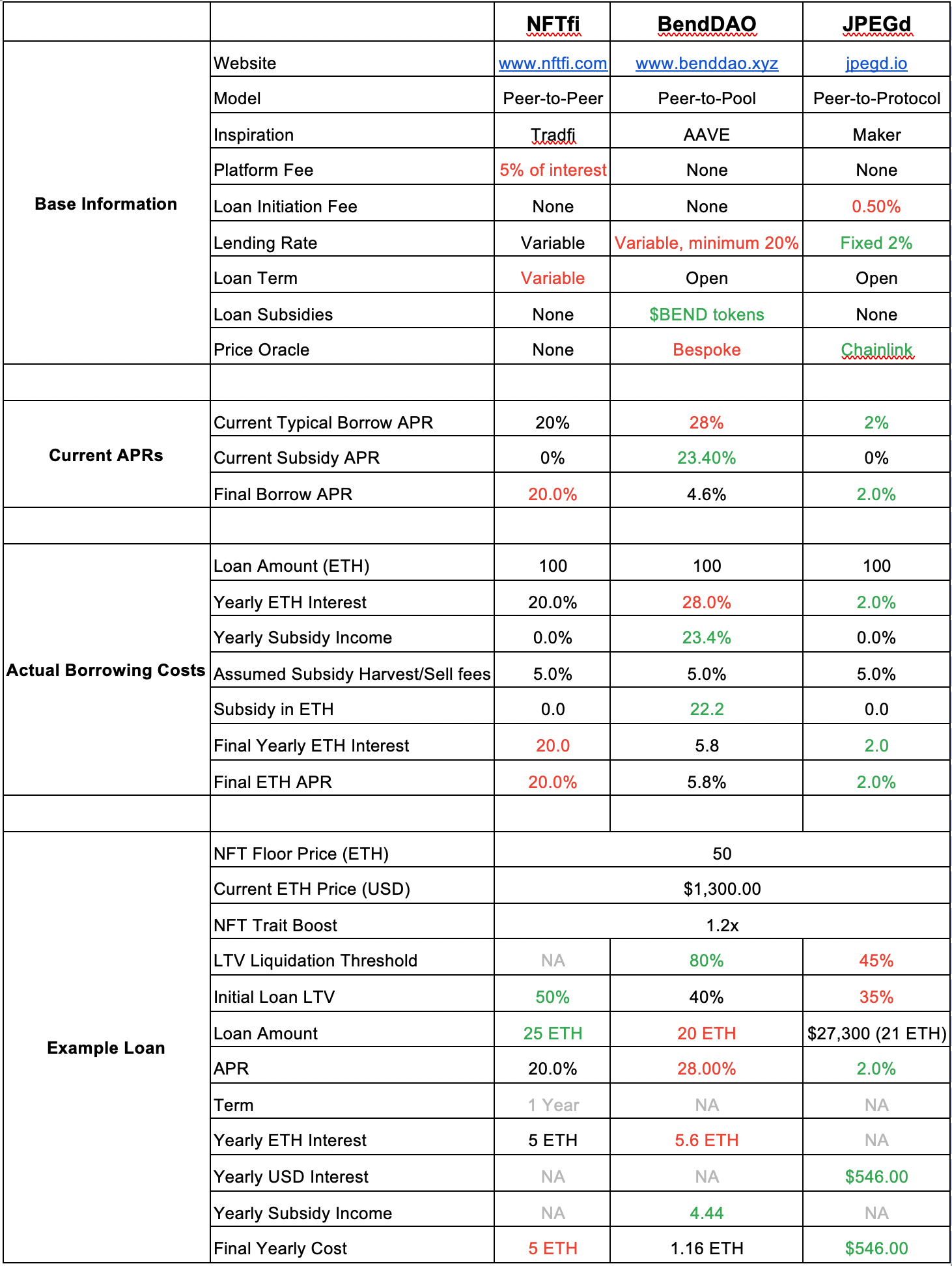

Here’s a quick summary table with some numbers to consider. The platform you choose to use is up to you-just make sure you consider putting your expensive, illiquid, JPEGs to work!