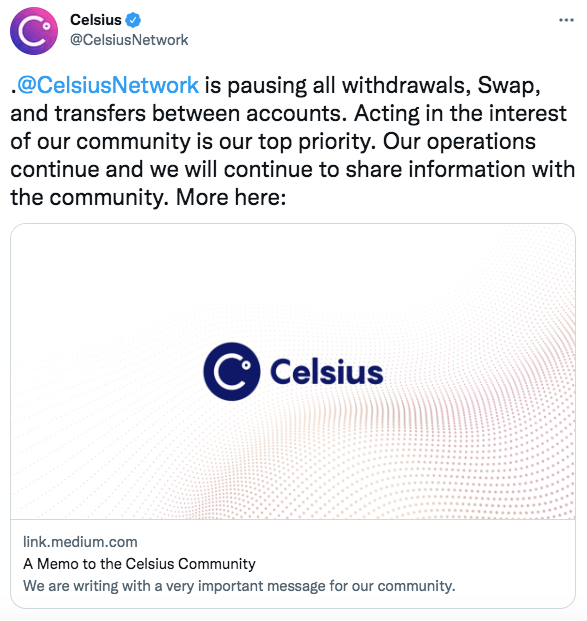

Just when it looked like things couldn't get any worse for crypto, popular crypto “bank” Celsius announced on Twitter that it was pausing all withdrawals, swaps and transfers. This comes amid fears that the platform (which has 2 million members, $19 billion in assets and was valued at $3.25 billion only last November) might go bust. Celsius does not have FDIC protection which means that if it does go under it will take most, if not all, of its customer's funds down with it. This is a naturally terrifying prospect that caused Bitcoin and ETH to tumble still further.

https://twitter.com/CelsiusNetwork/status/1536169010877739009

One of crypto’s biggest institutions

Celsius Network has always had a reputation for stability and security. It’s one of the largest so-called crypto “banks.” The platform allows users to variously buy, borrow, earn and swap their crypto, all within a single app and without fees. Its homepage comes with a dazzling array of endorsements from industry insiders. The company even uses the slogan #HomeForCrypto. Nearly 24 hours after that fatal tweet withdrawals are still paused and users are no closer to gaining access to their funds.

https://twitter.com/isaidelgoley/status/1536194801124638720

CEL (the native token) was decimated by the news and fell by over 60%, bringing its total losses to around 80% since the start of the crypto crash. The crypto market is currently valued at under $1 trillion - the lowest it's been since December 2020. Amidst a perfect storm of global financial challenges, rising inflation rates, a cost of living crisis and the recent collapse of LUNA, the market has been battered. Celsius is just the latest victim.

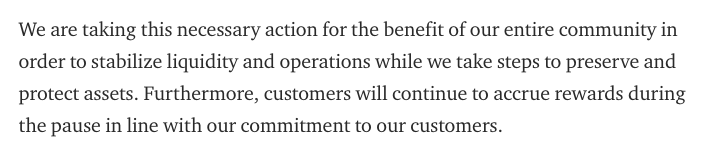

A blog post from the team hasn’t exactly filled customers with confidence. Although it claims that “acting in the interest of our community is our top priority” and the pause is designed “to stabilize liquidity and operations while we take steps to preserve and protect assets” it strikes a foreboding tone. Celsius admits that it’s struggling due to “extreme market conditions.” Given that the platform once prided itself on “free and unlimited access to funds” this seems like a watershed moment. The post makes no mention of how exactly Celsius plans to protect those assets other than suggesting that there are “various options.”

https://medium.com/p/a-memo-to-the-celsius-community-59532a06ecc6

Fear spreads

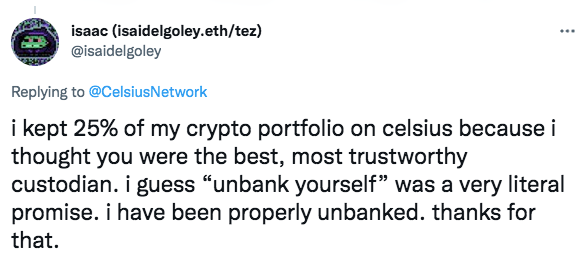

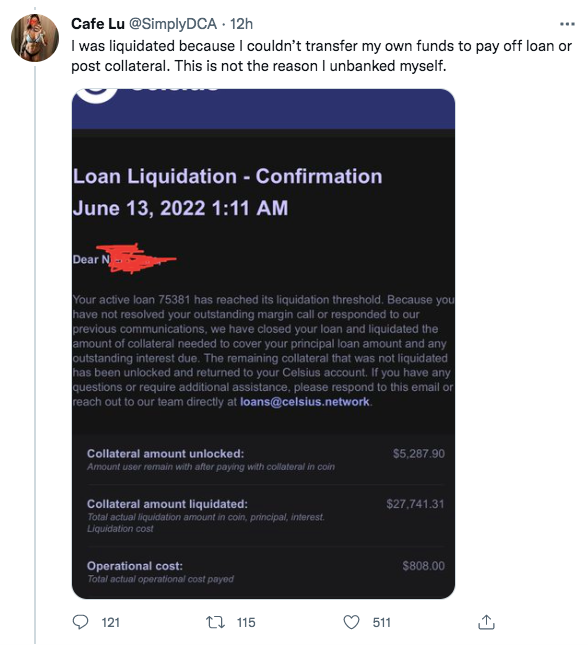

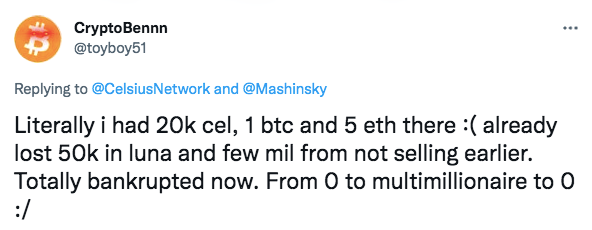

Twitter users were quick to voice their concerns, especially those who have outstanding loans that they now won’t be able to pay off despite having the funds. There are even - *unconfirmed* - reports that some customers have been liquidated because they couldn’t make the required transfers. Others lament having vast portions of their portfolio tied up in Celsius, having transactions cancelled - one person dreads that he will lose money again, having previously invested in LUNA.

https://twitter.com/CelsiusNetwork/status/1536169010877739009

Blue ticked @Watcher.Guru (followed by over 1 million people) even alleges that Celsius transferred $320,000,000 to FTX just before transactions were stopped. Confidence is already at an all-time low after another “too big to fail” project - LUNA - did exactly that. There’s now a burgeoning sensation that nothing is safe, so Celsius will have to act fast and intelligently if it wants to restore user confidence. In the meantime, desperate investors have been left to hope that CEL won't follow LUNA down towards $0. Both did, after all, promise big rates on supposedly stablecoins.

https://twitter.com/WatcherGuru/status/1536214132231442434

Some Twitter users adopted a more humorous tone, however. Many took aim at Celsius’ #UnBankYourself campaign, which focused on unlimited access to funds. An unfortunate promise on the platform’s website: “access your coins whenever, keep them safe forever” has also been the subject of ridicule.

Another bad week for crypto

The crisis has echoes of a “run on the banks” whereby people scramble to withdraw their cash in a sudden rush, destabilising the bank and leading to bankruptcy. There’s an element of the self-fulfilling prophecy with bank runs. As soon as customers lose confidence that a bank is stable, it becomes unstable, sparking a collapse. Celsius might be trying to prevent this scenario by freezing withdrawals. In a financial world where confidence is key, though, they’ve managed to obliterate customer trust overnight.

Bank runs are usually (but not always) precursors to collapse. Even more concerning are those reports of customers receiving margin calls but being unable to move their coins to cover loans. While we can’t verify these claims, users on Twitter appear genuinely distraught as what seemed like a safe haven is buffeted by market conditions.

https://twitter.com/toyboy51/status/1536223380520706049

With yet another crypto institution teetering, it’s been another terrible week of doom scrolling, apocalyptic headlines, diminished portfolios and plunging prices. As 2022 rolls on we can only hope that, for Celsius and the wider crypto market, what goes down must eventually also come back up.

Read more:

Crypto Bloodbath: Is This Really the End?

10M$ Defi LUNA Bet

2025 Solar Superstorm Could Crash Crypto