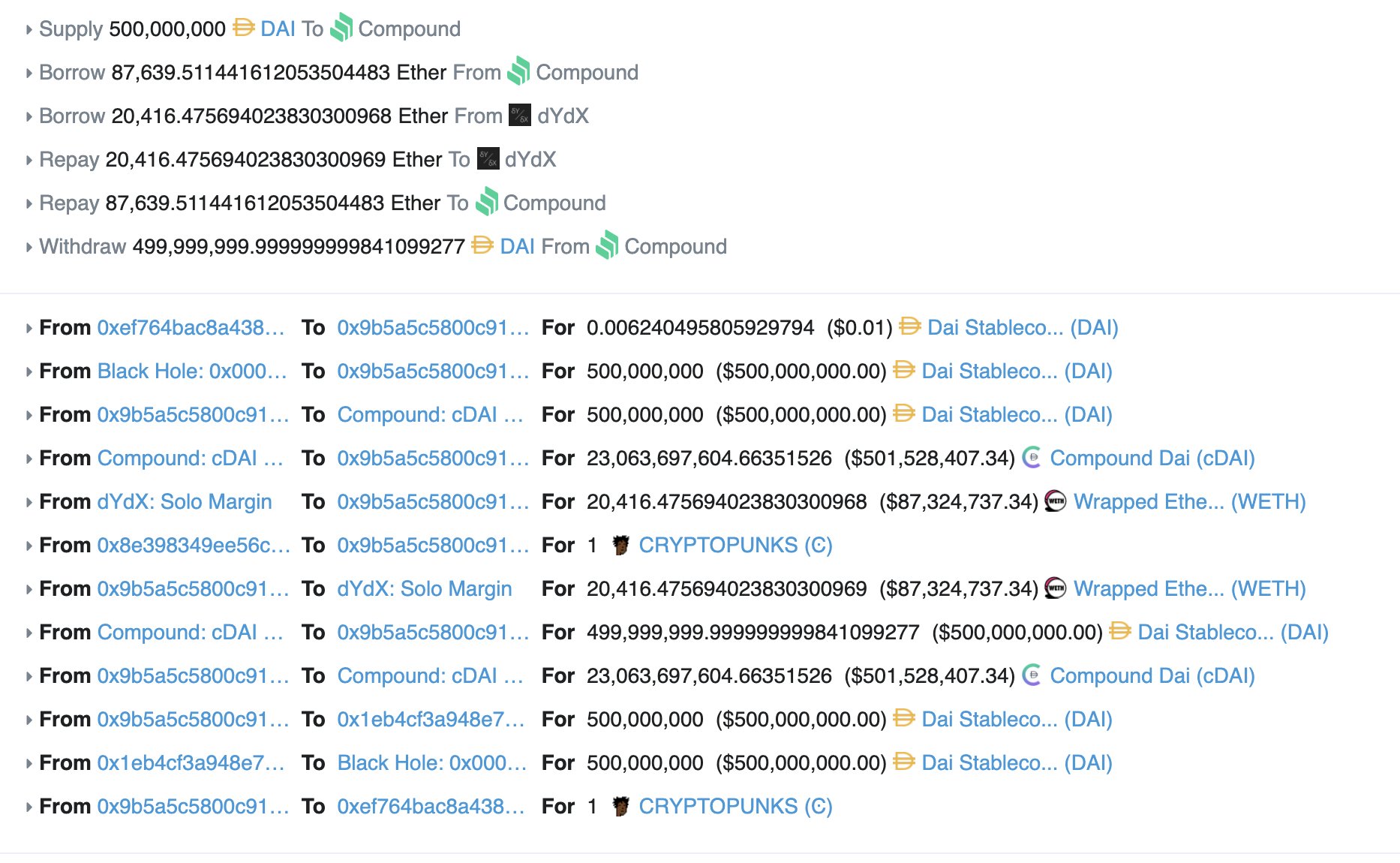

Lightning struck on Wednesday when CryptoPunks Bot tweeted about a 124,457 ETH sale (~$532 million USD at the time) for the white-haired and green-eyed CryptoPunk #9998. It was the first of several flashloan sales gimmicks to generate buzz around Punks and DeFi this week.

Punk 9998 bought for 124,457.07 ETH ($532,414,877.01 USD) by 0x9b5a5c from 0x8e3983. https://t.co/dmT6jDRC1W #cryptopunks #ethereum pic.twitter.com/UQlmm1oqkj

— CryptoPunks Bot (@cryptopunksbot) October 28, 2021

A flashloan is a feature that allows some amount of assets to be borrowed without collateral from a designated protocol. It is used to arbitrage and swap collateral to prevent liquidation as use cases for DeFi. It was introduced by Marble protocol and later popularized by Aave and DyDx. Interestingly, a flashloan has to be borrowed and repaid in the same transaction. A transaction represents certain operations in a sequence. Failing to execute any of the set operations will roll back the previous operations, thereby invalidating the transaction. All of it has to be done within the same block. Notably, flashloans can potentially cripple a protocol in case of bugs in the lending protocol.

NFT Twitter was soon blasted with screenshots of the transaction sequence. For a brief moment, there were mixed views, with some suggesting the sale was artificially inflating the NFT market and its volume. Since it was a registered sale, it would reflect in rankings for some time. Some users likened it to money laundering while others perceived it as trolling. It didn't take long for other large flashloan bids.

More flashloan bids 😂 pic.twitter.com/nscXwgx05t

— Redlion.news (@redlion_news) October 29, 2021

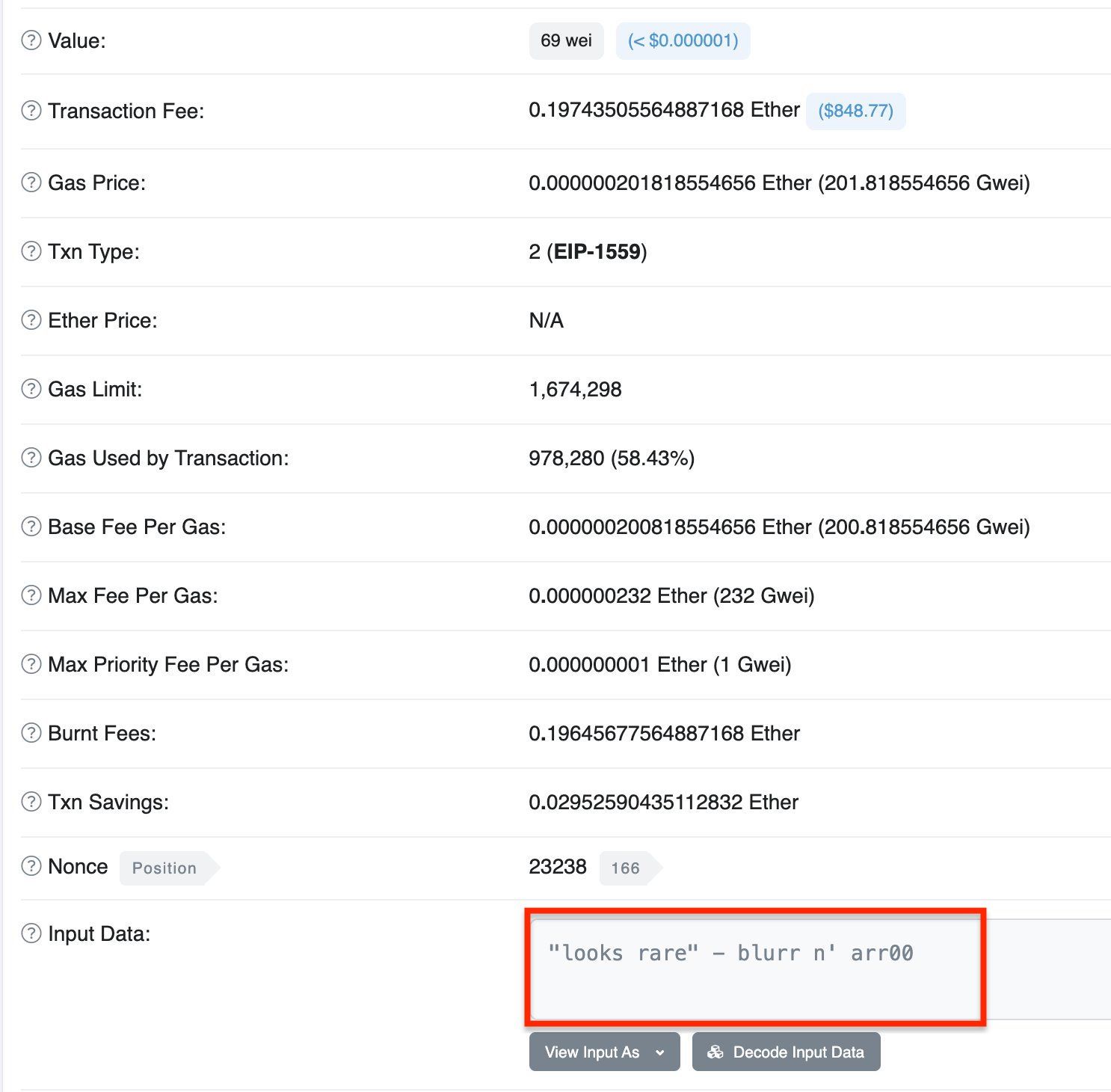

The sales weren’t illegal, weren’t scams, and no third-party wallets or protocols were affected--it was simply an interesting exercise done because it was possible. The seller-buyers could have used an anonymous wallet to complete the transactions but we can assume that the theatrics of the transaction was what drove the “deal”.

knowing the guy who did it, the point was definitely just to troll everyone and get them talking

— NateAlex (@NateAlexNFT) October 29, 2021

yeah the tx message should have been a give away . seeing tweets about how irs will come after the sale for tax. peeps clearly dont know who they talking about pic.twitter.com/yFxJnOXTtt

— barthazian.eth (@Barthazian) October 29, 2021