After months upon months of positive price action with only minimal corrections along the way, crypto markets corrected dramatically over the course of just a few days, sending Bitcoin’s price to a multi-month low of $30,000. Best guesses as to why?

There are a few most likely potential causes for this steep drop in price being discussed, as there always are. The downward price action seemed to begin with a strange and unexpected tweet from Elon Musk, announcing Tesla would no longer accept Bitcoin for vehicle purchases...

Elon ... you realize that 75% of miners use renewable energy, right?

— Pomp 🌪 (@APompliano) May 12, 2021

This energy story has been debunked over and over again.

Elon either wasn’t aware of BTC mining energy usage during past support of BTC, or simply was not interested in highlighting its energy use or any related ecological concerns up until now. Nor did he lend much to the idea of Bitcoin mining actually incentivizing green energy usage. For whatever reason, the negative headline was thrust into the spotlight once more.

Trolling BS projections like this. Bitcoin gets exponentially more efficient per capita as it gets bigger, while the incentives push for greener energy.

— Willy Woo (@woonomic) May 21, 2021

Meanwhile mainstream media ignore the competing USD Petrodollar regime which has kept renewables from developing for 50 years. pic.twitter.com/X4GJgRb6w5

Before getting too bearish based on rich celebrity crypto tweets, maybe worth checking in with a few long-time crypto enthusiasts with years of knowledge and experience.

Along with the ongoing extensive over leveraging, much of the same old Chinese FUD being reiterated before the market could recover from Musk’s environmental tweets certainly didn’t help matters. The cumulative cryptocurrency market cap proceeded to fall to beneath $1.5 trillion over the course of the following days, a drop of over $1 trillion from the peak of $2.5 trillion reached in early May. Matters have been even worse for altcoin prices. Which was actually good for current BTC market dominance, but not much else!

Ethereum experienced a massive drop over the course of hours, if that long. After reaching a peak of over $4,300 the second largest crypto by market cap fell over 50% in price in just over 1 week. After such an epic run up should we really be totally surprised?

“These overleveraged positions bring vulnerability to the market, making it excessively sensitive to negative news flow. A combination of statements coming from Vitalik Buterin, Elon Musk, and Chinese authorities in a space of a week was sufficient to trigger a market correction. This was exacerbated by a cascade of auto liquidations of overleveraged positions on crypto exchanges, which amounted to over $9 billion in 24 hours, one of the largest volumes of liquidations ever.”-Anatoly Crachilov

Though the correction has been as steep as many alts, Ethereum is not just another alt coin any longer. Sure it’s been a dramatic week, but no reason to lose sight of the bigger picture.

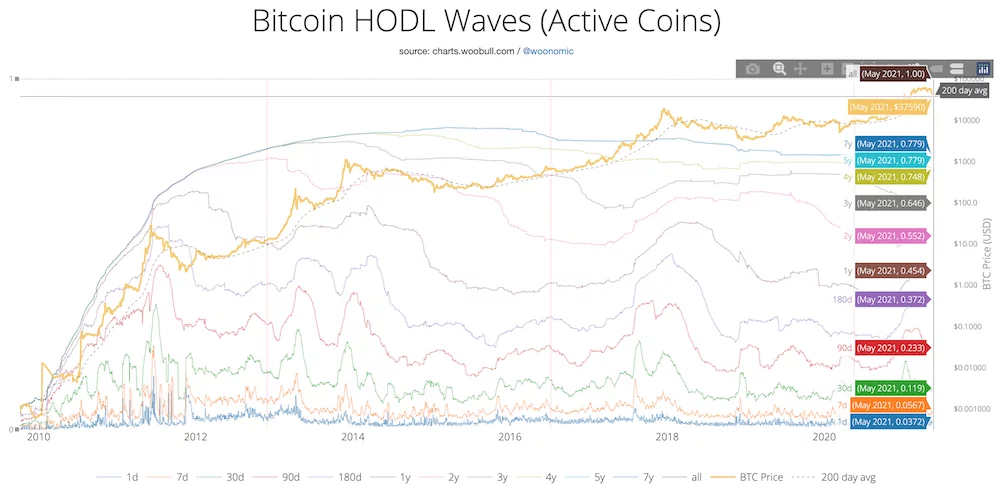

A bit of context, the setup from 2 days ago (this went out in long form with pretty charts to subscribers). pic.twitter.com/k4JrumZ1nL

— Willy Woo (@woonomic) May 20, 2021

In addition to the pain of the sell-off experienced by all long BTC holders, many users attempting to transact on centralized exchanges experienced issues. Many Coinbase, Binance, and Robinhood users reported they were either subjected to extremely high gas fees or left completely unable to trade at all during the sell-off and rebound buying.

Just to be clear: I do not think $60K was the top, far from it, because I do not see the kind of transactions that normally happen after an ATH (red dots). In fact, I think we are just a couple of months out of the bear market (blue dots). And yes, this on-chain view fits S2F(X). pic.twitter.com/omLh23MsrX

— PlanB (@100trillionUSD) May 18, 2021

Another fan of on-chain analysis, PlanB’s popular Stock-to-Flow (S2F) model also still seems to be well intact.

In other bullish fundamental news, the Chief Investment Office of Singapore's largest Bank, DBS, made a case for Bitcoin as a more effective store-of-value asset than US-based fiat.

“Indeed, the exponential rise in Bitcoin prices are rivaled only by the meteoric expansion in the balance sheets of the largest global central banks around the world – the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BOJ), as well as the People’s Bank of China (PBOC).

Such trends would unequivocally drive demand for alternative currencies, even unorthodox digital forms that would potentially represent a store of value more faithfully than physical dollars would.”

With the drop continuing to new lows as we close this article, what better way to complete the circle than another tweet from ‘The Dogefather’.

One of the world’s richest men has spoken. https://t.co/7njh6rXjj1

— Pomp 🌪 (@APompliano) May 22, 2021

What would we do without you Elon?