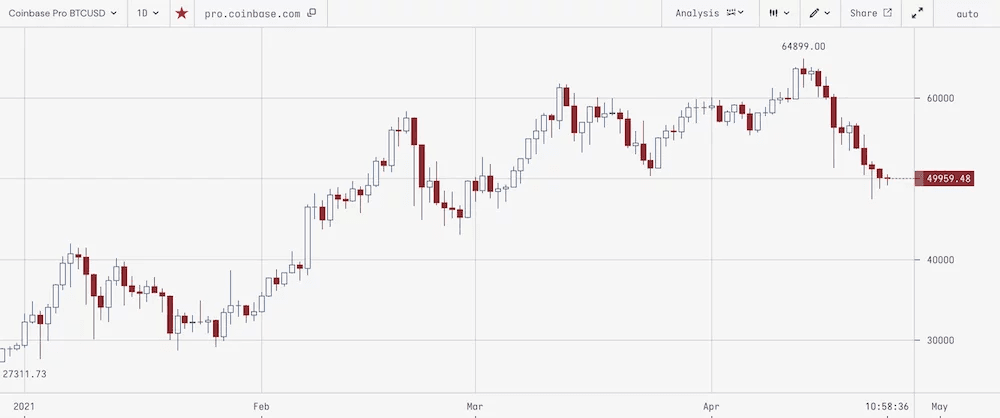

Currently, Bitcoin is fighting to hold it’s ~$50,000 level as its dominance hits 50% for the first time since 2018. The crypto community has of course speculated as to the possible reasons for this latest “crash”. The currency crisis in Turkey and subsequent cryptocurrency payments ban? Was this latest BTC price drop actually due to a power outage and subsequent reduction in BTC's hashrate? Perhaps most likely of all, the new taxes being proposed on capital gains by the United States President Joe Biden.

Going forward. the Biden presidency may become a big negative factor for Bitcoin. Large $BTC supply will come to market to get in front of capital gains taxes which will exceed 55% in some U.S. states. #Lid_on_markethttps://t.co/k1ZQZ2ElOQ

— Peter Brandt (@PeterLBrandt) April 24, 2021

If this came to pass, it could indeed be the largest tax increase in history and potentially devastating news for wealthy crypto day-traders. To be fair, Peter Brandt did quickly clear the air regarding his bearish BTC tweet, affirming his long-term bullish view.

“Wow!!!This Tweet was NOT intended to portray a long-term bearish opinion of Bitcoin ($BTC continues to be one of my largest holdings), but, as a negative opinion of mega-dollar government programs. I am a Bitcoin bull Libertarian.”

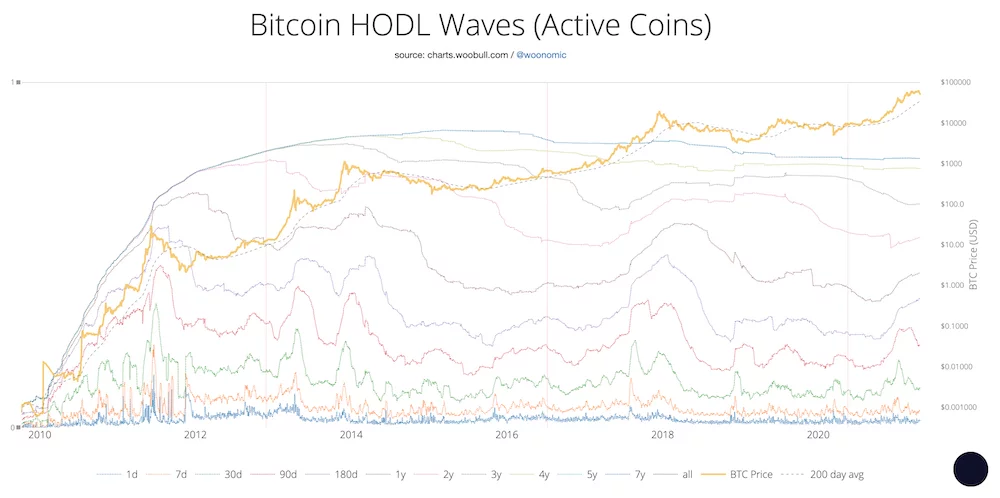

Somewhat contrary to what the price drop might suggest, Glassnode data suggests that the rate of BTC withdrawals from exchanges is still accelerating...

This $BTC chart might be more important than the price chart: bitcoin supply is being withdrawn from exchanges at an all-time-high pace.

— Luke Martin (@VentureCoinist) January 20, 2021

Historically, bull cycles have ended AFTER liquid supply change flips positive (🟡)

That flip has not happened yet.

h/t @glassnode pic.twitter.com/NYWzlCdHAY

It’s always worth considering just who is doing the majority of the buying or selling that is leading to the most recent price action. You can find some of my favorite BTC charts, metrics and properties here. Selling BTC due to news of potentially unfavorable future taxes wouldn’t make much sense for long term BTC holders. Suddenly rushing to sell an asset they believe in the future of and are primarily accumulating more of would immediately, assuredly create a tax liability, which they are presumably trying to avoid.

Dips aren’t just a great time to continue disciplined dollar cost averaging, but also a great time to continue learning! Soon enough the next bear market will come, and it will surely bring with it another great opportunity for creators and communities to focus on collaborating, innovating, and building.

This is a must read piece on the topic of capital gains tax rates.

— Pomp 🌪 (@APompliano) April 24, 2021

Explains why the United States would likely be better off by lowering capital gains taxes to 0%, rather than raising them to the proposed higher levels.https://t.co/yS5OsNGIBZ

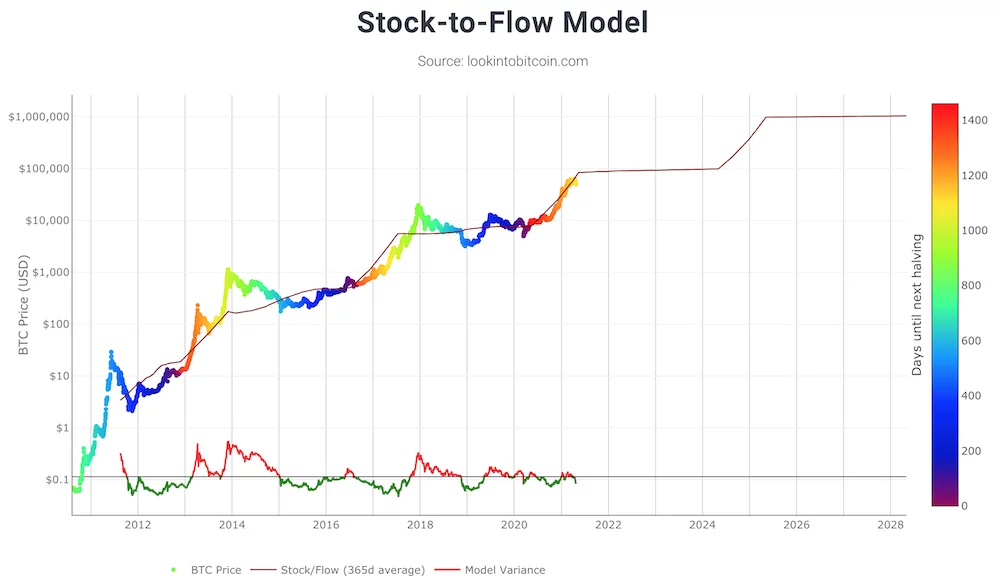

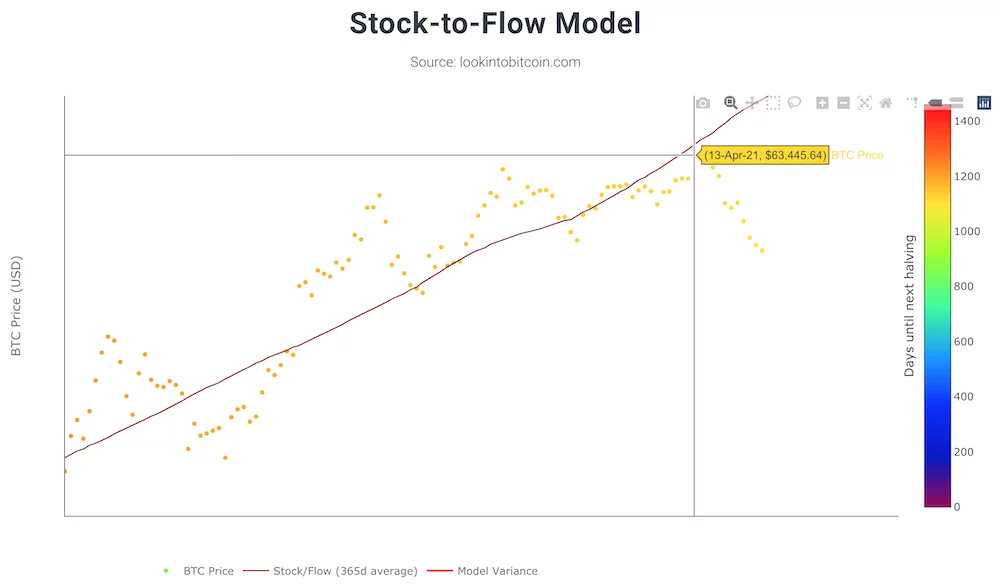

Certainly not to belittle potentially massive tax reform implications, but this tax plan is far from passing, so perhaps it’s the mix of FUD which caused the BTC price drop of ~$16,000 in 10 days. Well, if you follow the Bitcoin stock-to-flow model this might not be anything to panic about at all. The S2F model creator weighed in on the recent price volatility, and PlanB poses that the recent BTC price correction was actually quite welcome after multiple consecutive months of upward action, further suggesting that BTC could be right around the middle of its current bull run, with a stock-to-flow target of ~ $288,000.

One might reason for now, that regardless of when the next bear market arrives, with the expectation of unprecedented world reserve currency printing continuing into the foreseeable future, more and more individual and institutional investors are evermore likely to search for sound, inflation-hedging, safe-havens. Where will they turn?

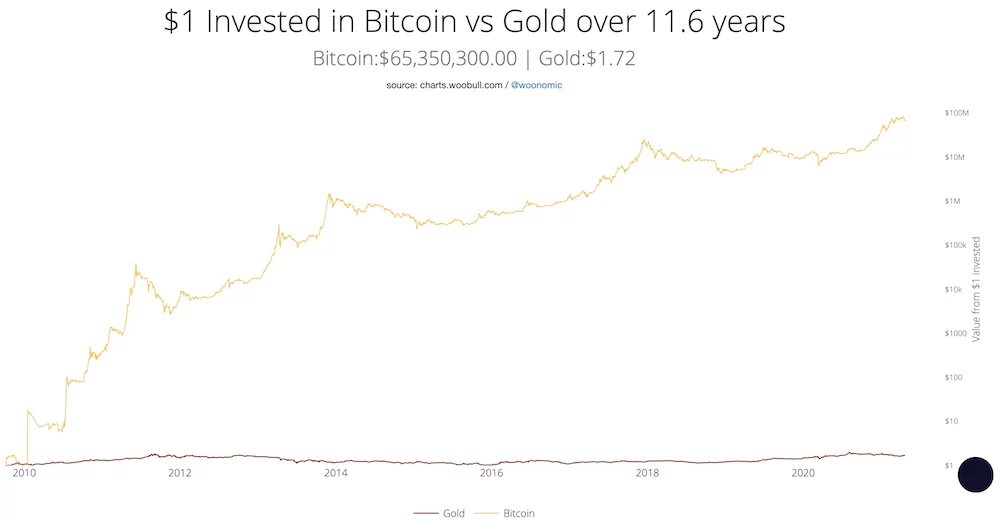

‘This chart tracks Gold vs Bitcoin performance from a $1 investment on 6 Oct 2009 when Bitcoin first had a market price.

I humbly dedicate this chart to @PeterSchiff in honor of his tireless promotion of Bitcoin to his audience of gold bugs, we are forever grateful.’