Candles are turning green and the headlines are positive: crypto is up and (so far) it's staying that way. Are we on the brink of a new bull market or is the crypto upturn just a prolonged dead cat bounce?

You decide…

4 reasons to be bullish on crypto

Let's start with the bright side.

#1 The market is recovering

ttps://alternative.me/crypto/fear-and-greed-index/

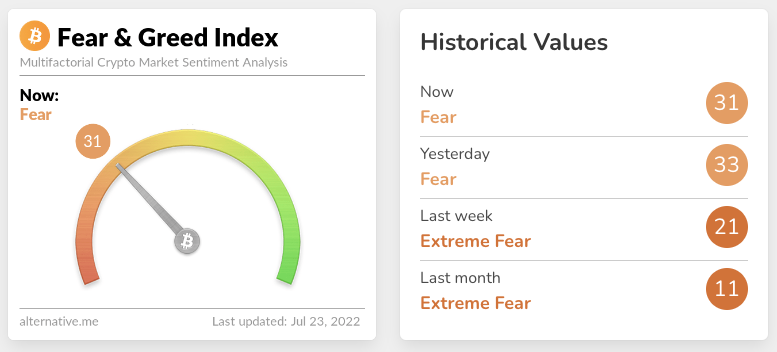

Markets are up across the board, some quite dramatically. The global market cap is back to over $1 trillion, Bitcoin is recovering (hitting its highest level for a month) and so are altcoins including Cardano, XRP and Doge. ETH showed massive gains on the back of the Merger announcement and climbed as high as $1,500 from being in single figures. This translates into something else: sentiment. There’s an element of the self-fulfilling prophecy in trading. If enough people feel like the bottom has been reached, then it has. This is - somewhat - reflected in the Crypto Fear & Greed Index (a measure of market sentiment) which climbed from “extremely fearful” to merely “fearful.” Baby steps.

#2 The Merger is coming

https://twitter.com/WatcherGuru/status/1547934436242497536

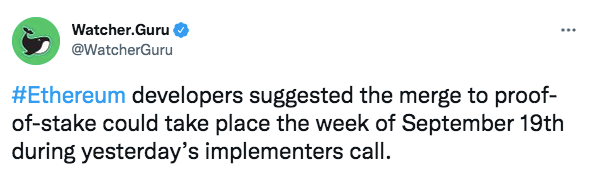

We seem to have been talking about the Ethereum Merger for most of our lives but now it really does seem to be imminent with a date pencilled in for the 19th of September. That announcement sparked a flurry of bullish sentiment around ETH, propelling it well above the lows it reached earlier in the summer. A big price increase for ETH will have knock-on effects on the wider crypto markets and NFTs. Vitalik hinted at more to come, too, suggesting that even after the Merge Ethereum would only be 55% complete. Supply will shrink, likely pushing prices even higher.

#3 Tech stocks are up

Although the global economic picture remains bleak, tech stocks have bucked the trend. Major averages reached their highest since early June. Tech is high risk, but after a tumultuous period, investors seem to have decided that we’ve reached the bottom. This makes it easier to take higher-risk options. Stocks were also helped by a Senate bill to increase microchip production. Inevitably, a stronger and more bullish tech sector is positive for crypto.

#4 Venture capitalists still believe

Some saw the downturn as a disaster, others as an opportunity. Lower valuations meant easier investment opportunities. Last week saw some massive moves in crypto venture capital including a $100 million fund from Protagonist to support fledgling crypto companies and a massive $430 million one from Multicoin Capital. These venture capitalists aren’t focused on the near future. They don’t care what crypto does tomorrow, even next year. This long-term investment suggests that they believe in long-term success and value.

4 reasons to be bearish on crypto

The more pessimistic amongst us might argue that...

#1 Market conditions haven’t really changed

None of the global problems that caused the downturn have been resolved. The war in Ukraine rages on and many countries are grappling with a cost of living crisis. Inflation is sky high (and climbing) around the world. The UK’s chancellor recently discussed putting the country on a “crisis footing.” Inflation in America is higher than it’s been for 40 years. For all that we like to think of crypto as independent, it does tend to track world indices. If the global financial situation hasn’t improved, why should crypto?

#2 Crypto institutions are still in trouble

https://twitter.com/CelsiusNetwork/status/1547375324622618624

Remember Celsius? It announced back in June that it was ‘pausing all withdrawals, Swap, and transfers between accounts.’ Now it’s bankrupt, leaving customers in limbo. OpenSea recently laid off large numbers of staff and Blockchain.com took similar steps (sacrificing 25% of its workforce). The list of troubled crypto companies is long: Zipmex, Vauld and Babel Finance (although Voyager is planning to reopen withdrawals) all appear to be in peril. Analysts will be picking over the smouldering ruins of Terra LUNA for many months to come.

#3 Regulation is still on the cards

It’s no secret that regulatory bodies are encroaching on crypto. The SEC has been closing in for months, the UK treasury has its eye on stablecoins and regulation in Thailand delayed SCB X’s (the country’s oldest bank) acquisition of BitKub (its largest crypto exchange). Crypto and regulation don’t go well together. Bitcoin hit an all time low in 2019 thanks to the Chinese government announcing regulatory measures. Whether the DeFi world likes it or not, regulation is coming. How this will affect crypto’s long-term price prospects remains to be seen, but expect short-term jolts as new measures are announced.

#4 Tesla dumped 75% of its Bitcoin holdings

Yes, this was back between April - June, yes it’s only one company but it’s still a big deal. Elon Musk has long been a cheerleader for crypto. It doesn’t bode well if even he’s having doubts. Tesla liquidated its holdings into fiat, ostensibly to boost cash reserves in the face of production challenges and unfavourable conditions. Whatever the reason, the price of Bitcoin slid when the news broke, ironically putting a dent in Tesla’s remaining holdings. If Musk and Tesla believe that Bitcoin has big long-term value, would they really be dumping it?

So what do you think? Is this the beginning of a brave new crypto world or a false dawn?

Sources

https://alternative.me/crypto/fear-and-greed-index/

https://twitter.com/WatcherGuru/status/1547934436242497536

https://www.reuters.com/world/uk/britains-sunak-put-government-crisis-footing-times-interview-2022-07-22/

https://www.wsj.com/articles/us-inflation-june-2022-consumer-price-index-11657664129

https://twitter.com/CelsiusNetwork/status/1547375324622618624

https://twitter.com/business/status/1550562836686032899