#1 ETH might drop in value

ETH is already pumping in expectation of the Merge (breathing life into the crypto markets) but the immediate aftermath might cause a price drop. This would be due to a market phenomenon called a ‘sell news event.’ Most investors are already well aware of the Merge and will have bought ETH by the time it happens. This means that the Merge is “baked into” the price. Everybody planning to buy will have bought by the time it happens, leaving fewer in the immediate aftermath. “Buy the rumour, sell the news” is a common market adage: investors sell just after a big news event because they’ve already made their profits in the run-up. Price predictions for ETH long term remain bullish but don’t be surprised to see a dramatic and apparently counterintuitive dip right after the Merge. This would be investors cashing out the hype.

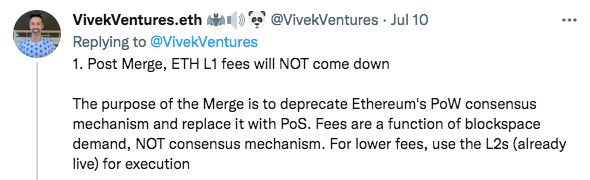

#2 Gas might actually go up

It’s a popular (and not completely unfounded) myth that the Merge will magically reduce gas fees. The Merge will replace PoW with PoS. PoW is not entirely to blame for high gas fees though; these are “a function of blockchain demand.” Demand is currently low because crypto is in the middle of a market slow down and fewer people are trading. We should see more activity post Merge, pushing fees up. You can read more about this in a thread by DeFi expert Vivek Raman. His argument would seem to support an earlier tweet from Vitalik, which argued that the only way to “cut fees” is via Layer 2s, not scrapping PoW.

#3 Graphics cards will get cheaper

Ethereum’s mining industry is worth $19 billion, but that will be wiped out after the Merge as miners become almost obsolete. Mining requires enormous amounts of computer power and is somewhat responsible for the high price and demand of GPUs (graphics processor units). As this demand falls away, so too will subside the price of these units. Some miners will move elsewhere (perhaps towards Web3 protocols like Render Network and Akash) or simply head for Ethereum Classic, but there’s no doubt that the demand for GPUs will significantly drop, taking prices with it.

#4 Altcoins could get a big boost

Amongst all the bullish sentiment on ETH, it’s easy to overlook another unintended effect of the Merge: edging some Altcoins closer to the moon. Protocols built on top of Ethereum (Polygon and Arbitrum, for example) will almost certainly get a price boost after the upgrade. The picture is less encouraging for Ethereum’s competitors. A cleaner, faster Ethereum puts pressure on so-called “ETH killers” like Solana, Polkadot and even Tezos. The biggest winner may well be Ethereum Classic. Prices are already up after a $10 million investment from Antpool, positive comments from Vitalik and suggestions that miners and users might switch to a true PoW blockchain.

Sources:

https://twitter.com/VivekVentures/status/1545985708858302464

https://twitter.com/vitalikbuterin/status/1435413681588736007

https://twitter.com/Dennis_Porter_/status/1552036338924486658

https://twitter.com/AntPoolofficial/status/1552090925785968642